Updated SJC gold price

As of 9:22, the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.5-120.5 million/tael (buy in - sell out), an increase of VND 800,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 118.5-120.5 million VND/tael (buy in - sell out), an increase of 800,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.5-120.5 million VND/tael (buy in - sell out), an increase of 800,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117.77-120.5 million VND/tael (buy - sell), an increase of 700,000 VND/tael for buying and an increase of 800,000 VND/tael for selling. The difference between buying and selling prices is at 2.8 million VND/tael.

9999 round gold ring price

As of 9:27, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 115-117 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114-117 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

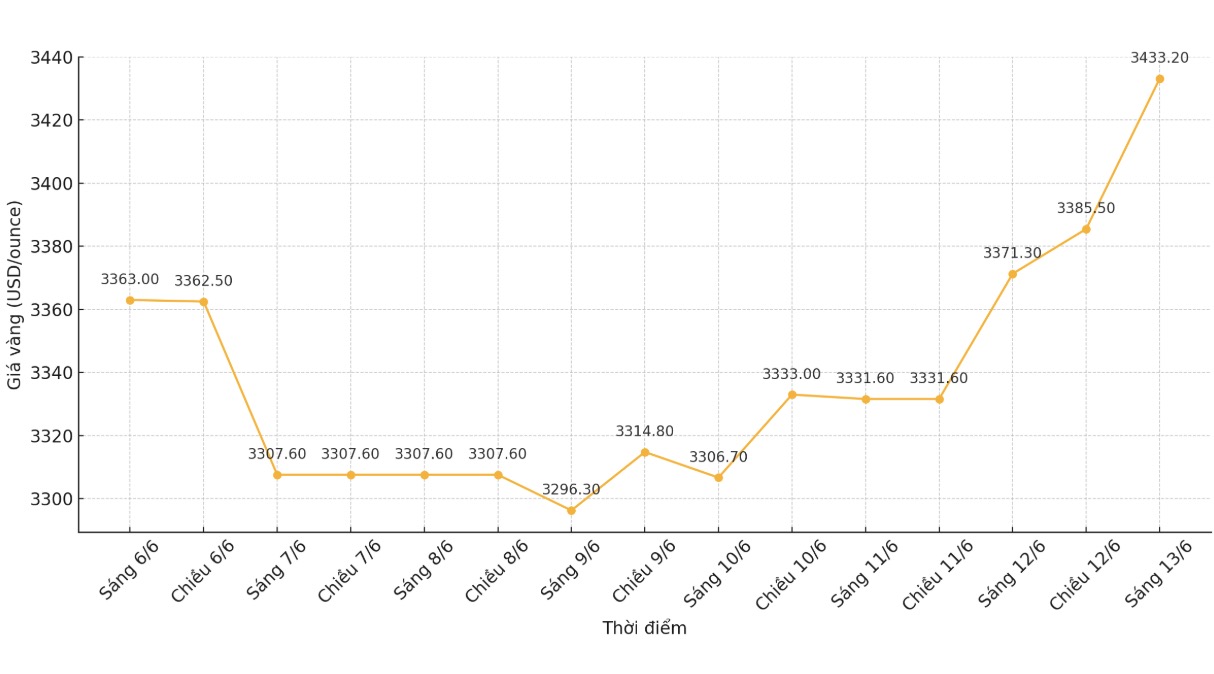

World gold price

At 9:28 a.m., the world gold price was listed around 3,433.2 USD/ounce, up 61.9 USD compared to 1 day ago.

Gold price forecast

World gold prices increased sharply thanks to the need for safe havens amid concerns about increased risks in the general market. There are reports that the US government has ordered the withdrawal of non-essential personnel from some areas in the Middle East due to increasing security concerns. Nuclear talks between the US and Iran are scheduled to take place later this week in Oman.

Reports say Israel is considering attacking Iranian nuclear facilities. Meanwhile, Iran said it is building a new nuclear facility.

Meanwhile, the US Department of Labor has just announced that the Producer Price Index (PPI) increased by 0.1% in May, lower than economists' expectations (0.2%). However, in the past 12 months, wholesale inflation has increased by 2.6%, equivalent to the forecast but higher than the 2.5% adjustment in April.

The core PPI, which eliminates food and energy costs, rose 0.1% in May, well below expectations of 0.3% and after a correction of -0.2% in April. Annual core PPI inflation reached 3.0%, lower than the 3.1% forecast and the 3.2% adjustment in April.

The US Department of Labor previously announced that the initial seasonal adjustment of unemployment claims remained steady at 248,000 in the week ended June 7, higher than the forecast of 242,000 claims. This figure shows that the number of unemployment claims remains at its highest level since the beginning of October.

The US labor market has a big influence on the US Federal Reserve's (FED) decisions to adjust interest rates, with a strong labor market often reflecting the possibility that the economy can endure higher interest rates to curb inflation, while a weak labor market could be a sign that the Fed needs to cut interest rates to support economic growth.

According to David Morrison from Trade Nation, gold prices are also affected by uncertainties related to the trade policy of the Donald Trump administration, especially in the application of "going back and forth" tariffs.

Technically, gold speculators in August are currently holding a near-term technical advantage. The next target for buyers is to push gold prices above $3,477.30/ounce, while the downside target for sellers is to push prices below $3,300/ounce. The first resistance level was determined to be 3,427.7 USD/ounce, followed by 3,450 USD/ounce. The first support level was 3,475 USD/ounce and then 3,358.5 USD/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...