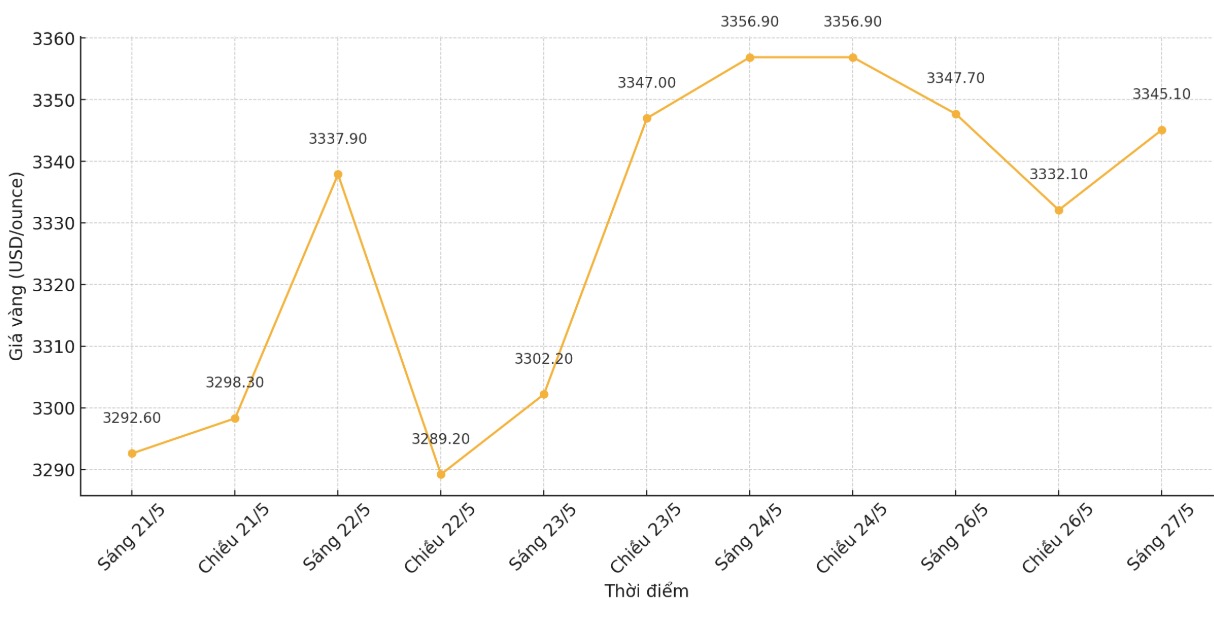

Due to the US closing for a long Memorial Day holiday, the world gold market recorded slight profit-taking activities in a quiet atmosphere, but still maintained a support level of over 3,300 USD/ounce.

Analysts said the precious metal is struggling as safe-haven demand eases. Gold increased sharply last Friday after President Donald Trump threatened to impose a 50% tax on all imports from the European Union (EU) starting from June 1.

However, in a decision to change over the weekend, Donald Trump postponed the plan until July 9 after a call with European Commission President Ursula von der Leyen.

Although the threat of a global trade war has immediately subsided, uncertainty is still affecting investor sentiment, which is expected to continue to support gold prices.

Although gold prices fell slightly on Monday, the broader technical and fundamentals were still leaning towards the uptrend. Citi Bank has raised its 3-month price target to $3,500/ounce, based on geopolitical risks, tariff policies and concerns about the US budget. UBS also remains positive, predicting gold will retake the $3,500 mark, said James Hyerczyk, senior market analyst at FXEmpire.com, in a report.

The market remains above $3,310 and safe-haven demand remains strong, traders should prioritize uptrends, paying attention to outstanding information to get into the order, the expert added.

Although trade tensions have eased somewhat, currency experts at Brown Brothers Harriman warned that the escalation on Friday, this time against Europe, cannot be underestimated.

We already knew this would happen after Donald Trump admitted that the US could not complete the 9-day holiday and would start imposing tariffs instead. Who knows why he chose the 50% is unpredictable, but this is just the beginning of announcements about a higher tax rate.

According to the first announcements on April 9, no serious analysis has been conducted for these tariffs, they are simply sanctions against countries with trade surpluses with the US. We expect the EU to respond quickly. The US, EU and China account for 60% of global GDP, so this escalation could have a negative impact on the whole world," experts said.

In this context, BBH maintains a optimistic view on the USD. Their comments came as the US dollar index fluctuated near 99.

The US dollar continues to be affected by many negative impacts at the same time: growing concerns about finance, unpredictable tariff policies and weak US economic data. These factors will continue this week, the experts said.

In addition to trade issues, the sharp increase in US public debt is also shaking confidence in the bond market. As the Finance Ministry prepares to bid for 2, 5 and 7-year bonds, analysts believe that weak demand and any spike in bond yields could further boost gold prices.

Gold is still one of the few safe-haven assets that are widely trusted. And as yields increase, it could force the US Federal Reserve to take action, by controlling the yield curve or cutting interest rates, analysts see the potential for gold to increase.

See more news related to gold prices HERE...