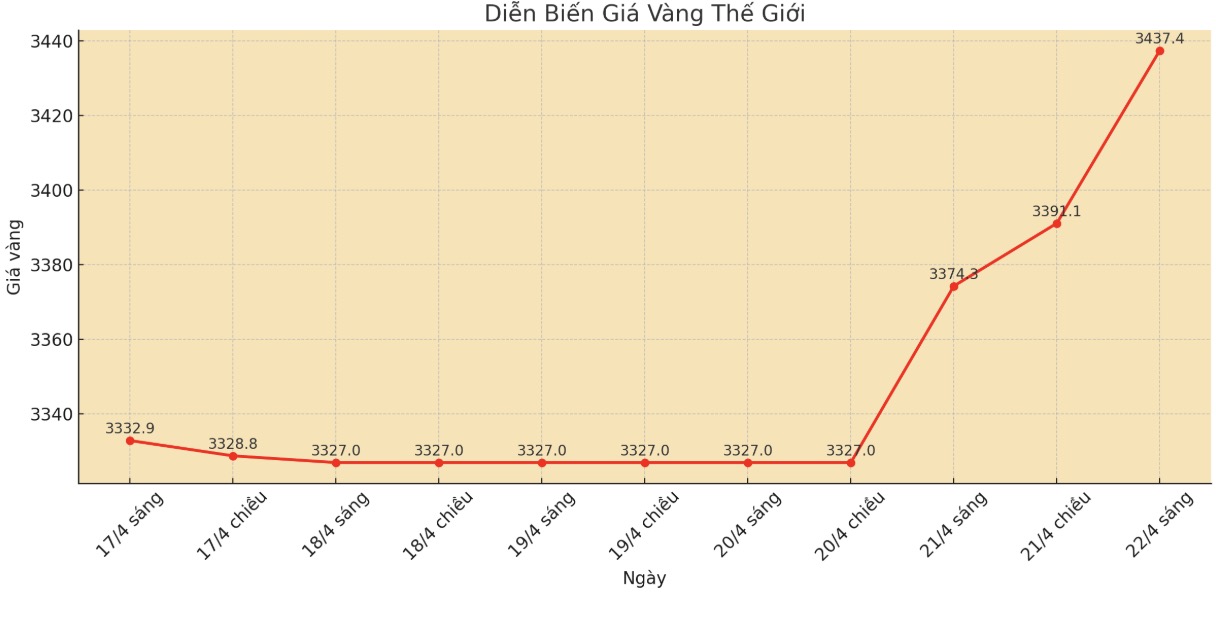

World gold prices increased sharply, surpassing the historical $3,400/ounce for the first time, as the market fluctuated strongly following President Donald Trump's new criticism of the US Federal Reserve's (FED) policies.

The most heavily traded June gold contract increased by 92.2 USD (2.8%) on Monday, reaching 3,434 USD/ounce. This strong growth has helped gold prices increase by more than 400 USD in just 9 trading days, with most of the growth coming from increased purchases, accounting for about two-thirds of the increase.

The rest of the growth period came from the weakening of the USD, when the USD index decreased by 1.02% to 98.165.

Investors rushed to safe-haven assets, including gold and the Swiss francs, while US bond yields increased amid market uncertainty. US major stock indexes fell more than 3% as the president continued to attack Fed Chairman Jerome Powell.

I think the US economy could slow unless interest rates are cut immediately, Trump said on Monday, continuing previous criticism of Powells monetary policy.

This came after a series of criticisms on April 17, when the US President accused the Fed president of "playing politics" for not cutting interest rates.

In a post on the social network Truth Social, Mr. Trump wrote: "With the rising costs I predicted, there is almost no chance of inflation, but the economy could slow down unless Mr. Too Late (the nickname given by President Donald Trump to Fed Chairman Jerome Powell - PV), a big loser, cuts interest rates right now".

The US president also suggested that he had the right to fire Mr. Powell "very quickly" and looked forward to the day the Fed chairman would leave.

These comments go against Powell's cautious stance, who expressed concern about Trump's tariff policies in a speech on April 4 in Arlington, Virginia. Mr. Powell said the Fed is currently facing a "very uncertain outlook."

We are in a good position to wait for more clarity before considering policy adjustments, Powell said. "It is too early to say which monetary policy path is appropriate."

According to Reuters, Powell remains on the view that interest rates should not be lowered until there is more clarity on whether Trump's tariff plans could spark a prolonged wave of inflation.

As political tensions and economic uncertainty continue to rise, golds position as a top safe haven asset has been consolidated, pushing gold prices to record highs.