Gold prices increased closer to $3,400/ounce after less positive than expected labor market data was released, showing that the number of Americans filing for new unemployment benefits was higher than economists predicted.

The US Department of Labor said on Thursday that the number of first-time seasonally adjusted jobless claims reached 226,000 in the week ended August 2. This figure was higher than expected, with analysts expecting 220,000 orders. Last week's figure was also revised up to 219,000 orders.

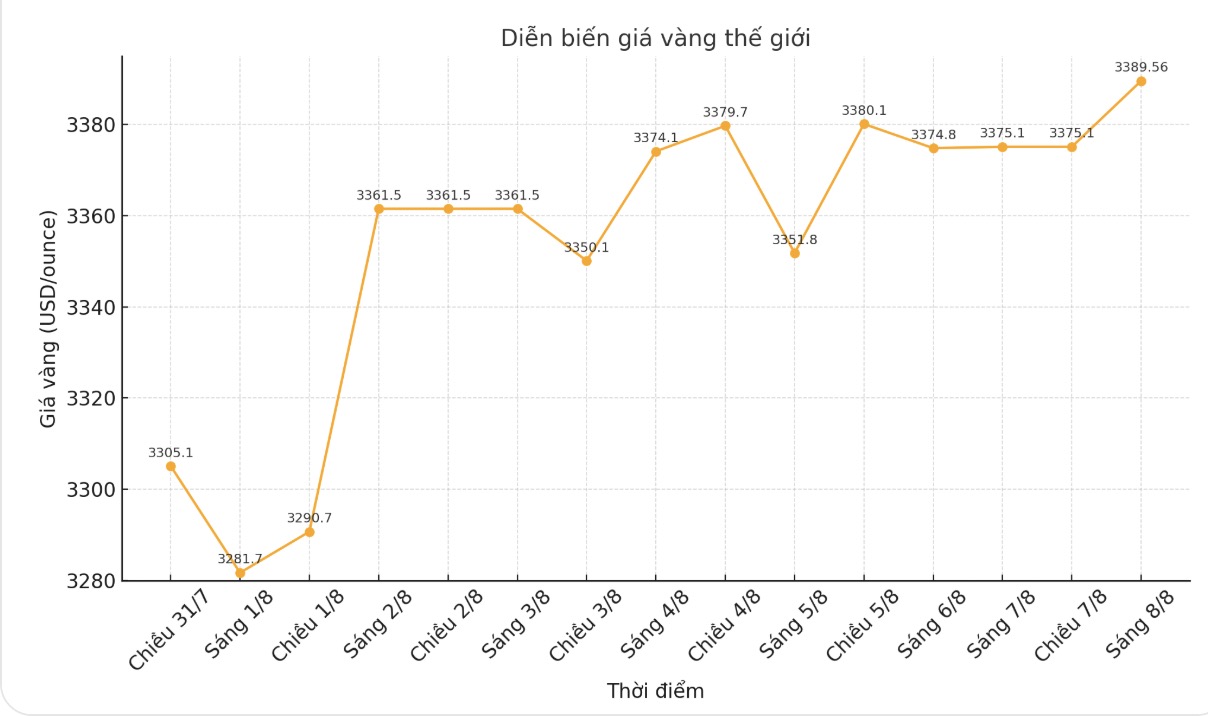

After the data was released at 8:30 a.m. EDT, spot gold prices increased higher. Recorded at 7:40 a.m. on August 8 (Vietnam time), the world gold price was listed at $3,389.56/ounce.

Meanwhile, the 4-week average of new applications - a measure considered more reliable for the labor market due to eliminating weekly fluctuations - reached 220,750, lower than the forecast of 222,000 and compared to the average of 221,250 of the previous week (adjusted).

The number of continued unemployment claims - reflecting the number of people receiving benefits - was 1.974 million in the week ended July 26, higher than the forecast of 1.947 million and 1.936 million in the previous week (adjusted down).

The weaker-than-expected US labor market is creating more momentum for gold prices, as investors bet the US Federal Reserve (FED) will soon switch to an loose stance to support growth.

The increase in unemployment benefit applications reflects reduced recruitment demand, leading to concerns about economic weakness. In that context, gold becomes more attractive thanks to its safe-haven role and the advantage when interest rates are likely to cool down.

The rapid increase in gold prices after the data was released shows the market's sensitive reaction to uncertain signals, while strengthening the prospect that this precious metal could soon challenge the psychological mark of 3,400 USD/ounce if US economic indicators continue to be unfavorable.

See more news related to gold prices HERE...