The conflict that has broken out in the Middle East has once again prompted money to seek gold as a safe haven. Israel's initial attack triggered a sell-off in the stock market and pushed oil prices up. At the same time, safe-haven demand has pushed gold prices to their highest level since the record peak in April of $3,500/ounce. However, the biggest surprise was that bond yields and the US dollar remained almost unchanged.

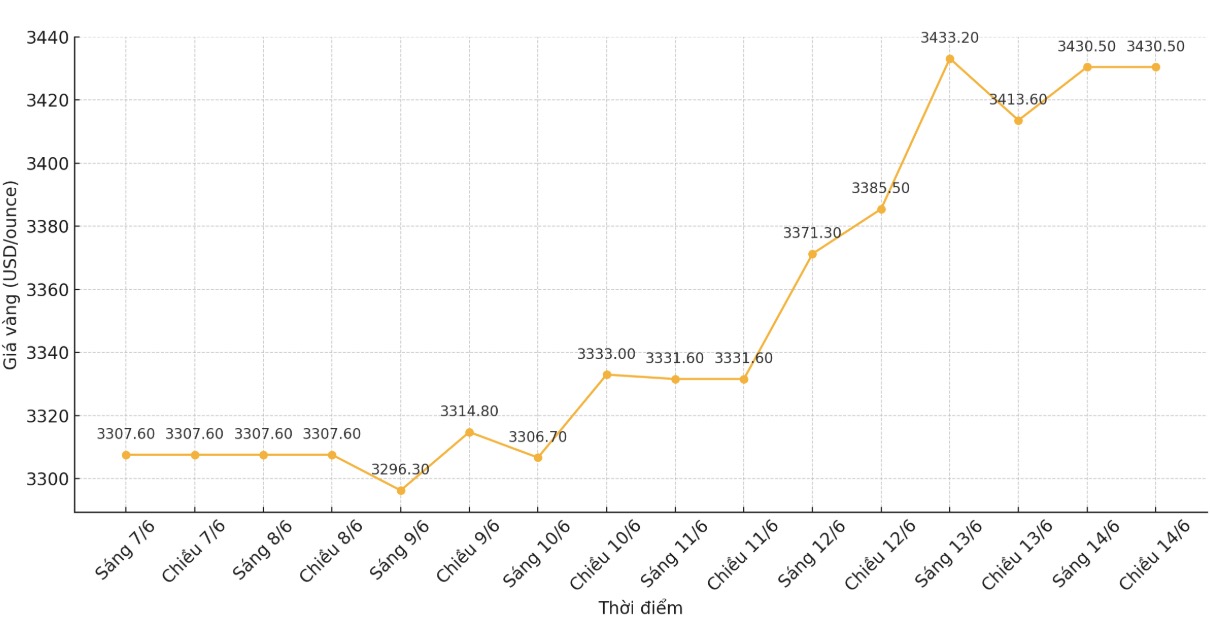

The gold market ended the week up 3.7%, while the USD may end the week down 1%, trading at its lowest level in about three years.

The decline in the USD in the current context is really surprising. The US economy is often considered a stable support for the global economy.

As concerns grow, traditional investors will seek safe-haven assets to protect capital, typically the US dollar and US Treasury bonds, the top safe-haven assets ever. In such situations, safe-haven demand will often push both the US dollar and gold higher.

However, this time, gold seems to be climbing alone. Over the past few months, markets have increasingly questioned the USs reliability as a trading partner.

The global economy has suffered thousands of billions of USD in losses as bond yields increased from 3.98% before April to the current level of about 4.42%.

Gold continues to shine as the most attractive safe haven asset, not affected by the risks of third parties in the geopolitical context.

Although gold is still an attractive long-term alternative currency asset, investors should be cautious when following the market at current prices.

The problem with event-related uptrends is that the increase is often quick when stress is reduced or the market's attention is turned to other issues. The main risk next week is that this new turmoil could stimulate inflationary pressures, forcing the US Federal Reserve (FED) to maintain its neutral stance.