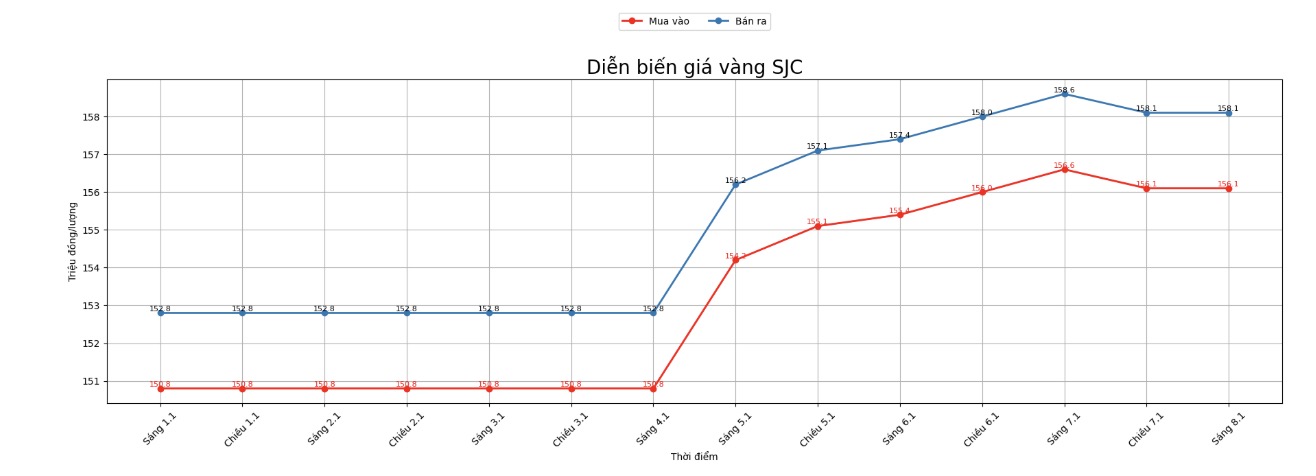

SJC gold bar price

As of 9:30 am, SJC gold bar prices were listed by DOJI Group at the threshold of 156.1-158.1 million VND/tael (buying - selling), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 156.1-158.1 million VND/tael (buying - selling), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at 156.1-158.1 million VND/tael (buying - selling), down 500,000 VND/tael in both directions. The buying - selling price difference is at 2 million VND/tael.

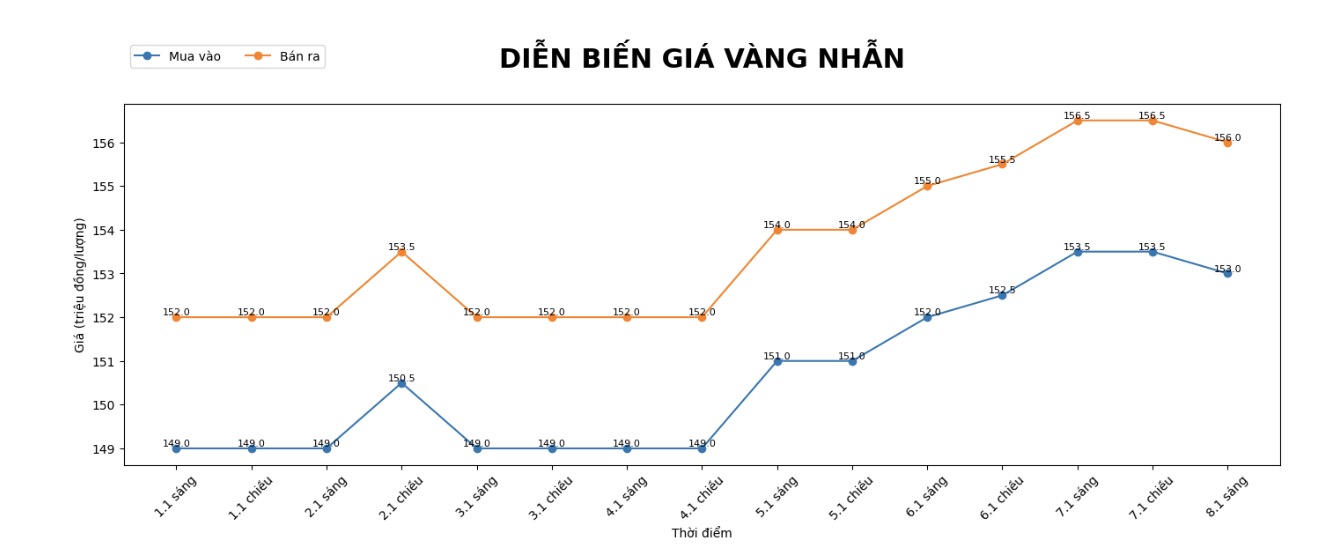

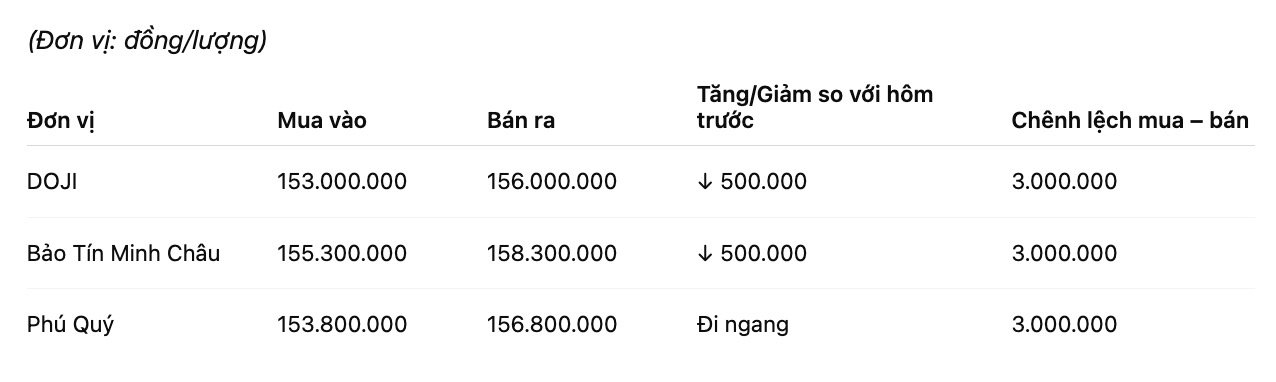

9999 gold ring price

As of 9:30 am, DOJI Group listed the price of gold rings at 153-156 million VND/tael (buying - selling), down 500,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155.3-158.3 million VND/tael (buying - selling), down 500,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 153.8-156.8 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

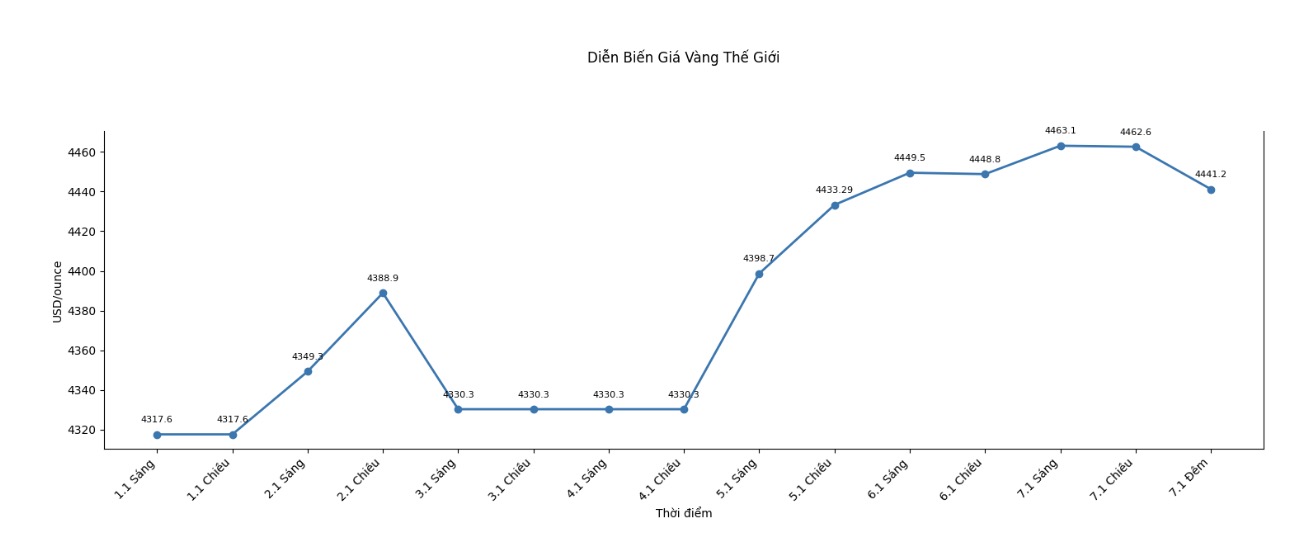

World gold price

At 9:40 am, world gold prices were listed around the threshold of 4,434.3 USD/ounce, down 15.2 USD compared to the previous day.

Gold price forecast

Gold prices are showing signs of correction after a period of strong increases and consecutive peaks. Profit-taking pressure appears as the precious metal once reached its highest level in more than a week at the beginning of the session, amid the recovery of the USD and investors being cautious about a series of important US economic data to be released soon. The strengthening greenback makes gold – the asset valued in USD – less attractive to international capital flows in the short term.

According to Mr. Kyle Rodda, senior financial market analyst at Capital.com, the current developments of gold prices are heavily influenced by speculative factors. “Basic factors have not created a clear boost, while short-term trading activities cause prices to fluctuate in two directions. However, the overall trend of gold still leans towards increasing,” Mr. Rodda said. This view suggests that current corrections may be more technical than reflecting the actual weakening of the market.

From a monetary policy perspective, it is expected that the US Federal Reserve (Fed) will begin an easing cycle this year, continuing to play an important supporting role for gold prices. Non-profit assets such as gold are often benefiting in a low-interest environment, especially when economic and geopolitical risks still exist. The market is currently closely monitoring the non-agricultural employment report, along with JOLTS and ADP data, to find more signals about the timing and level of Fed interest rate cuts.

In the medium and long term, many experts still maintain an optimistic view of precious metals. Mr. Ole Hansen – Head of Commodity Strategy at Saxo Bank – believes that gold is increasingly seen as an important monetary asset, playing a role in replacing the USD in the context of the world facing geopolitical fragmentation, fiscal pressure and currency devaluation risks. “The story of gold investment is basically unchanged as the new year begins,” Hansen assessed.

However, experts also note that short-term volatility risks are still present, especially when global investment funds are restructuring their portfolios after a period of strong price increases. Therefore, in the coming time, gold prices may continue to fluctuate with a wide range. For investors, closely monitoring the developments of monetary policy, the strength of the USD and market sentiment will be key factors to make appropriate decisions.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...