Buying power based on chart analysis is dominating as both gold and silver maintain a clear technical upward trend. Closing the most recent session, February gold futures increased by 43.6 USD, to 4,880.9 USD/ounce. March silver futures increased by 3.023 USD, to 95.64 USD/ounce.

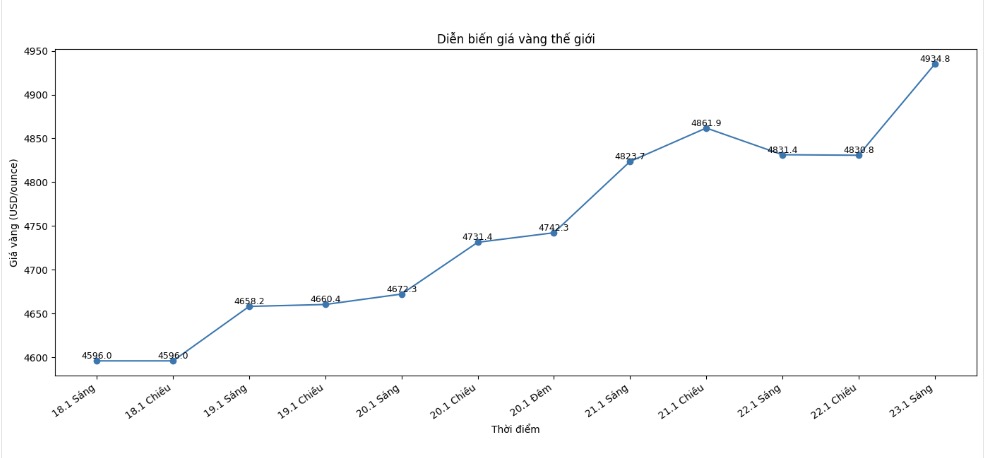

In the spot market, gold prices recorded at 5:55 am (Vietnam time) listed around the threshold of 4,934.8 USD/ounce; while silver increased to 96.06 USD/ounce.

Two precious metals rose in price during the day despite improved risk appetites from traders and investors. On Wednesday afternoon, US President Donald Trump said he would temporarily not impose tariffs on goods from European countries protesting his efforts to gain control of Greenland, on the grounds that a "framework for future agreements" related to the island had been reached.

The market was also somewhat reassure when Japanese government bonds recovered for the second consecutive session on Thursday, led by ultra-long terms, as market sentiment stabilized again after a strong sell-off at the beginning of the week. The recovery took place after calls for calm from Japanese Finance Minister Satsuki Katayama, in the context that some fund managers see recent yield increases as an opportunity to "catch the bottom".

Traders are following the policy decision of the Bank of Japan (BOJ) on Friday, along with the statements of Governor Kazuo Ueda, as well as the auction of 40-year Japanese bonds scheduled to take place next week.

Regarding technical analysis, with February gold futures, the buying side is still clearly dominant. The next price increase target of the market is to bring the closing price to surpass the strong resistance level of 5,000 USD/ounce. In the opposite direction, in the adjustment scenario, the short-term downside target of the selling side is to pull the price below the important technical support zone of 4,539.10 USD/ounce.

In the immediate future, gold is resisting at a record peak of 4,891.1 USD/ounce, followed by the 4,900 USD/ounce mark. The nearest support zones are at 4,800 USD/ounce and the bottom overnight was 4,772.7 USD/ounce respectively. According to Wyckoff's assessment scale, the gold market currently reaches 9.0 points, showing a very strong upward trend.

For silver for March delivery, the technical advantage is leaning completely towards the buying side, as the upward trend is maintained firmly on the price charts. The next upward goal of silver is to close past the important psychological resistance level of 100 USD/ounce. Meanwhile, the downward goal of the selling side is to pull the closing price below the solid support zone at the bottom of this week, 86.57 USD/ounce.

In the immediate future, silver is facing resistance levels at 96 USD/ounce and 97.50 USD/ounce. On the supporting side, important milestones are 92 USD/ounce and 90 USD/ounce respectively. The market ranking according to Wyckoff for silver is currently at 9.5 points, reflecting a very strong price increase.

In foreign markets, crude oil prices fell and traded around 59.75 USD/barrel. The USD index fell sharply, while the US Treasury bond yield for 10-year terms is currently around 4.25%.

The world gold and silver market operates through two main pricing mechanisms. First is the spot market, quoting prices for buying and selling and immediate delivery. Second is the futures contract market, setting prices for futures delivery at a time in the future. Due to factors of adjusting position at the end of the year and market liquidity, December gold futures contracts are currently the most actively traded contracts on the CME exchange.

See more news related to gold prices HERE...