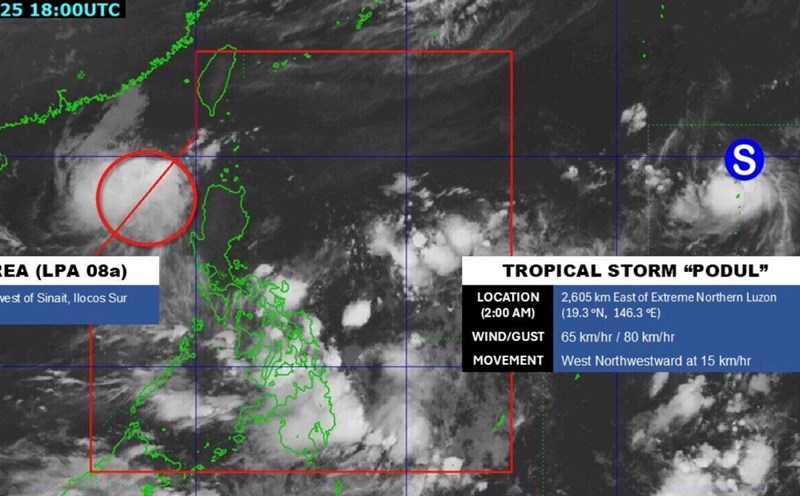

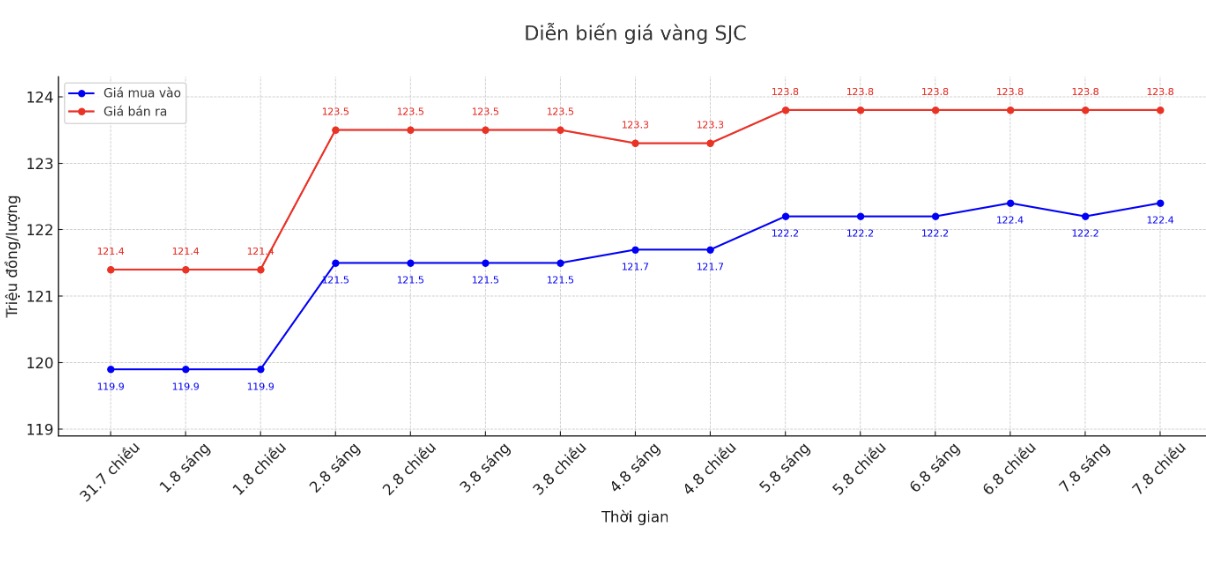

SJC gold bar price

As of 10:25 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND122.4-123.8 million/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 1.4 million VND/tael.

DOJI Group listed at 122.7-124.1 million VND/tael (buy - sell), an increase of 500,000 VND/tael for buying and an increase of 300,000 VND/tael for selling. The difference between buying and selling prices is at 1.4 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 122.4-123.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.4 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 121.2-123.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

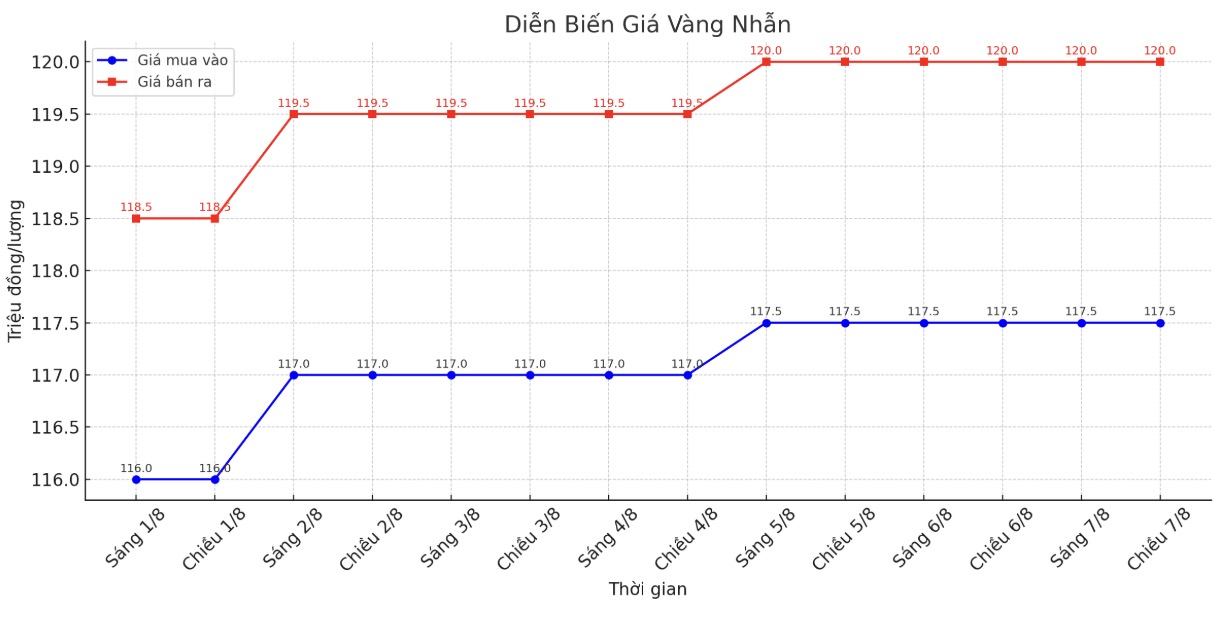

9999 gold ring price

As of 7:00 p.m., DOJI Group listed the price of gold rings at 117.5-120 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.8-120.8 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.8-119 1.8 million VND/tael (buy in - sell out), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

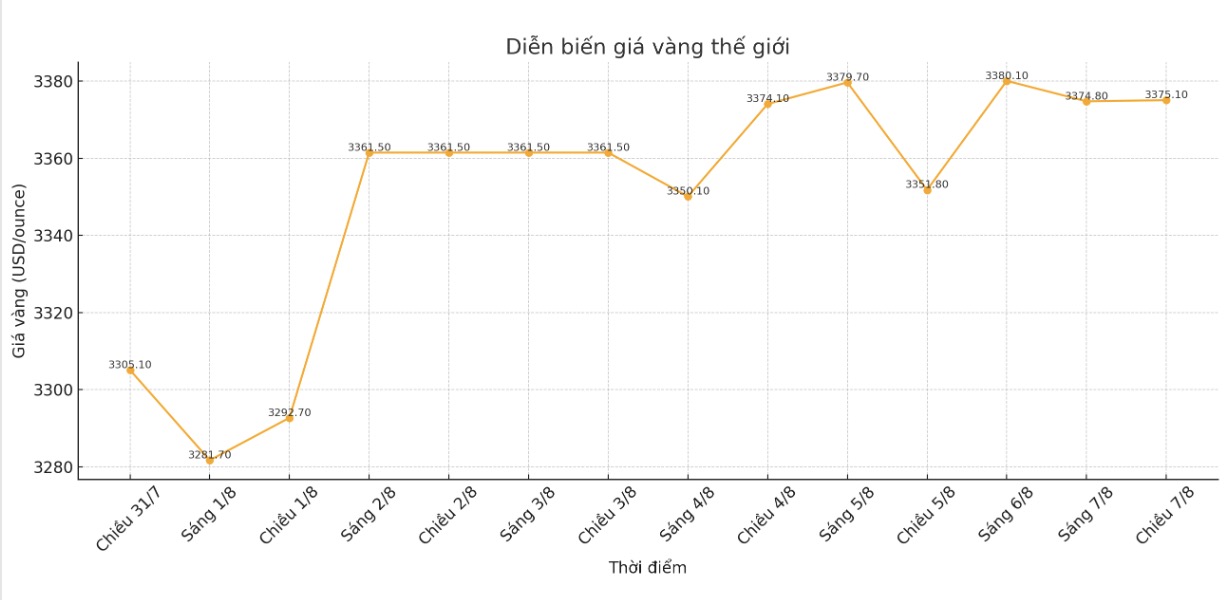

World gold price

The world gold price was listed at 22:30 on August 7 at 3,386.1 USD/ounce, up 6 USD/ounce compared to a day ago.

Gold price forecast

Gold prices increased, hitting a two-week high as positive technical signals in the short term are boosting buying pressure for precious metals.

Meanwhile, the People's Bank of China increased its gold reserves in July, marking the Ninth consecutive month of buying, as part of its asset diversification strategy, reducing dependence on the USD.

Some news agencies said that the amount of gold held by this bank increased by 60,000 ounces, to 73.96 million ounces last month. Since November last year, China has purchased about 36 tons of gold.

Central bank purchases, especially in China, have been a key factor driving gold's 30% gain since the beginning of the year. However, the buying speed has slowed down due to high gold prices.

The European and Asian stock markets mostly moved up in the last session. US stock indexes are also heading for higher openings in today's New York session.

In other news, the Bank of England has cut policy interest rates by another 0.25 percentage points to 4.0%. This move is not surprising to investors.

Russian President Vladimir Putin and US President Donald Trump will have a summit in the next few days, according to the Kremlin. Russia and the US have agreed on a venue and are working together to prepare a agenda for the meeting scheduled for next week, according to foreign policy advisor Yuri Ushakov.

Technically, December gold buyers are having a clear advantage in the short term. The next target for buyers is to close above the strong resistance level at the July peak of 3,509 USD/ounce. On the contrary, the sellers will try to pull prices below the solid support zone at the bottom of July at 3,319.2 USD/ounce.

The first resistance is today's peak of 3,470.3 USD/ounce, followed by 3,500 USD. The first support was an overnight low of $3,430/ounce, followed by $3,400/ounce.

In other markets, the USD index is taking a slight increase. Nymex crude oil also increased, trading around $64.75/barrel. The yield on the 10-year US government bond is currently around 4.24%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...