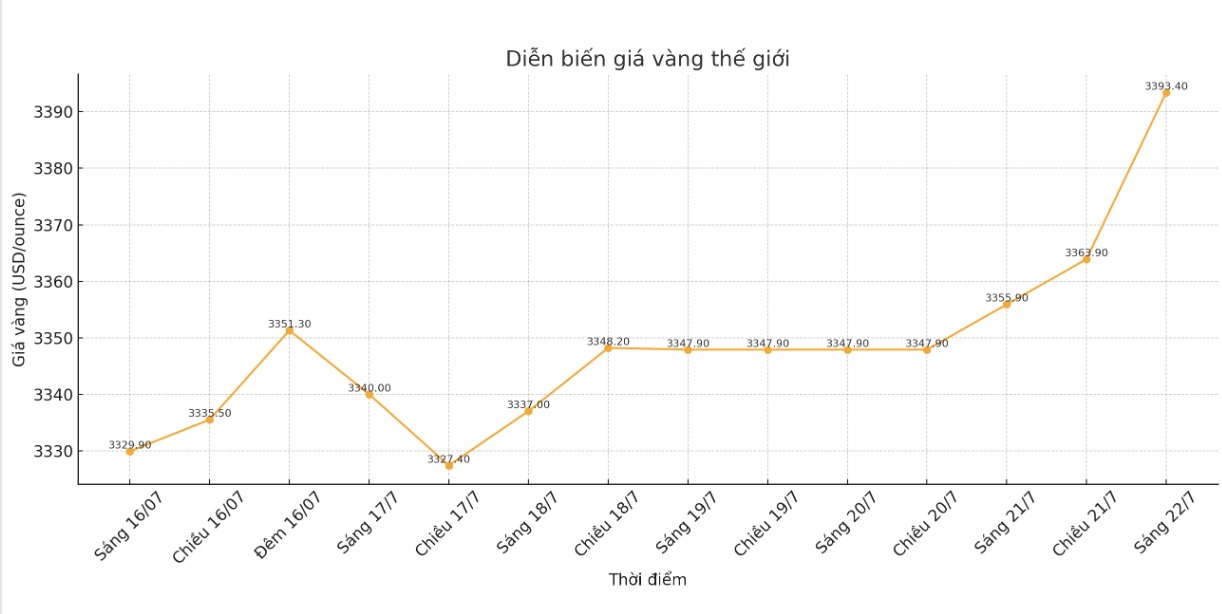

Gold futures for next month's delivery increased by 1.5%, reaching $3,401.9/ounce, while spot gold prices surpassed $3,390/ounce - the highest level since mid-June.

The main driver for gold's price increase is the clear weakness of the USD, as this currency decreased sharply compared to many other major currencies. The ICE Dollar Index lost 0.62 points to 97.86 points, creating a platform to support USD-denominated goods.

At the same time, US Treasury yields also fell, with the 2-year yield falling by 2.6 basis points to 3.854%, while the 10-year yield falling by 5.7 basis points to 4.366%.

The combination of a weak US dollar and falling bond yields has created an ideal environment for gold, an asset that is often more favored when investment yields fall.

Security shelter demand has increased as trade tensions between the US and major partners have escalated, increasing market uncertainty.

A recent speech by US Secretary of Commerce Howard Lutnick has further accelerated trade talks. Although optimistic about the possibility of reaching an agreement with the European Union, Mr. Lutnick emphasized that the deadline of August 1 is a "hard deadline" for negotiations.

He also affirmed that the basic tax rate of 10% will be maintained throughout the negotiation process, showing the government's steadfastness in the current trade policy framework.

Previously, US President Donald Trump officially informed trading partners about specific tariffs that would be applied if negotiations failed.

In response, the European Union has prepared response measures, in the context of the increasingly fragile possibility of reaching a mutually beneficial deal.

In addition, expectations for monetary policy continue to fluctuate. Traders are now pricing in a 60% chance that the Federal Reserve will cut interest rates in September, reflecting growing speculation about the central bank's ability to change leadership and restructure.

This puppet view also contributes to the weakening of the US dollar and falling bond yields, thereby supporting gold prices.

The combination of factors such as geopolitical tensions, currency fluctuations and expectations of monetary policy changes is creating a favorable context for the precious metals market.

As trade talks enter the decisive stage and the Fed's policies are still unclear, gold's traditional role as a hedge against risks is once again affirmed.