Employment data positively pushes gold prices near record

The latest data from the US Department of Labor shows that the number of initial unemployment claims in the week ended March 22 fell to 224,000, lower than the forecast of 225,000.

This figure continues to strengthen the recovery of the US labor market, as the number of unemployed people shows signs of decreasing slightly. However, data on unemployment claims still shows that some issues in the US labor market have not been completely resolved.

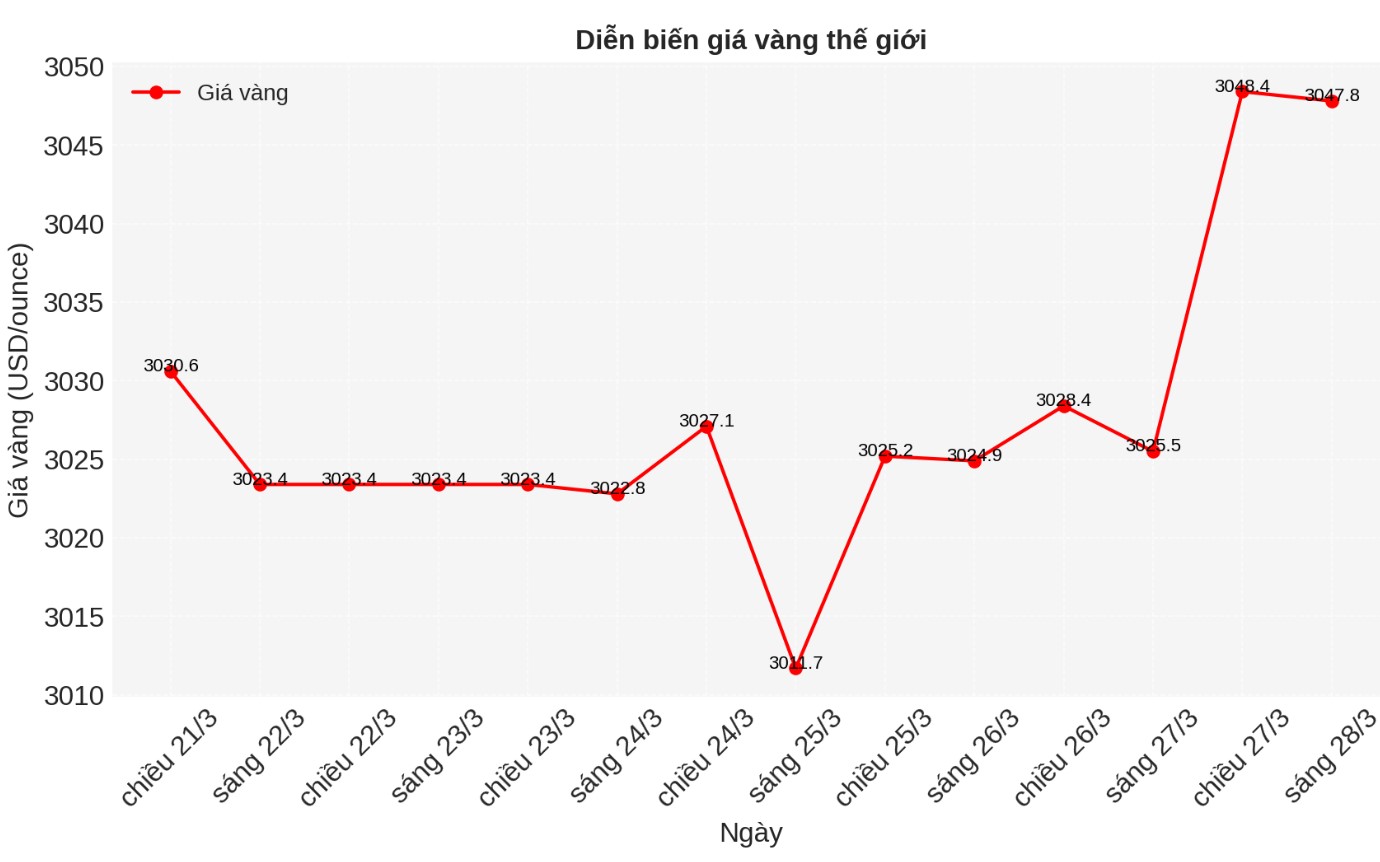

This positive data on employment has helped gold prices continue to maintain their upward momentum. The gold market continues to react strongly to economic data, showing the uncertainty of the economy and causing investors to seek safe assets such as gold.

In general, economic data from the US in February and the fourth quarter of 2024 showed optimistic signs, but not strong enough to prevent gold's price increase. Concerns about the global economy, high interest rates and an uncertain employment situation continue to boost demand for gold as a safe asset.

Factors such as the monetary policy of the US Federal Reserve (FED), the slowdown of the economy and concerns about the labor market will continue to be important factors deciding the gold price trend in the coming time. The combination of these factors, along with uncertainty in the future, will be the driving force for gold prices to continue to soar.

US GDP growth is stable

US GDP growth in the fourth quarter of 2024 reached 2.4%, slightly higher than experts expected, when they forecast a growth rate of 2.3%. Although economic indicators show that the US economy is still maintaining growth momentum, gold prices are not affected too much by these figures.

Although GDP data shows steady consumption, with consumer spending increasing by 4%, concerns about the slowdown of the economy have caused investors to turn to gold as a safe haven, pushing gold prices closer to record highs.

In addition, concerns about inflation and other uncertainties in the global economy have contributed to strengthening the upward trend of this precious metal.

US housing market recovers slightly

Recent data from the National Association of Realtors (NAR) shows a slight recovery in the US housing market, as the number of unfinished home sales contracts increased by 2% in February, reaching 72.

This is a good sign after the index hit an all-time low of 70.6 in January. However, the housing market continues to face many difficulties due to high housing prices and high home loan interest rates, making it impossible for many buyers to access.

Despite a slight recovery, experts still warn that unfinished home sales contracts are still lower than the historical average, which shows that the housing market is not completely stable.

mortgage rates are expected to fall slightly in the coming years, but this decrease is not strong enough to return to the low level of the early period of US President Donald Trump's term, when mortgage rates ranged from 4% to 5%.

See more news related to gold prices HERE...