Gold price increases by 80% after only 14 months

Gold prices are heading for an unprecedented high in 2025, with a series of two consecutive increases showing that another strong rally could be on the way.

The precious metal has broken a series of records this year, following an impressive increase of 80% since October 2024, equivalent to an increase of 1,564.1 USD in just 14 months.

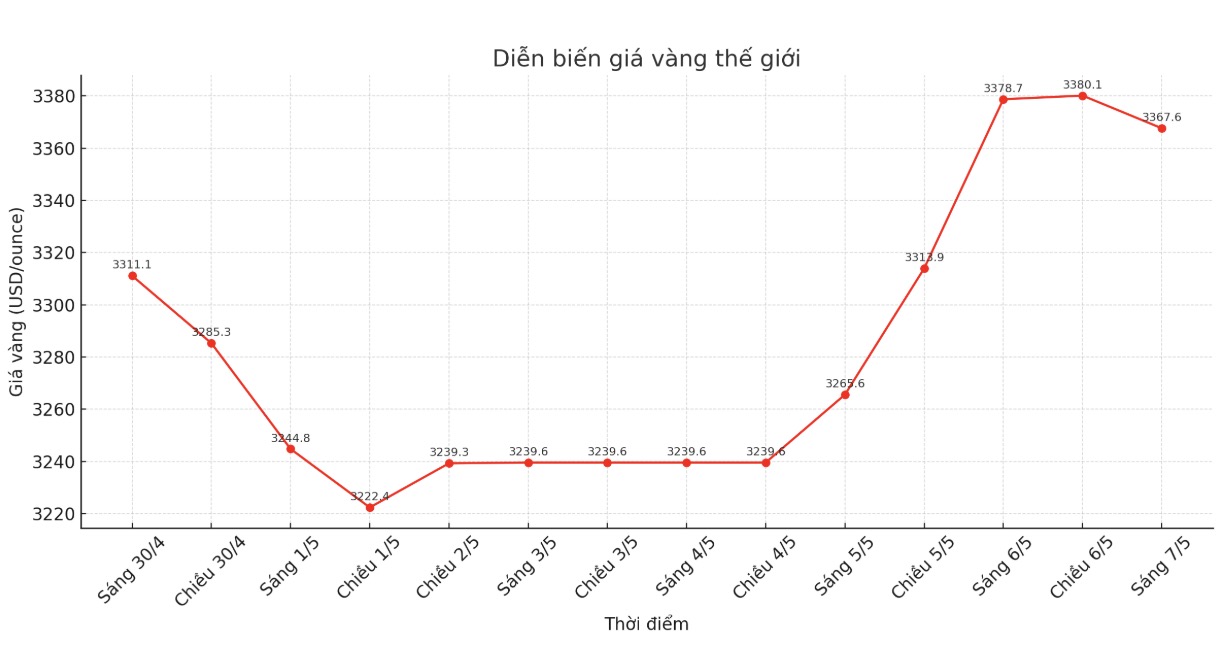

The June 2025 gold futures contract - the most traded type today - closed at 1,966 USD on October 24, 2024. In the last two sessions, the price of this contract has increased by nearly 200 USD, from about 3,244 USD to 3,444.5 USD/ounce.

Many analysts said that this increase is reminiscent of the sharp increase in April, when gold prices jumped from $2,998 to $3,509.9/ounce in just 8 trading sessions, up 17.52%.

The two main reasons behind this are the weak USD and the extremely optimistic sentiment of investors. When the global economy and geopolitics are uncertain, gold is increasingly considered a safe haven.

Current economic concerns mainly come from the new administration's tough trade policy. President Donald Trump has imposed import tariffs on almost all major economies, causing many countries to slow growth and increase the risk of inflation.

Gold is particularly attractive during a period of currency depreciation due to loose global policies. In addition, tensions in the Middle East and the conflict between Russia and Ukraine continue to push up demand for gold.

Central banks speed up gold purchases

Central banks around the world are buying gold at record levels to diversify assets and reduce dependence on the USD. According to the World Gold Council, in 2024, central banks bought more than 1,000 tons of gold, the third consecutive year, and this trend is expected to continue in 2025.

The People's Bank of China is particularly active, increasing its gold reserves for the fourth consecutive month as of February 2025. According to Reuters, China's gold reserves have increased from 73.45 million ounces to 73.61 million ounces, worth more than 208.64 billion USD.

Non-dollar trend drives gold demand

Many countries are stepping up their de-dollar strategy to reduce their dependence on the US dollar and avoid the risk of sanctions. This has further prompted central banks to buy more gold, considering it a safe alternative.

If the increase continues, gold prices could approach the $4,000/ounce mark by the end of 2025 or early 2026.