Updated SJC gold price

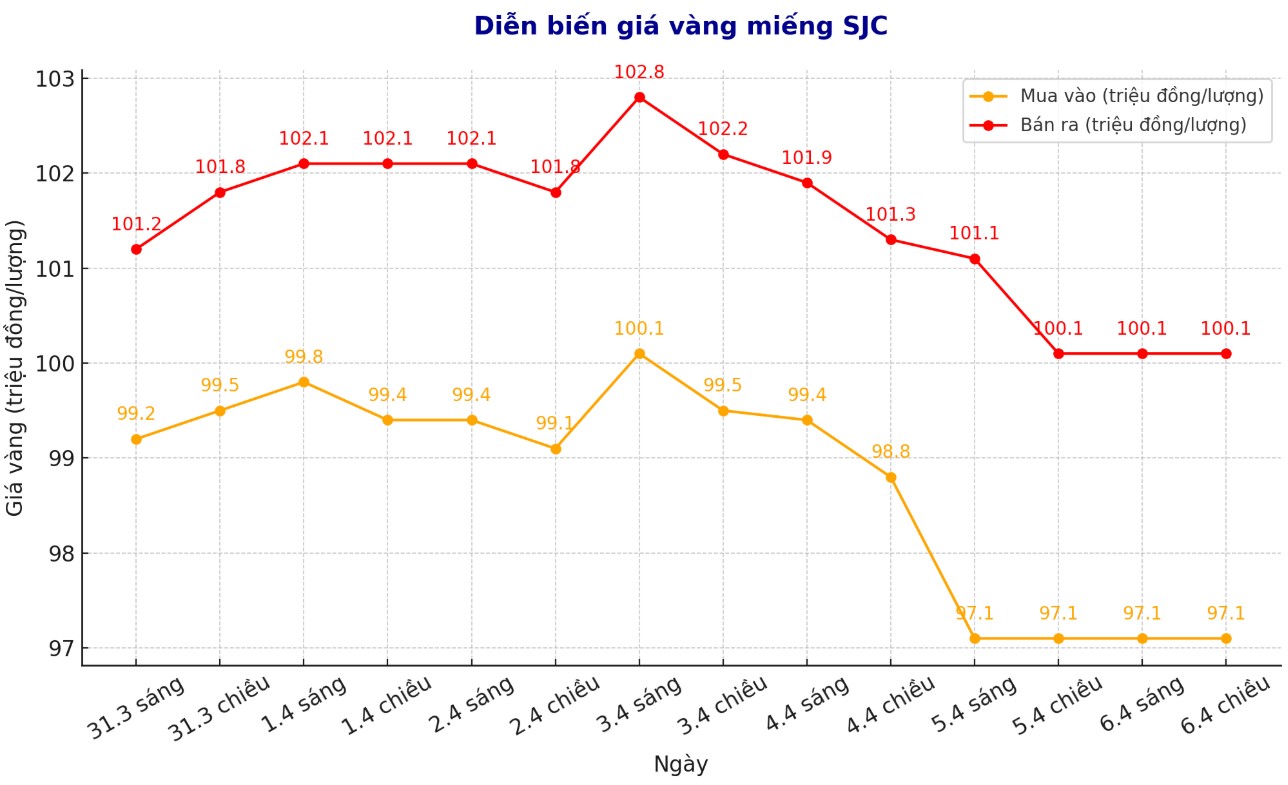

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND97.1-100.1 million/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 97.1-100.1 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 97.2-100.1 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.9 million VND/tael.

9999 round gold ring price

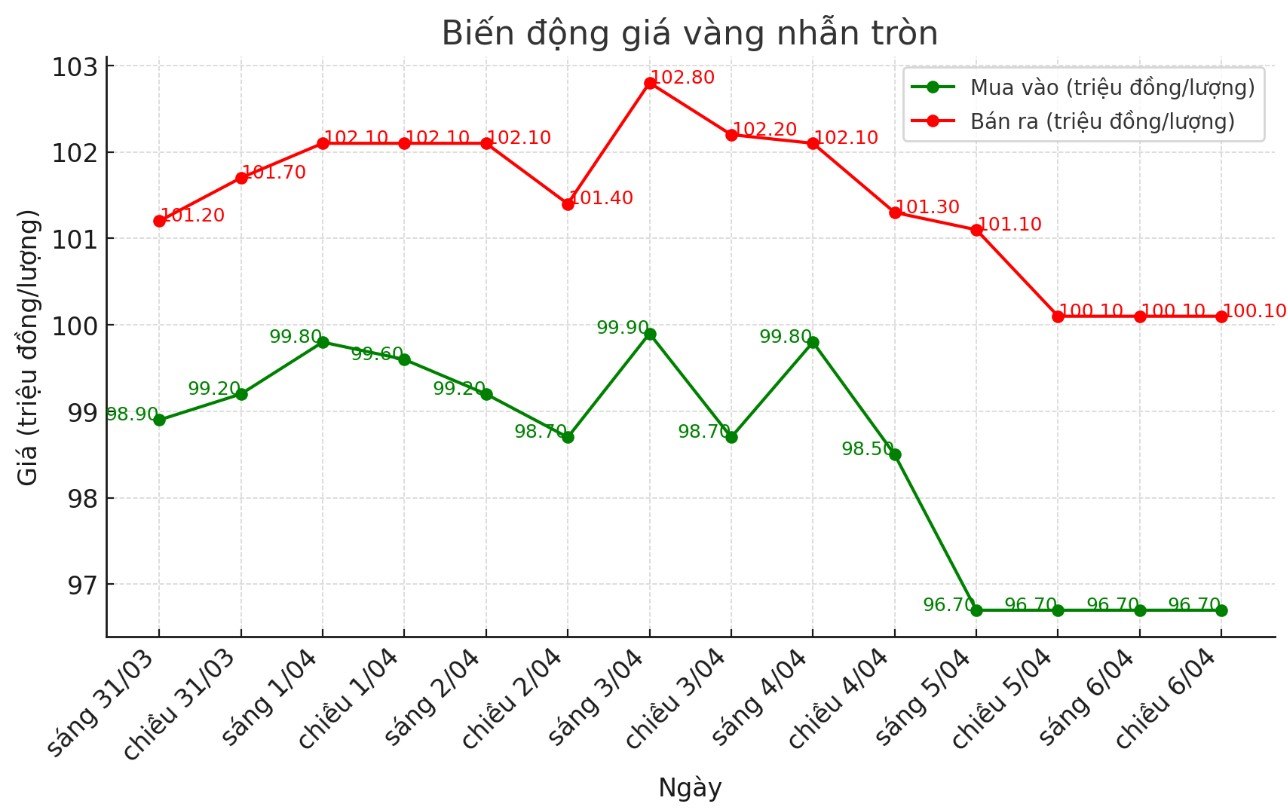

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 96.7-100.1 million VND/tael (buy in - sell out). The difference between buying and selling is at 3.4 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 97.5-100.5 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

As world gold prices fluctuate strongly, the gap between domestic and domestic prices is widening, showing very clear risks. If gold prices turn down, buyers will face a huge loss. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

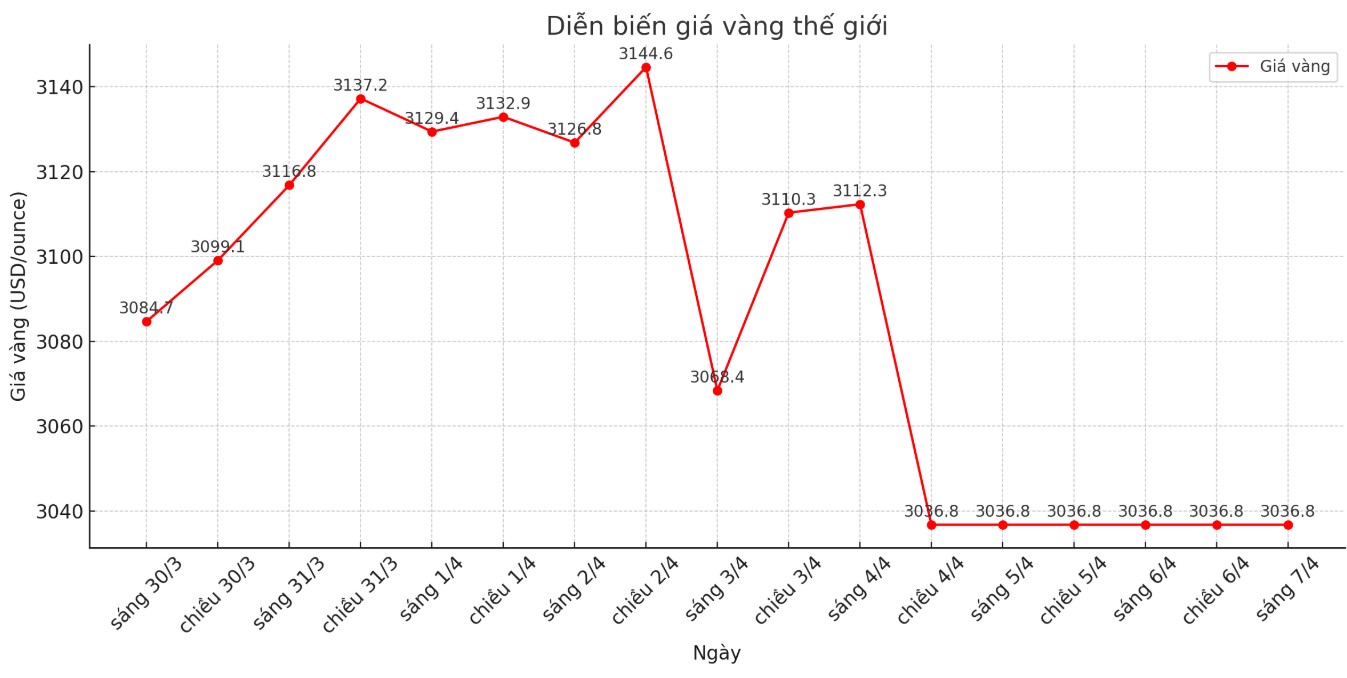

As of 6:00 a.m. on April 7, the world gold price was listed at 3,036.8 USD/ounce.

Gold price forecast

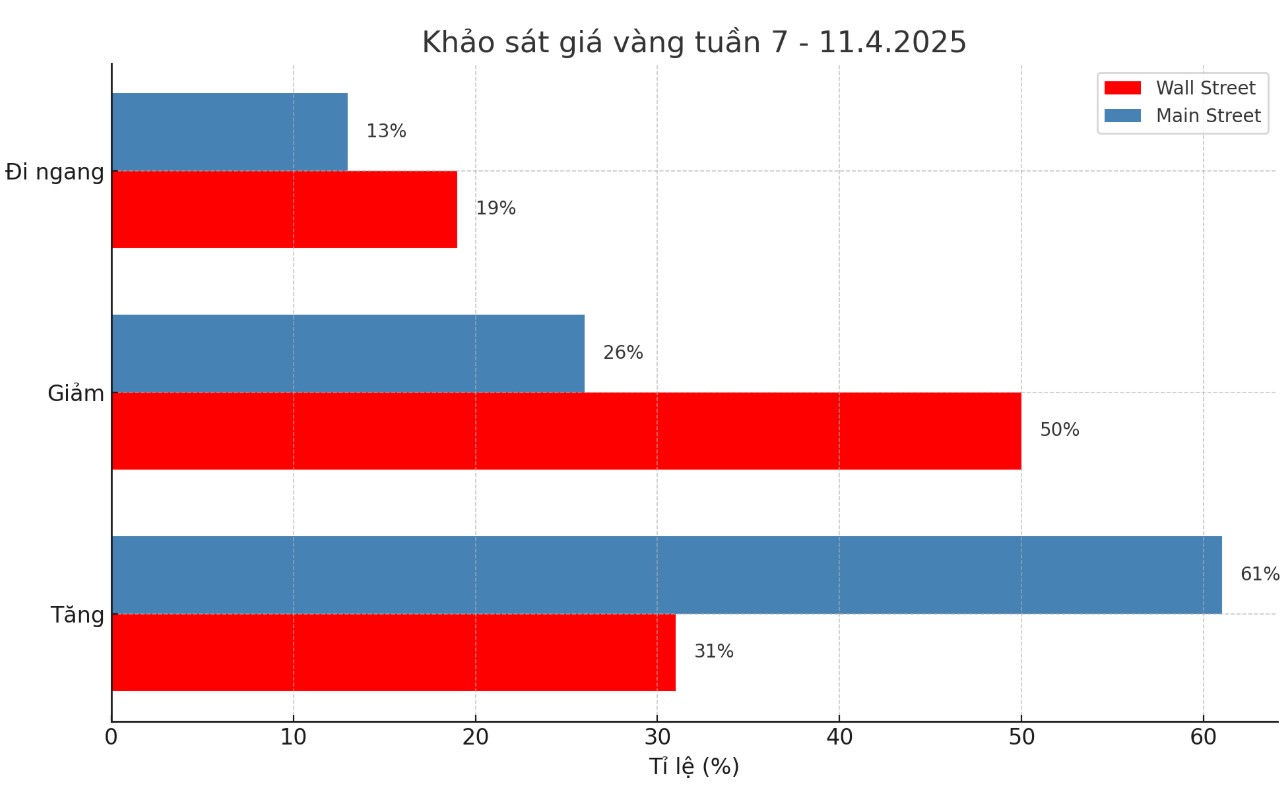

The latest weekly gold price survey from Kitco News shows that many industry experts have given up the strong optimism like last week.

Meanwhile, individual investors have become slightly more pessimistic about short-term gold prices, despite a strong sell-off this week.

This week, 16 experts participated in the Kitco News Gold Survey, the results showed that Wall Street reversed the extremely optimistic view last week. Five experts (31%) predict gold prices will rise again this week. Eight (50%) see gold prices falling further. The remaining three (19%) see gold prices moving sideways around current lows.

Meanwhile, Kitco's online survey attracted 273 individual investors to participate. The sentiment of retail investors has only decreased slightly compared to last week. 167 people (61%) expect gold prices to rise this week; 70 people (26%) expect prices to fall; the remaining 36 people (13%) expect prices to fluctuate sideways.

Marc Chandler - CEO at Bannockburn Global Forex commented that gold is gradually losing its role as a safe haven asset in the eyes of individual investors when it is sold off in parallel with stocks, although the USD and bond yields are decreasing.

He said the 1.5% reduction this week was just to regain the previous increase. If gold price breaks the mark of 3,054 USD/ounce, it may continue to fall to 3,030 and then 3,000 USD/ounce. According to him, technical indicators are signaling a decrease.

According to Standard Chartered analyst Suki Cooper, gold is operating in the right historical trend. He added that it is unusual for gold to sell off after a risky event given its role in the portfolio.

Colin Cieszynski - Director of Market Strategy at SIA Wealth Management has a pessimistic view in the short term.

He said that gold has increased sharply before the tariff information, so many traders can take profits, leading to a short-term adjustment. However, he is still optimistic about the medium-term trend as there are still uncertainties supporting gold.

Adrian Day - Chairman of Adrian Day Asset Management said that gold prices may continue to decline in the next few days, possibly falling around the $3,000 mark but only a short and slight adjustment.

He stressed that the factors supporting gold over the past two years have not only not been lost but have become more obvious. Although prices have increased sharply this year, gold is still not widely available, especially in North America. Therefore, he predicted that gold prices will decrease next week but will increase sharply in the rest of the year.

However, some opinions still believe that gold will soon reverse to increase. Rich Checkan - Chairman and COO of Asset Strategies International believes that gold prices will increase next week. According to him, the recent sell-off was due to investors needing cash to meet deposit calls after the stock market collapsed due to tax repayment.

He believes that next week, investors will take advantage of buying cheap gold and silver, helping prices recover from this temporary decline.

See more news related to gold prices HERE...