Update SJC gold price

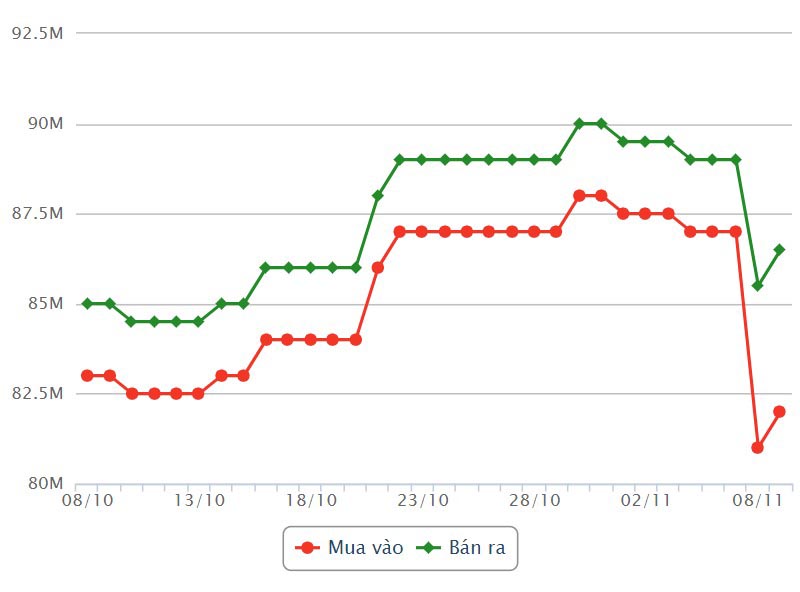

As of 9:00 a.m., the price of SJC gold bars was listed by DOJI Group at 82-86.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold price at DOJI decreased by 3 million VND/tael for buying and 1 million VND/tael for selling.

The difference between buying and selling prices of SJC gold at DOJI Group is at 4.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 82-86.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC decreased by 3 million VND/tael for buying and decreased by 1 million VND/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 4.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82-86.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold price at Bao Tin Minh Chau decreased by 3 million VND/tael for buying and decreased by 1 million VND/tael for selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 4.5 million VND/tael.

Currently, the difference between the buying and selling price of gold is listed at around 2 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

Price of round gold ring 9999

As of 9am today, the price of 9999 Hung Thinh Vuong round gold ring at DOJI is listed at 82.8-84.6 million VND/tael (buy - sell); down 1.3 million VND/tael for buying and down 900,000 VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 83.08-85.08, down 1.35 million VND/tael for buying and down 1.15 million VND/tael for selling compared to early this morning.

Like the price of SJC gold bars, although it decreased compared to the beginning of the trading session on the morning of November 7, the price of plain gold rings has recovered a lot compared to the close of the previous trading session.

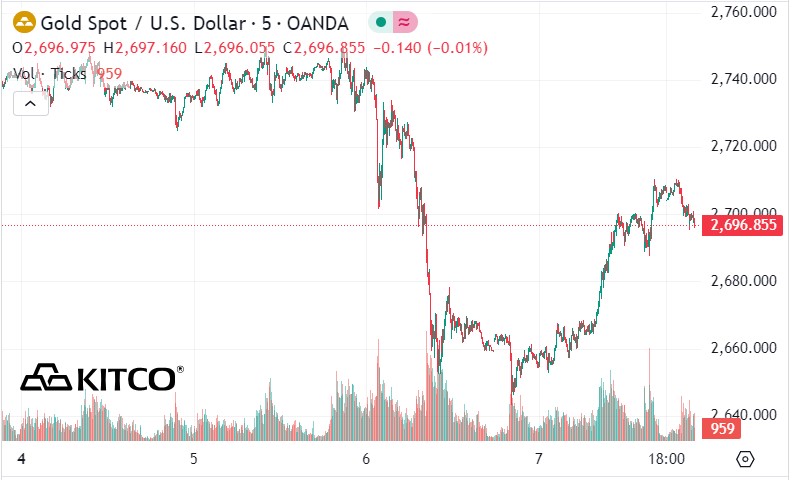

World gold price

As of 9:50 a.m., the world gold price listed on Kitco was at 2,696.8 USD/ounce, up 40.8 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices recover despite the high USD value. Recorded at 9:50 a.m. on November 8, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 104.430 points (up 0.19%).

According to Kitco, central banks cutting interest rates, a wave of buying, and recently released US economic data... are supporting gold prices to recover.

On Thursday, the US Federal Reserve (FED) continued its long-anticipated and anticipated interest rate cut. The Federal Open Market Committee (FOMC) lowered the federal funds rate by 25 basis points, in line with expectations. The rate is currently trading in a range of 4.5% to 4.75%.

The Fed did not provide much guidance on the future path of monetary policy, noting that the economy continues to grow at a solid pace.

Not only the FED, the Bank of England (BoE) has also just decided to cut interest rates further. In a long-awaited move, the BoE cut the bank rate to 4.75% on Thursday.

In addition, gold prices rebounded sharply after the release of US labor market data. Mr. Ernest Hoffman - market analyst at Kitco News - said that the US Department of Labor announced on Thursday that initial jobless claims increased to 221,000 in the week ended November 2. This figure was completely in line with expectations, as the general estimate forecast the number of claims was 221,000.

According to Kitco senior analyst Jim Wyckoff, another reason for gold's recovery last night was a wave of buying as the metal fell sharply before the US presidential election results.

According to analysis by experts at Germany's Commerzbank, in the short term, gold may be under selling pressure to reduce risks after Donald Trump wins the US presidential election.

After that, the market is expected to gradually stabilize, possibly within 1 week to 10 days. At that time, money flow may gradually return to gold, especially in the context of countries around the world reducing interest rates.

Analysts believe that in the long term, more money will be pumped into the economy during Donald Trump's term through businesses. As this money is pumped in (combined with lower interest rates), the price of gold may continue to rise. Many forecasts suggest that the price of gold could reach $3,000/ounce by 2025.

See more news related to gold prices HERE...