The gold market is showing initial signs of recovery after experiencing its strongest decline in more than 18 years. Both spot gold prices and December gold futures on Comex formed a doji candle model in the trading session on Wednesday, showing the possibility of a reversal after the initial volatility of the week.

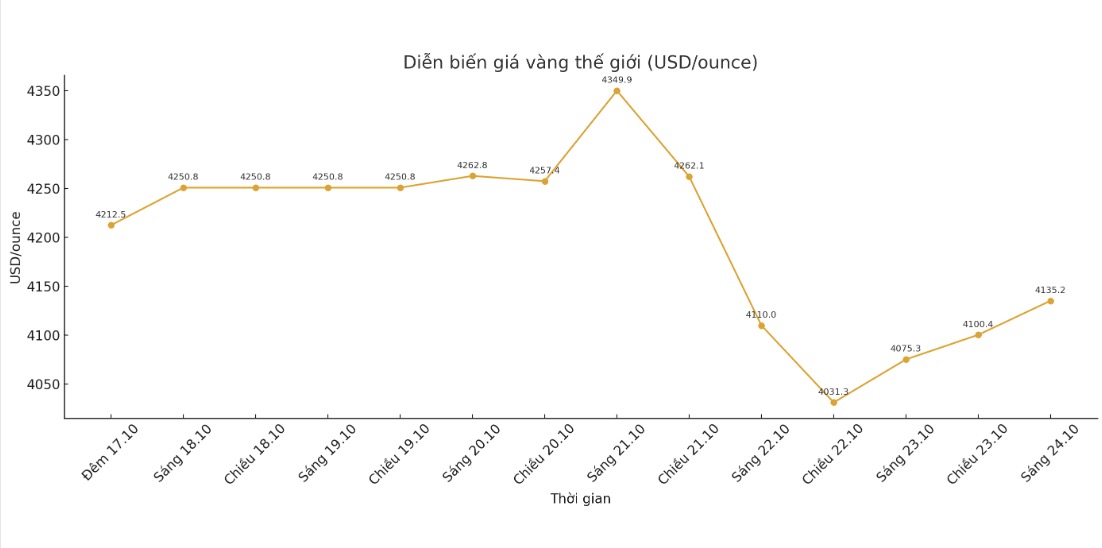

The strong fluctuations began on Monday when spot gold prices hit a historical peak of 4,381 USD/ounce, while December gold futures skyrocketed to 4,398 USD/ounce. However, the excitement quickly ended.

By Tuesday, both markets had fallen more than $230 (forward contracts fell $235), becoming the strongest one-day decline since 2013. Although the sharp decline caused "stunned", technical experts assessed this as a reasonable adjustment after an increase of nearly 57% since the beginning of the year.

This is also the first significant correction since gold started its uptrend from the $3,358/ounce zone just two months ago. The appearance of doji candles in the fourth session shows that the basic price increase momentum has not been lost.

Technical analysts consider this a "long-legged doji" model (ie, in the price session, it fell very strongly but then the buying force appeared in a rush, pulling the price back), with the bottom candle bulb lasting about 5 times the candle body. This reflects strong buying pressure in the low price range, as investors rush to buy and put the closing price about 95 USD higher than the lowest level of the day.

While the doji model can signal accumulation or reversal, the current price action is more inclined towards the possibility of an increase in reversal.

As of the time of writing, gold futures have increased by more than 0.65%, to $4,135.2/ounce. This positive development reinforces expectations that the market is creating a short-term bottom and the uptrend may soon return to a new peak.

In addition, today's candle formation also extends a remarkable pattern: throughout the recent rally, gold has hardly had two consecutive sessions of decline, but has always created a bottom after each correction and continued to break out - and this pattern seems to be repeating itself.

In the coming sessions, a factor that is likely to strongly impact gold prices is the Consumer Price Index (CPI) report released on Friday, which was postponed due to the US Government's closure. Analysts forecast annual inflation at 3.1% and most of it has been reflected by the market.

However, if the actual figures are significantly higher, expectations of the FED's rate cut progress could be adjusted - and this is one of the important drivers of gold's strong rally since the beginning of the year.

See more news related to gold prices HERE...