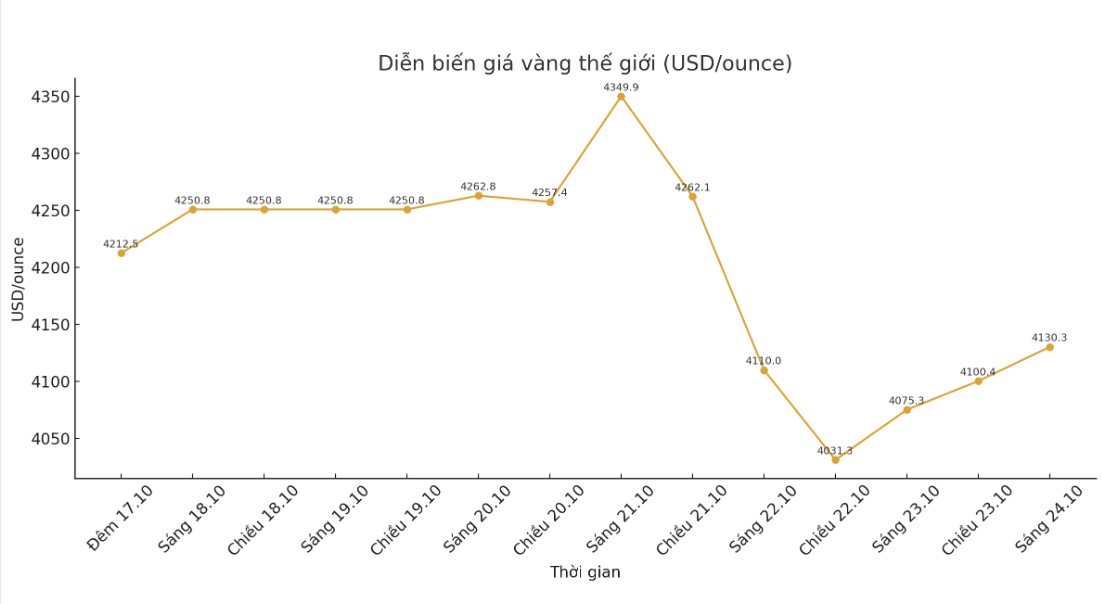

After surpassing the $4,000/ounce mark on October 10, gold hit the 4,380/ounce barrier and had its strongest decline in 12 years on October 21.

Since the beginning of the year, gold prices have increased by about 50%, strengthening their position as one of the best performing assets in 2025, Morgan Stanley's commodity analysis team wrote in a report.

Experts say the upward trend of gold reflects a series of policy, geopolitical and economic fluctuations this year such as US trade tariffs, conflicts in the Middle East, concerns about the independence of the US Federal Reserve (FED) and the risk of the US Government's closure.

Morgan Stanley Research expects gold price increase to continue and has raised its 2026 price forecast to 4,400 USD/ounce, much higher than the previous 3,313 USD/ounce. This is equivalent to an increase of about 10% by the end of next year.

Ms. Amy Gower - Commodity Strategist at Morgan Stanley Metals & Mining, commented: Investors watching gold is not only a hedge against inflation, but also a measure of everything from central bank policy to geopolitical risks. We continue to assess the upward outlook for gold thanks to a weakening USD, strong capital flows into ETFs, net buying from central banks and an unstable environment increasing demand for safe-haven assets.

Morgan Stanley believes there is a strong driving force to continue supporting gold prices: For the first time since 1996, gold holds a larger holding position than US Treasury bonds in central bank reserves a strong signal of confidence in the long-term value of precious metals - the report stated.

In addition, gold ETFs have also stepped up buying, showing a return of interest in institutional investors. In the third quarter, gold ETFs recorded record capital flows of $26 billion and total managed assets of $472 billion - also an all-time high.

After two years of "inactive rowing", individual investors have also quickly joined the race. The weakening USD outlook as the US economy grows slowly is causing investors to shift their safe-haven portfolios from USD-denominated assets to gold, the analysis team emphasized. In addition, a weaker USD makes gold cheaper for international buyers.

The Fed's interest rate cut is also an important support for gold. According to Morgan Stanley, since the 1990s, gold prices have increased by an average of 6% within 60 days after starting the Fed's interest rate cut cycle.

With all these factors, its not surprising that gold is at the top of our priority portfolio for commodities, Gower said.

However, the bank also warned that gold could face risks if the USD maintains its strength or the FED cuts interest rates less than expected.

The higher gold prices go, the more demand can be affected, Gower said. For example, when gold prices increase sharply, central banks will have to reduce purchases to meet reserve targets.

She also noted that the jewelry market - which accounts for about 40% of global gold demand - could put downward pressure on prices. "The demand for jewelry is showing signs of weakening. The second quarter recorded the lowest level since the third quarter of 2020 when consumers hesitated before prices were too high.

Gold prices reaching a peak also help cash flow and stock valuations of mining enterprises improve significantly.

Many mining enterprises are submitting feasibility studies for new projects, extending the life of mines or restarting mines that were previously considered ineffective, the report said. However, there is still a risk of delaying or canceling projects due to difficulties in environmental and social licensing, tax and copyright issues, as well as financial limitations. In the US, no new mines have been in operation since 2002.

Although mine supply has only increased by an average of 0.3% per year since 2018, Morgan Stanley believes that it is unlikely to see a new investment "super cycle" in the gold industry.

Exploiting customers will still focus on unticking the project and boosting investment capital by the end of the decade, said Michael Harleaux, an analyst at Morgan Stanley Research. But a super cycle with completely new large-scale exploitation projects is unlikely due to licensing and regulatory problems.

See more news related to gold prices HERE...