According to Reuters, gold prices increased on Thursday after the US Federal Reserve (FED) warned of the risk of rising inflation and a weakening labor market, raising concerns about economic prospects. In addition, investors are also watching the results of the high-level trade talks between the US and China this weekend.

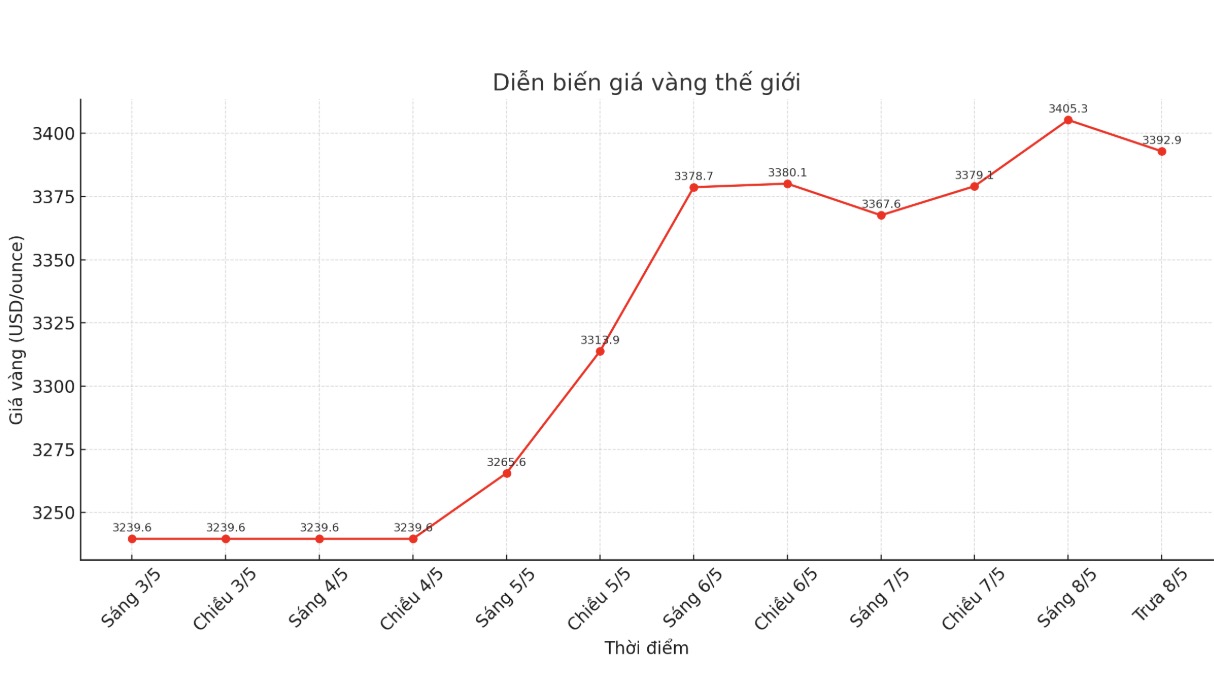

At 4:16 GMT (ie 11:16 Vietnam time), spot gold prices increased by 0.9%, to 3,392.9 USD/ounce; US gold futures increased slightly by 0.2%, to 3,399.80 USD/ounce.

The gold market is focusing on the Feds statement, as the central bank kept interest rates unchanged but warned of rising inflation and unemployment risks, said Jigar Trivedi, senior commodity analyst at Reliance Securities.

The Fed kept interest rates unchanged on Wednesday, but warned of rising inflation and unemployment risks due to the impact of US President Donald Trump's tax measures.

Mr. Trump has said China is the initiator of upcoming trade negotiations, and affirmed that the US will not cut taxes to put Beijing at the negotiating table.

Kyle Rodda - market analyst at Capital.com - commented: "Mr. Trump's tough statements about trade negotiations with China also contribute to improving market sentiment. This is related to two major issues: slowing US growth and the trend of de-dollarization.

The New York Times reported that Mr. Trump is expected to announce a trade deal with the UK on Thursday.

Gold is not profitable, so it is often favored in the context of political and financial instability, especially when interest rates are low.

In other developments, India airstrikes Pakistan-controlled Kashmir on Wednesday in response to the murder of a tourist in Kashmir last month. Pakistan has vowed to retaliate and said it has shot down five Indian aircraft.

Brian Lan - CEO of GoldSilver Central in Singapore - commented: "If tensions continue to escalate, gold prices may continue to increase and surpass the previous peak".

Gold prices hit a record high of $3,500.05 an ounce on April 22.

At the same time, spot silver prices increased by 1.2% to 32.85 USD/ounce, platinum prices increased by 0.9% to 982.81 USD, and paladi decreased by 0.3% to 969.93 USD/ounce.