Gold prices increased sharply, surpassing the threshold of 3,900 USD/ounce for the first time in history on the morning of October 7, driven by safe-haven demand after the Yen plummeted and the US Government continued to close.

Increasing expectations that the US Federal Reserve (FED) will continue to cut interest rates also contribute to this increase.

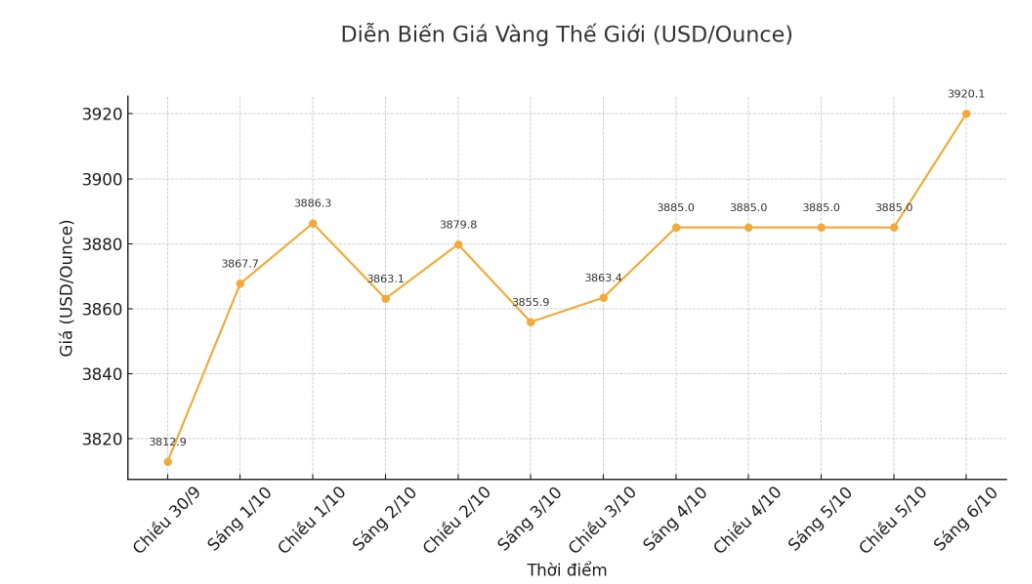

As of 9:08 (Vietnam time), spot gold prices increased by 0.9%, reaching 3,922.28 USD/ounce, after reaching a record high of 3,924.39 USD before. December gold futures on COMEX increased 1% to $3,947.3 an ounce.

Mr. Tim Waterer - chief market analyst of KCM Trade, commented: "The weakening of the Yen after the LDP election in Japan caused investors to lose a traditional safe-haven asset, and gold took advantage of this opportunity to accelerate.

The US government's continued shutdown has left the country's economy covered in uncertainty, especially regarding its potential impact on GDP growth.

In this context, gold is a popular investment channel, especially as the FED is expected to continue cutting interest rates this month.

The Japanese Yen fell the most in five months against the USD after Sanae Takaichi - a moderate on fiscal - was elected to lead the ruling party and become the new prime minister.

According to a senior White House official quoted by Reuters, the Trump administration is considering a temporary staff cut in the event that negotiations with Congress continue to be at a standstill.

Last weekend, FED Governor Stephen Miran continued to call for a stronger rate cut roadmap, citing the influence of President Donald Trump's economic policies.

Since the beginning of the year, gold prices have increased by 49% after increasing by 27% in 2024, thanks to strong central bank buying, high demand for gold ETFs, a weak USD and increasing interest of individual investors in finding a hedge against trade and geopolitical tensions.

Gold's rally was fueled after the Fed cut interest rates by another 0.25 percentage points last month and signaled that it would continue to cut interest rates for the rest of the year.

According to the CME FedWatch tool, investors are predicting that the FED will continue to cut by 0.25 percentage points in October and December, with a probability of 95% and 83%, respectively.

In an environment of low interest rates and economic instability, gold - an asset that does not yield - often tends to increase in price. Since the beginning of the year, gold has broken the $3,000/ounce mark in March and surpassed $3,700/ounce in mid-September. Many brokerage companies are currently holding a positive view of the precious metal's upside prospects.

In other markets, spot silver prices rose 0.8% to $48.33 an ounce, platinum rose 1.1% to $1,621.9/ounce, and gold rose 0.8% to $1,270.25 an ounce.

See more news related to gold prices HERE...