Gold prices at major consumption centers in India and China have switched to positive price difference (premium) selling this week for the first time in about two months, as price adjustments from record highs have helped retail demand recover. Previously, the unprecedented increase in gold prices weakened purchasing power.

In India, gold dealers sell with premiums of up to 15 USD/ounce compared to the official domestic price (including 6% import tax and 3% sales tax), a sharp increase compared to the discount (discount) of up to 61 USD/ounce last week.

Indian domestic gold prices were at around 136,700 rupees/10 grams on Friday, after reaching a historic peak of 140,465 rupees last week.

A jewelry worker in New Delhi said that retail shopping has improved slightly this week after prices fluctuated sharply from record highs.

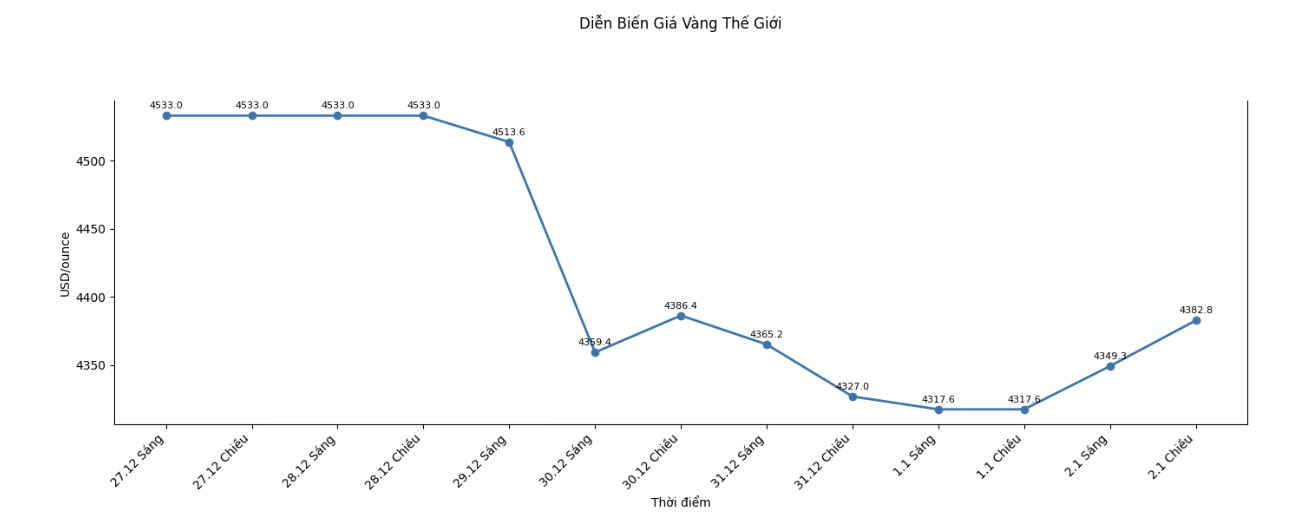

However, international spot gold prices started the new year with positive developments on Friday, resuming the upward momentum after closing 2025 with an increase of 64%, the highest since 1979.

Many buyers are temporarily suspending transactions due to strong price fluctuations and they are not sure which direction the market will take," said a precious metal dealer in Mumbai, a private bank.

In China - the leading gold consumer - gold bars have shifted from a discounted selling status to a premium of about 3 USD/ounce compared to the global spot price this week, thanks to strong retail demand and deep spot price adjustments.

It seems that retail demand in China is still relatively stable, especially considering the current price level. In summary, the volume of physical demand is still quite strong after a good price adjustment" - independent analyst Ross Norman said.

According to Peter Fung - Head of Transactions at Wing Fung Precious Metals, recent price fluctuations have made customers hesitant, in the context that liquidity is already very thin due to the year-end crop season, coinciding with the holidays.

In Singapore, gold is traded in the range from a discount of 0.50 USD to a premium of 1.20 USD/ounce.

In Hong Kong (China), gold is sold close to world prices, at times higher than 1.70 USD/ounce; while in Japan, gold prices closely follow spot prices.

(1 USD = 90,1250 Indian rupees).

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...