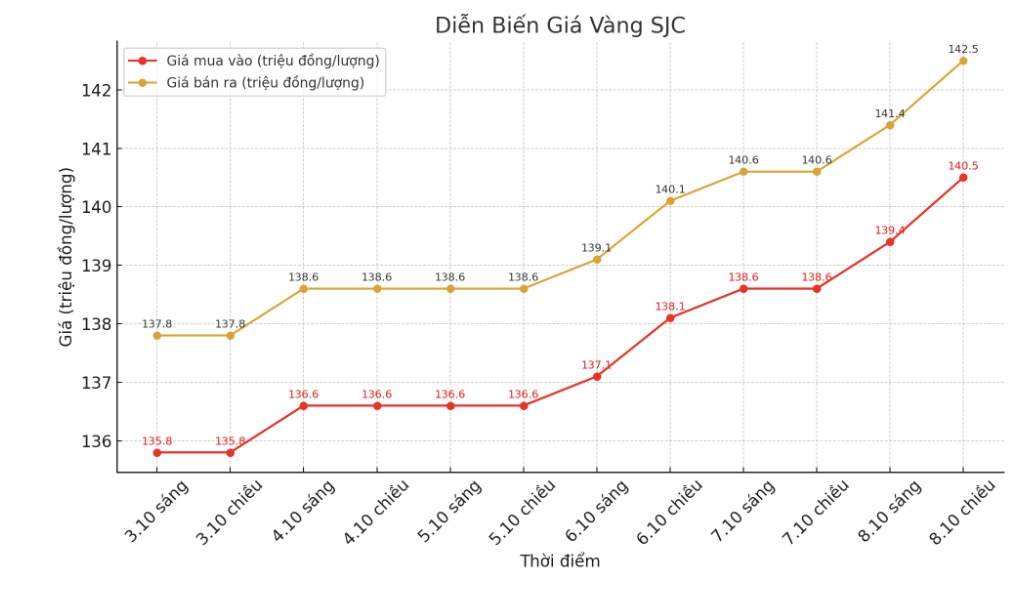

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group and Bao Tin Minh Chau at 140.5-142.5 million VND/tael (buy in - sell out), an increase of 1.9 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 140-142.5 million VND/tael (buy - sell), an increase of 2 million VND/tael for buying and an increase of 1.9 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

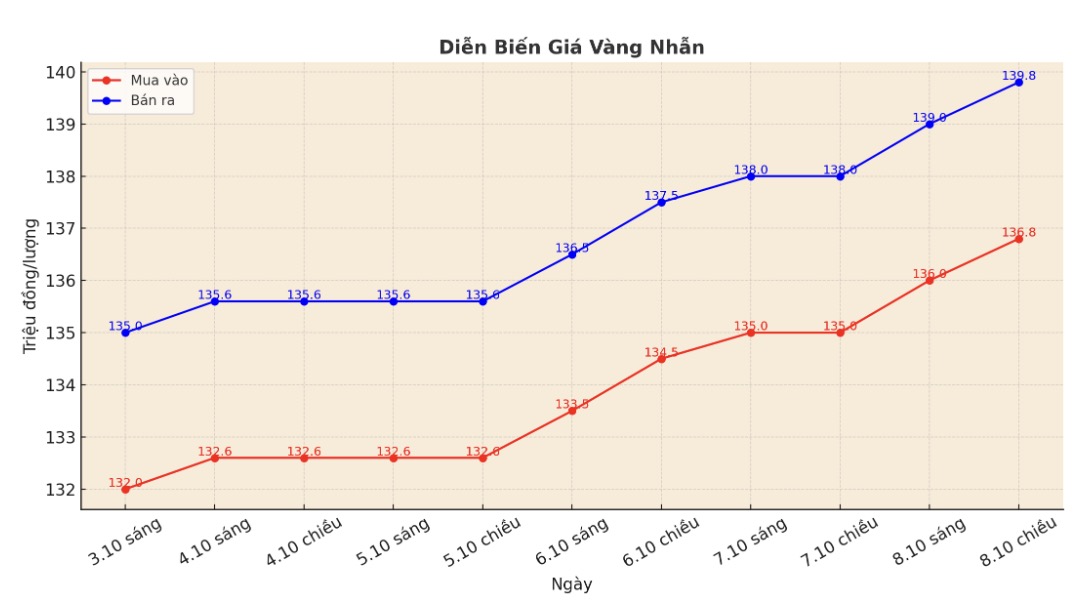

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 136.8-139.8 million VND/tael (buy - sell), an increase of 1.8 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 138.2-141.2 million VND/tael (buy - sell), an increase of 2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 137.5-140.5 million VND/tael (buy in - sell out), an increase of 2.3 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

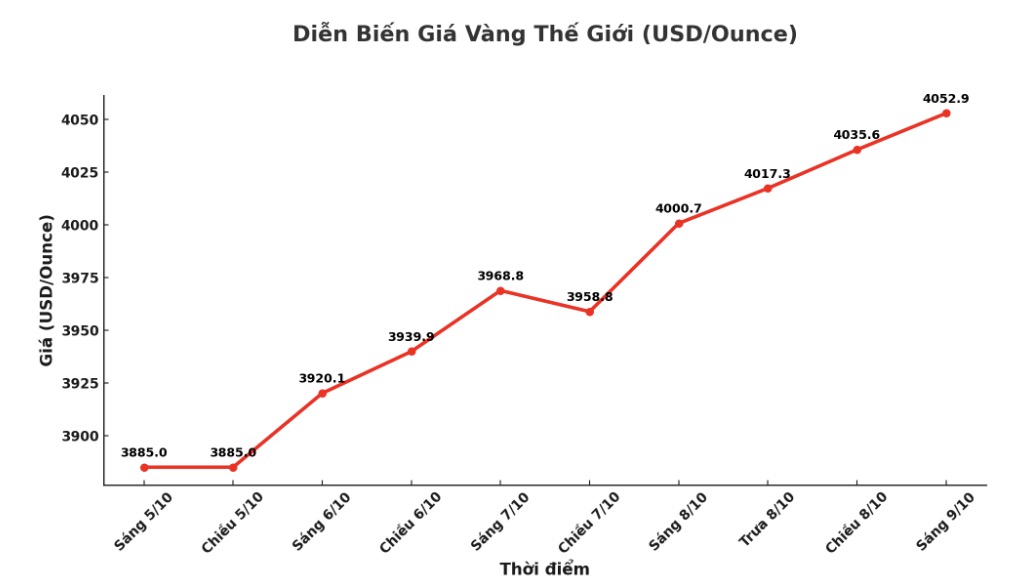

World gold price

The world gold price was listed at 0:30 at 4,052.9 USD/ounce, up 68.9 USD.

Gold price forecast

Safe-haven demand amid the US government's shutdown and other geopolitical uncertainties are fueling the rally of precious metals.

Usually, closures only last a few hours or a few days. The current slump has become the fourth extension in modern history.

One sign that the closure may not last much longer is the delay of flights in the US. According to reports, the previous government shutdown, which took place in late 2018 to early 2019, ended mainly due to widespread flight delays. It seems that US lawmakers in both parties are afraid of a backlash from travelers US voters when travel is affected.

In another development, the Bank of England (BOE) issued a strong warning that the global stock market is overvalued, especially technology companies focusing on artificial intelligence (AI).

In its latest quarterly financial stability report, the BOE said asset prices continue to increase and credit differences narrow, despite major uncertainties in the global economic outlook.

The BOE warned of the risk of a " strong correction" in the market, especially as "expectations of AI impact become less optimistic". Previously, legendary investor Paul Tudor Jones also commented that the US stock market may be entering the "last boom phase" before a strong correction.

Although gold increased, the USDX also increased to a 9-week high, while the Euro fell to a 2-month low due to the political crisis in France that caused instability in the European market.

The USD was also further supported when the New Zealand central bank suddenly cut interest rates more strongly than expected and signaled that it would continue to loosen monetary policy, causing the USD to fall to a 6-month low.

In other markets, crude oil prices rose slightly, trading around $62.75/barrel, while the yield on the 10-year US Treasury note was around 4.1%.

Technically, analysts said that buyers are still clearly dominating the short-term technical chart. Gold's next target is to close above the strong resistance level of 4,100 USD/ounce. On the contrary, the sellers will aim to pull the price below the technical support zone of 3,850 USD/ounce.

The first resistance level was today's record high (US$4,072.40/ounce), then US$4,100/ounce; the closest support was at the bottom of the night at $4,005.6/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...