The demand for gold in the third quarter of 2025 in the US increased by 58% compared to the same period last year, while capital flows into North American ETFs reached 16 billion USD and trading volume increased sharply, according to the World Gold Council (WGC)'s third quarter gold demand trend report.

Overall demand for US gold recovered in the third quarter to 186 tonnes, WGC analysts wrote, up 58% year-on-year. Consumer demand (in-kind + gold bars and coins) reached 32 tons, down 33% over the same period.

Gold jewelry consumption continued the downward trend starting from the second quarter of 2022, down 12% over the same period to 25 tons. In terms of value, jewelry spending decreased 12% quarter-on-quarter to $2.7 billion, but still increased by 23% year-on-year marking the Ninth consecutive quarter of annual growth.

Demand for US gold bars and coins continued to decline sharply, down 64% from the same period to only 7 tons - the lowest level since 20172019 before the COVID-19 pandemic.

This makes the Americas the only major region to see a yearly decline in the third quarter of 2025. In terms of value, demand is not improving as it decreased by 49% to 801 million USD. However, these figures hide the real picture: the weak quarter is due to vibrant two-way buying and selling activities, when strong purchases are compensated by profit-taking" - the report stated.

Meanwhile, demand for gold in the technology industry has mixed developments between four major electronics manufacturing centers. The US (16 tons, -2% compared to the same period) and Japan (-19 tons, -4%) decreased; while South Korea (+7 tons, +1%%) and China (+21 tons, almost flat) remained stable, the WGC said.

ETFs continue to be the main driver, as US-listed ETFs added 137 tonnes of gold in the third quarter - up 160% year-on-year, bringing their total holdings to 1,922 tonnes, equivalent to 236 billion USD in assets under management (AUM).

The WGC commented: The third quarter of 2025 marks a new record for gold ETFs, with global capital reaching $26 billion and total holdings increasing by 222 tons to 3,838 tons. Notably, the US contribution accounts for 137 tons ($16 billion), equivalent to 62% of total global demand. This breakthrough has significantly changed the picture of US gold demand. If we use the 10-year average of 21 tons - or even 70 tons of the previous quarter - the total demand in this quarter will decrease by 44% or 4% quarter-on-quarter, instead of increasing by 50% as in reality."

As of the end of September, North American gold ETFs' accumulated net capital flows from the beginning of the year reached 37 billion USD, of which 99% came from US funds - putting the region on track for the strongest increase in history, with preliminary data in October confirming this record. By volume, North American funds are also on track to record their third strongest year in history.

In the third quarter, the average daily trading value of futures and gold options on COMEX reached 104 billion USD (915 tons), up 35% over the same period; while North American ETFs (mainly the US) averaged 5 billion USD (42 tons) per day, up 109%. These two segments account for 40% of global liquidity, the report said.

The WGC quoted North American retailers as saying that retail demand for gold has improved since the end of the third quarter. individual investors have shifted from net selling to net buying, causing secondary market liquidity to run out, forcing agents to find sources of goods from refiners. However, refiners are cautious about expanding capacity due to low profits and high costs despite rising gold prices," the WGC said.

Costco's gold business is booming both online and in-store, thanks to consumer confidence and a policy of keeping prices stable in the context of escalating gold prices. Costco is also adding new products to boost sales, the report said.

The demand for small-scale gold bullion in the US is also very strong. Datoryants are willing to pay higher prices for small types, but limited production capacity makes delivery slower, the WGC added.

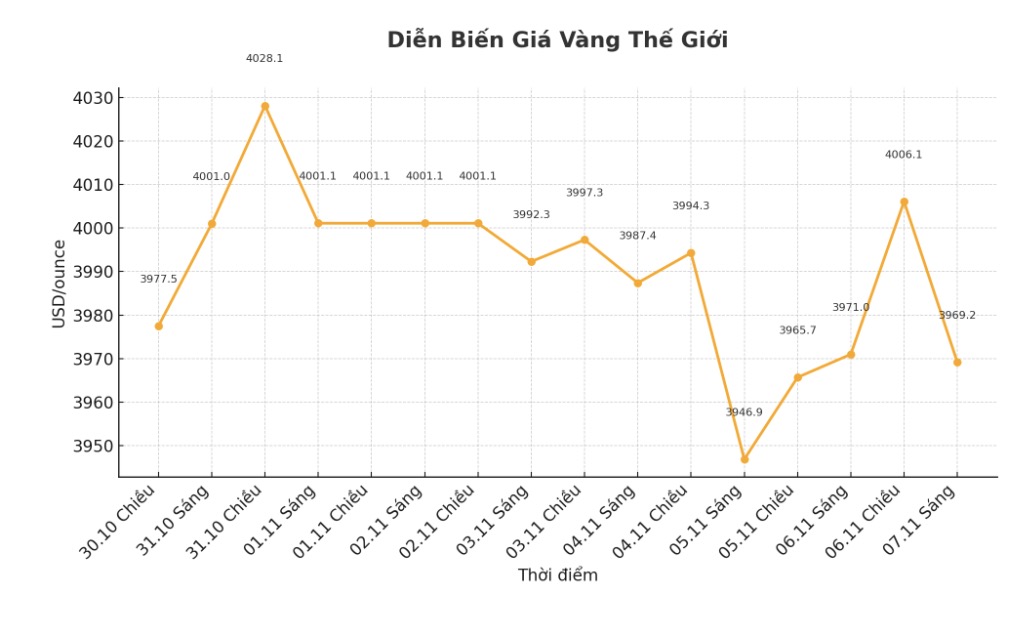

The WGC stated: After the recent price increase, both the futures curve and analysts forecasts have been adjusted higher. Bloomberg's consensus forecast now shows that gold prices will increase in the first half of 2026 before falling slightly towards the end of the year. New estimates in October show that the average gold price in the fourth quarter of 2025 will reach about 4,000 USD/ounce, while the target for the whole year of 2026 will be raised to around 4,500 - 5,000 USD/ounce".