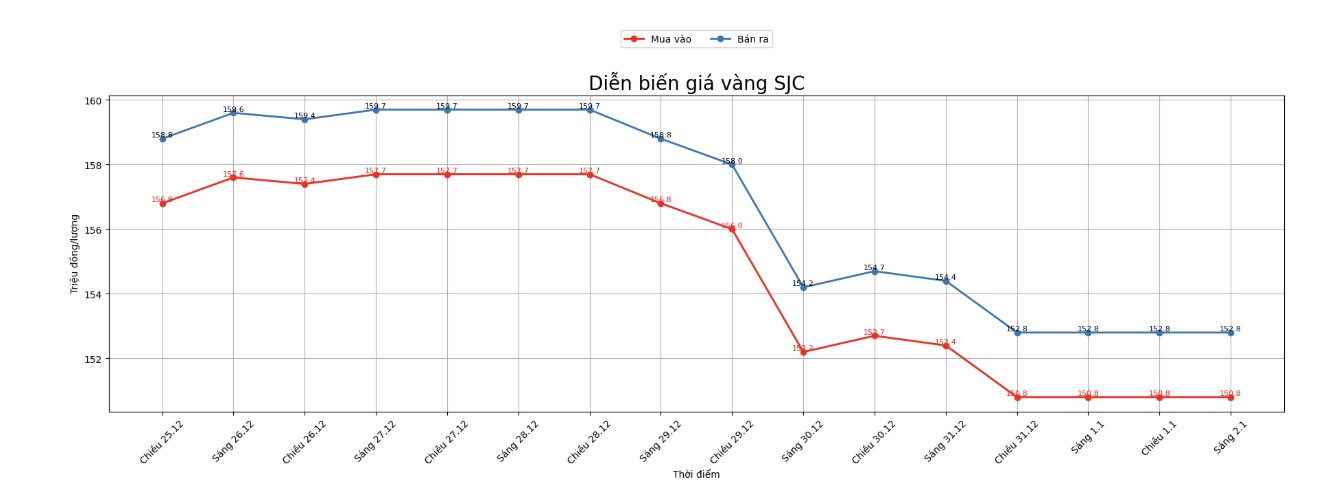

SJC gold bar price

As of 9:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 150.8-152.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 150.8-152.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 150.3-152.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

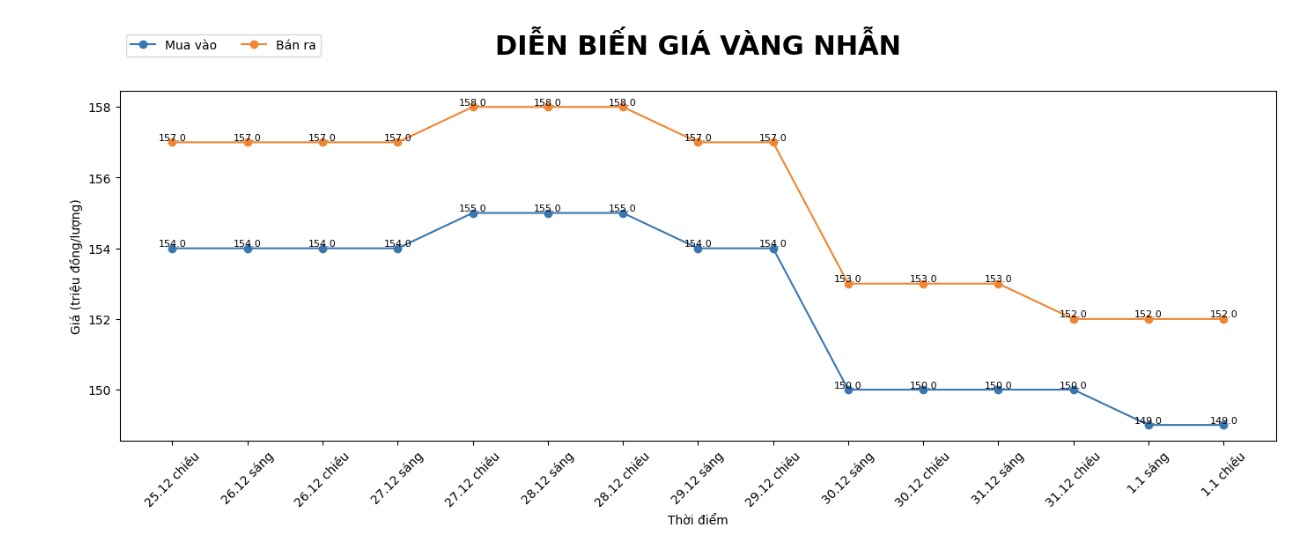

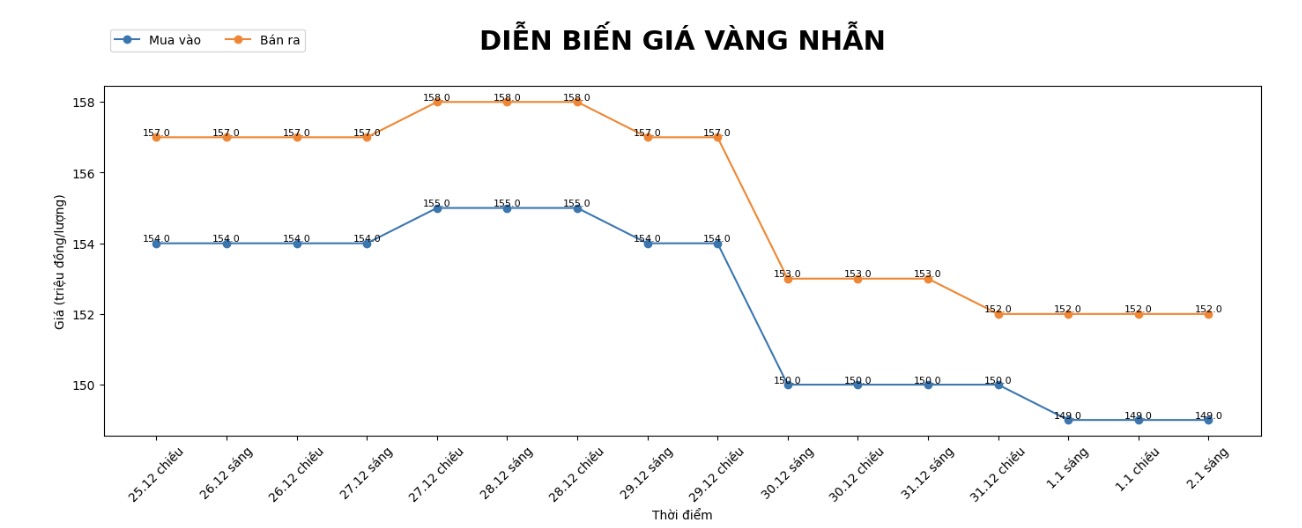

9999 gold ring price

As of 9:00 AM, DOJI Group listed the price of gold rings at the threshold of 149-152 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 152-155 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 149.8-152.8 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

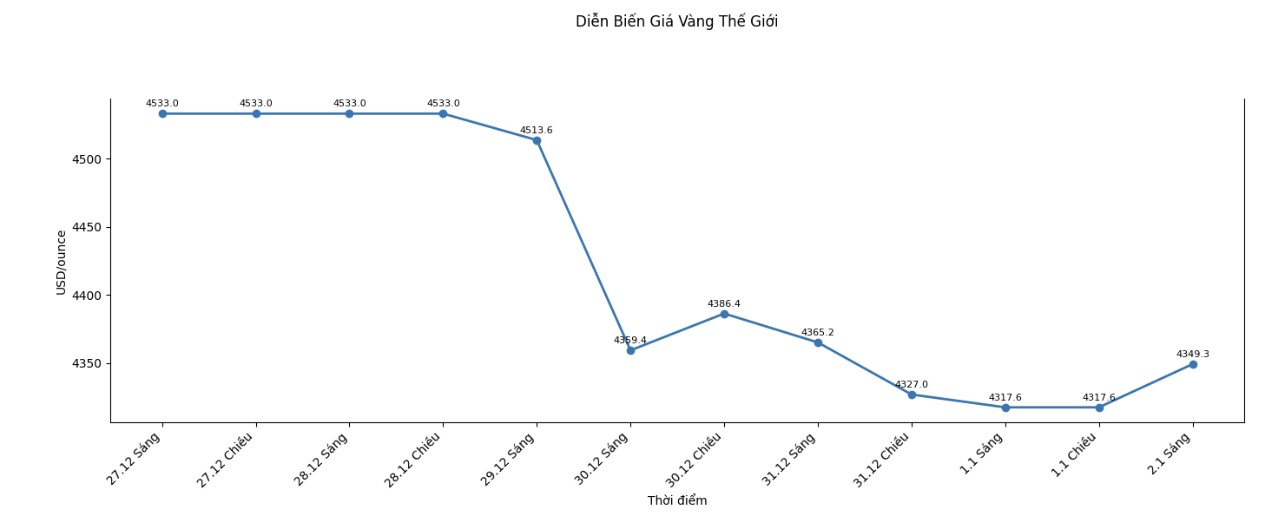

World gold price

At 8:30 am, world gold prices were listed around the threshold of 4,349.3 USD/ounce, up 31.7 USD compared to the previous day.

Gold price forecast

According to analysts, the trading session on January 2 is considered one of the most notable milestones of the gold market in recent years. After a long upward cycle and entering the "ripe" stage, the closing price of this session may play a role in orienting the medium-term trend. The fact that gold prices end the session near the peak or bottom of the week will strongly impact investor sentiment, thereby affecting the dien bien of precious metals in the following weeks.

Although there are many concerns that the strong increase in 2025 has pushed gold into a overbought state, many experts still believe that the possibility of deep correction is not high. The key driving force continues to come from the persistent gold accumulation demand of central banks - a trend that has formed since 2022 and is forecast to last until 2026. Along with that, long-term investment capital still maintains a certain interest in gold, especially in the context of economic and geopolitical instability showing no signs of cooling down.

Many international organizations assess that the room for gold to increase is still quite large. The amount of gold purchased by ETF funds in the past time has improved significantly, but according to many experts, this figure is still significantly lower than in previous crisis periods. If global economic prospects worsen, demand may spread to OTC markets, derivatives markets and central banks, creating more momentum for gold prices in the medium and long term.

From a short-term perspective, the market is still affected by cautious sentiment as the fluctuation range narrows and large cash flows have not returned strongly. The minutes of the Fed's most recent meeting show a lack of consensus in monetary policy orientation, thereby partly curbing gold's upward momentum. However, looking at the overall picture, gold is still one of the most outstanding assets in 2025, clearly reflecting the role of "safe haven" in a high-risk environment.

Another fundamental factor that continues to support the market is supply and demand. Global gold supply is increasing slowly, mining costs are increasing while long-term storage demand is still high. This helps gold prices absorb technical corrections without changing the main trend.

Summarizing the factors shows that gold prices may still fluctuate strongly in the first sessions of the year because liquidity has not really recovered. However, with long-term buying pressure from central banks and investors' risk hedging needs, the long-term upward trend of gold is still assessed as not broken.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...