Rising gold prices continue to fuel the transformation of the mining industry and bring increasingly great value to investors, as one of the world's largest gold mining groups announced record business results in the third quarter.

Barrick Gold Corporation (Barrick - one of the world's largest gold mining groups, headquartered in Canada) said adjusted net profit reached a record of 982 million USD, equivalent to 0.58 USD per share, up sharply compared to 529 million USD, or 0.3 USD per share, in the same period last year. This result is consistent with the analysts' forecast.

At the same time, this leading gold mining company also recorded record highs in operating cash flow and free cash flow, reaching 2.4 billion USD and 1.5 billion USD respectively - up 82% and 274% compared to the third quarter of 2024.

Barrick said it will use abundant cash to bring added value to shareholders. The Group announced a 25% increase in quarterly based dividends to 0.125 USD per share and an additional performance dividend worth 0.05 USD, bringing the total dividend for this quarter to 0.175 USD/share.

In addition, Barrick said it has bought back $1 billion in shares since the beginning of the year and will expand its buyback program to $500 million, bringing the total value of the year's shares back to $1.5 billion.

Mr. Mark Hill - Executive Director of the Group's operations and Chairman and Interim General Director - said: "Higher production gold volumes, lower costs and favorable commodity prices have helped Barrick achieve record cash flow in the third quarter of 2025.

Thanks to that, we can significantly increase stock buybacks, while continuing to implement key growth projects and maintain a strong financial balance sheet at the top of the industry.

With confidence in the ability to create stable cash flow and focus on shareholders, the Board of Directors approved a 25% increase in quarterly principal dividends. Our world-class asset portfolio continues to expand, as evidenced by the large-scale discovery of gold at the Fourmile mine in Nevada."

According to Barrick, record profits were achieved thanks to improved output this year. The group said it produced 829,000 ounces of gold between July and September, up 4% from the second quarter, although still 12% lower than the same period last year. Meanwhile, copper output in the third quarter reached 55,000 tons, down 7% compared to the second quarter.

The company is also controlling costs well. Assets-to-onds (AISC) reached $1,538/ounce, down 9% from the second quarter and up just 2% from 2024.

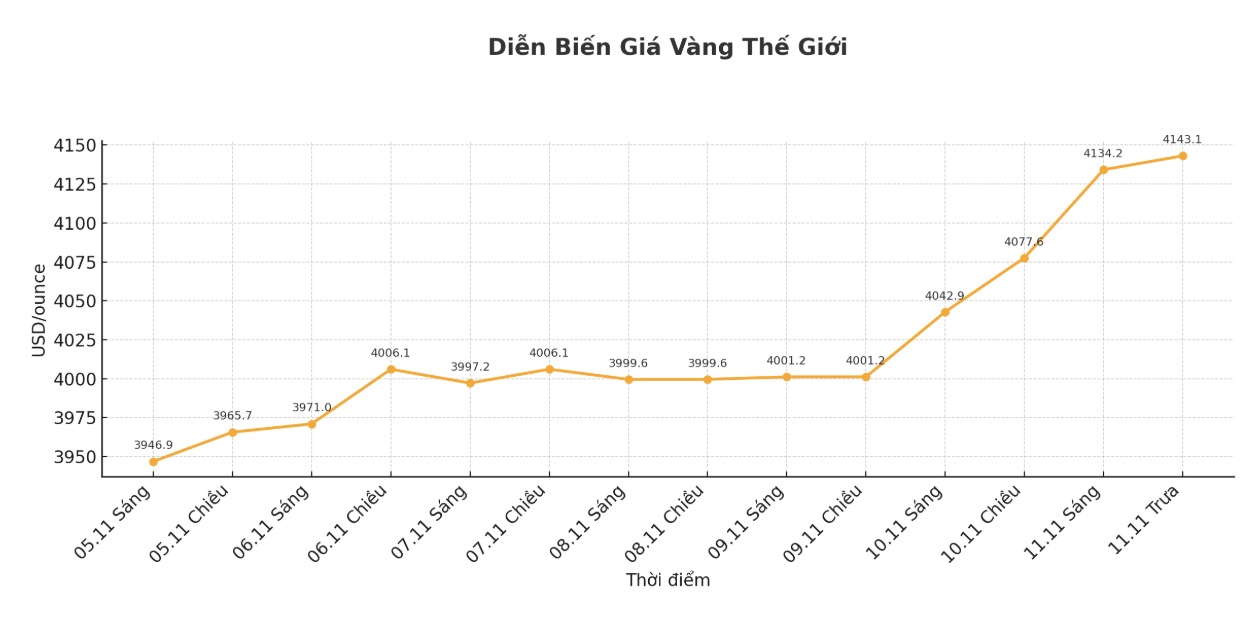

On gold prices, Barrick said the average selling price reached 3,457 USD/ounce, up 39% compared to the third quarter of last year.

Looking ahead, Barrick kept its year-on-year gold output forecast unchanged at 3.15 to 3.5 million ounces, with fourth-quarter output expected to be the highest of the year.

See more news related to gold prices HERE...