Gold prices rose in Tuesday's trading session, to their highest level in about a week, thanks to increased safe-haven demand amid escalating geopolitical tensions related to the US arrest of Venezuelan President Nicolas Maduro, along with growing expectations that the US Federal Reserve (Fed) will cut interest rates.

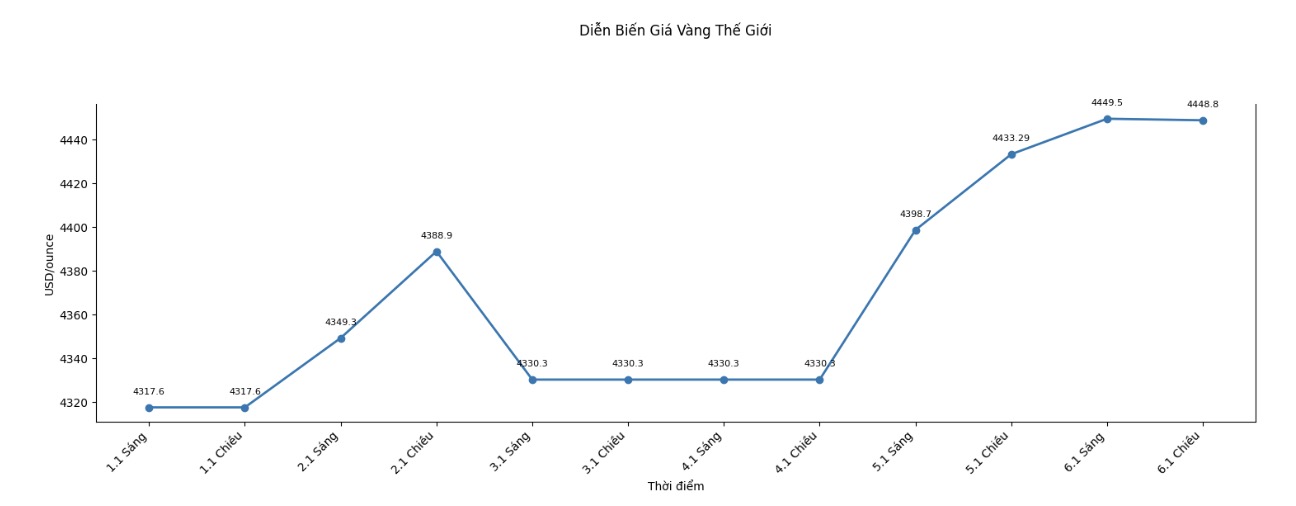

Spot gold prices rose 0.1%, to 4,452.6 USD/ounce at 9:46 GMT (16:46 - Vietnam time), after increasing nearly 3% in the previous session. Previously, gold had set a historical peak at 4,549.71 USD/ounce on December 26 and closed the year with an increase of 64% - the highest annual increase since 1979.

US gold futures for February delivery rose 0.3%, to 4,462.6 USD/ounce.

According to Mr. Ricardo Evangelista - an analyst at ActivTrades, gold prices are being supported by increased safe-haven demand amid escalating geopolitical instability after weekend events in Venezuela, and by the market increasingly betting on the possibility of the Fed cutting interest rates after US PMI manufacturing data showed disappointing results.

Venezuelan President Nicolas Maduro pleaded not guilty when appearing in court in New York on Monday, related to allegations of drug terrorism and possession of machine guns and weapons of mass destruction.

In other developments, US manufacturing activity in December declined more strongly than forecast, to the lowest level in 14 months.

Chairman of the Fed's Minneapolis branch - Mr. Neel Kashkari - warned that the unemployment rate could "skyrocket", thereby increasing the possibility of the Fed having to cut interest rates.

Investors are expecting the Fed to implement two interest rate cuts this year and are closely monitoring the December non-farm payroll report, scheduled to be released on Friday, to assess the direction of monetary policy in the coming time.

Non-profitable assets like gold often perform well in low-interest environments and when geopolitical or economic instability appears.

On other precious metals markets, spot silver prices rose 1.9% to 77.97 USD/ounce - the highest level in a week - after hitting a historic peak of 83.62 USD/ounce on December 29. Silver recorded the strongest increase in 2025, up to 147%, thanks to increased industrial and investment demand.

Spot platinum prices rose 1.4%, to $2,303.90/ounce, after reaching a record high of $2,478.50/ounce on Monday last week. Meanwhile, palladium prices rose 0.2%, to $1,710.25/ounce.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...