Gold prices increased thanks to growing expectations that the US Federal Reserve (FED) will continue to cut interest rates in December, along with signals that the US Government shutdown is about to end.

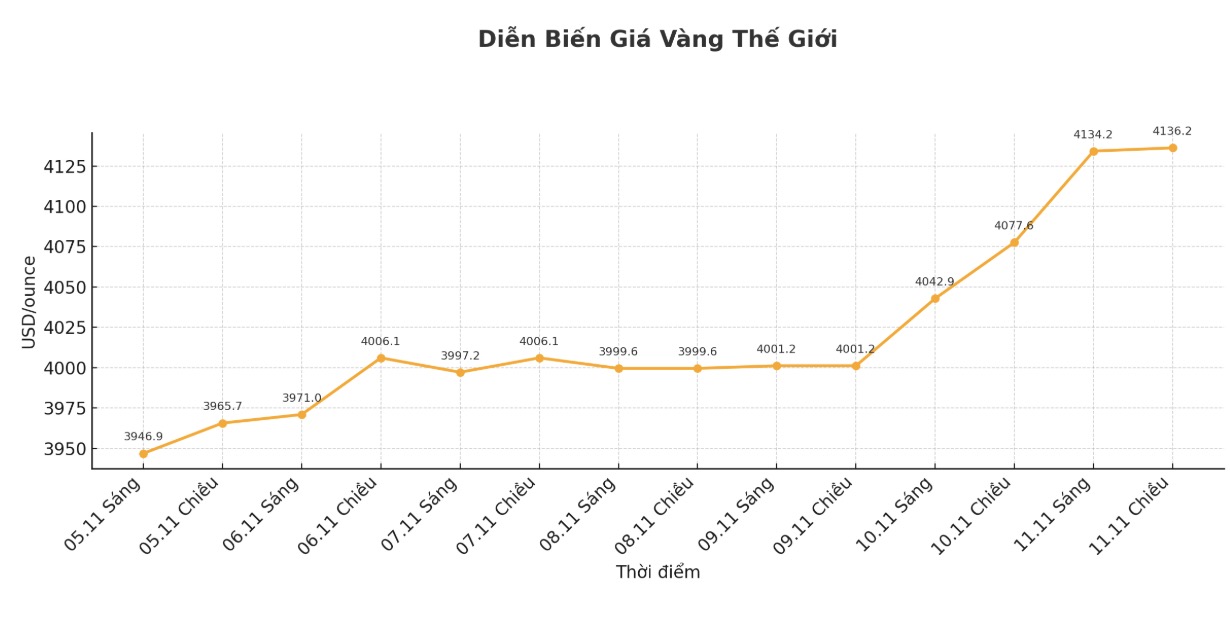

At 6:36 a.m. GMT, the December US gold futures also increased by 0.4% to $4,137.5 an ounce.

The US Senate on Monday approved a federal budget restoration deal, ending the longest government shutdown in the country's history.

Important economic indicators such as the non-farm payrolls report have been delayed due to the closure. The resumption of government operations in the next few days will help clarify the US economic outlook and the direction of the FED interest rate policy.

The news of the US government reopening is mainly welcomed by the market as the removal of an uncertain factor, helping investors return to this year's main speculative story, said Mr. Ilya Spivak - Head of Global Macro at Tastylive.

The trend for the rest of the year is still leaning up. The least Obstructive direction for gold prices is to return to October levels, and then move higher," he added.

Last week, data showed that the US economy lost jobs in October, mainly in the government and retail sectors. US consumer sentiment also weakened to a three-and-a-half-year low in early November, amid concerns about the economic impact of government shutdowns, according to a survey released on Friday.

According to CME Group's FedWatch tool, traders are currently pricing in a 64% chance of a further 25 basis point rate cut in December.

Fed Governor Stephen Miran said on Monday that a 50 basis point cut would be appropriate, noting that inflation is cooling while the unemployment rate is rising.

Gold - un interest-bearing assets often benefit in a low interest rate environment and when there is economic instability.

In other precious metals, spot silver rose 0.5% to 50.81 USD/ounce, platinum rose 0.7% to 1,588.8 USD/ounce, and gold rose 1.1% to 1,430.54 USD/ounce.

The world gold market operates mainly through two valuation mechanisms. The first is the spot market, which is the place to quot prices for buying - selling transactions and immediate delivery. Second is the futures market (futures), which sets prices for future deliveries. Due to declining market liquidity at the end of the year, December gold futures are currently the most actively traded on the CME.

See more news related to gold prices HERE...