Gold prices will also benefit if the USD continues to weaken

Although gold is in the overbought zone, some experts believe that it will continue to maintain a stable uptrend.

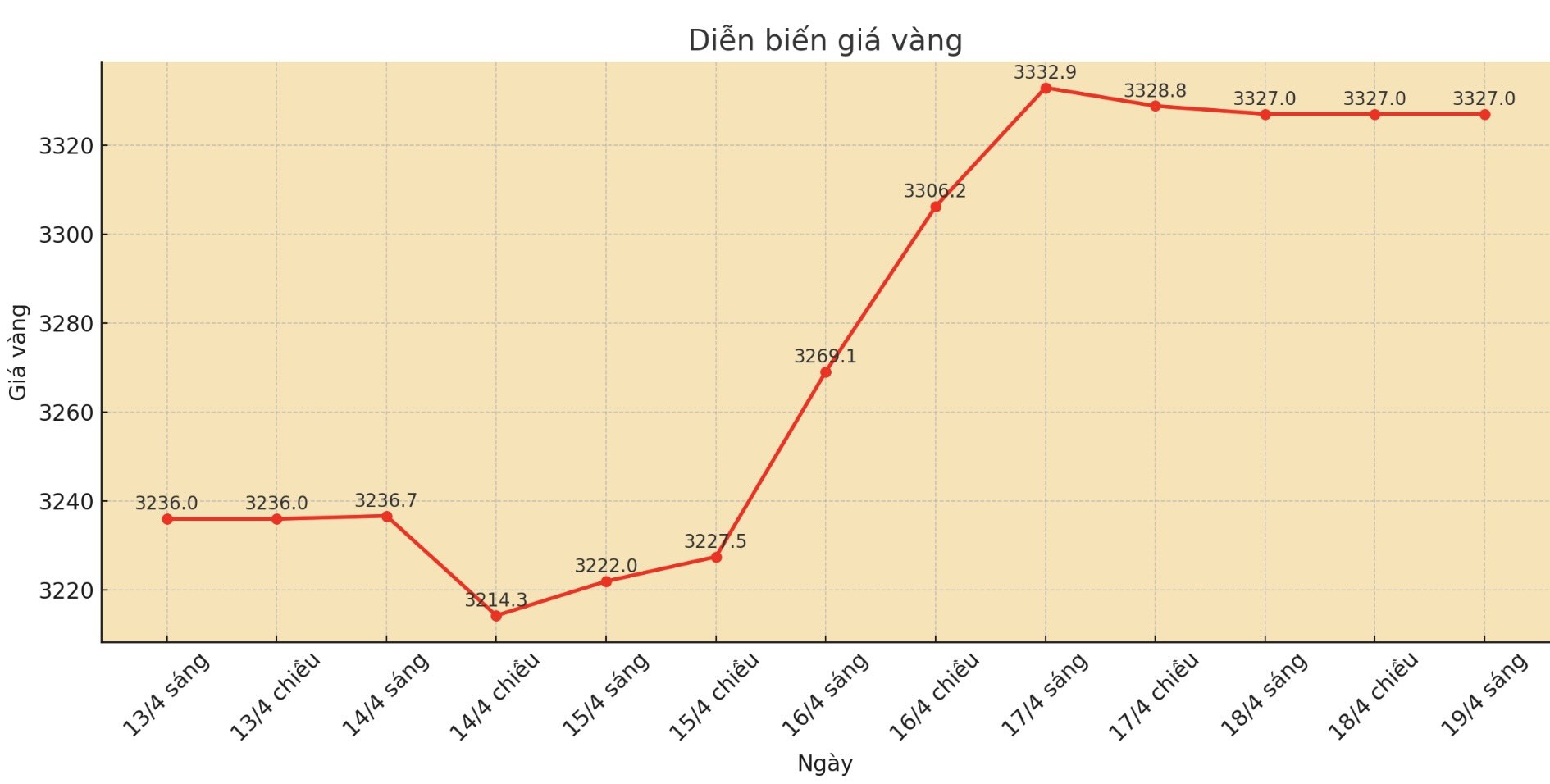

After falling under selling pressure on Thursday, gold still held steady support around $3,300/ounce. Spot gold prices closed the weekend trading session at $3,327/ounce, recovering almost all of the previous decline.

Expert David Morrison - Senior Analyst at Trade Nation - said that the strong increase of 100 USD on Wednesday was the "peak of the current price increase".

He commented: In just one week, gold has increased by 13% (ie 360 USD). Therefore, it is not surprising if prices adjust slightly. The MacD index is also in the same overbought range as its peak in 2011. Although that does not mean that prices cannot continue to increase, investors should be cautious.

Gold's stability comes from the fact that the USD is at its lowest level in 3 years, only 99.49 points.

Mr. Christopher Vecchio - Director of futures and foreign exchange contracts at Tastylive.com - said that gold will continue to benefit if the USD continues to weaken. This expert believes that although the USD has not lost its position as a global reserve currency, the unstable trade policy of US President Donald Trump has weakened the US position.

The US is withdrawing from its global leadership role (Pax Americana) to pursue a US First policy, he said. No currency replaces the USD, but we will need another reserve asset and that is gold.

Any correction is a buying opportunity

Experts at Brown Brothers Harriman also predict that the USD will continue to weaken, thereby supporting gold prices.

Mr. Win Thin - Head of Global currency strategy at this bank said that the decline of the USD reflects the declining confidence in US policymakers, along with the negative impact of uncertainty in policies.

In this context, Mr. Vecchio believes that "any correction in gold is a buying opportunity".

However, the current challenge is that it is difficult to determine a reasonable price in the skyrocketing trend. Mr. Lukman Otunuga - senior expert at FXTM - said that gold prices exceeding $3,350/ounce have increased by 28% since the beginning of the year, surpassing the increase of 24% last year.

Gold is still a safe haven amid concerns about recession and US-China trade tensions, he said. However, due to overbought conditions, the market may make technical adjustments. If adjusted, prices could fall to $3,250 or $3,140/ounce, with the psychological mark of $3,000/ounce as an important support. If it holds at $3,300, prices could continue to $3,400 an ounce and beyond.

Mr. Ole Hansen - Head of Commodity Strategy at Saxo Bank - said that gold prices will adjust strongly from 200-300 USD, but not at this time.

Mr. Donald Trump's public criticism of the Chairman of the US Federal Reserve (FED) - Mr. Jerome Powell further instabilized the market. While Mr. Powell remained neutral and stressed the risk of inflation, Mr. Trump wrote on social media: Powell was always late and wrong, and his report yesterday was another mess. The sooner he is fired, the better.

In contrast to the Fed, the European Central Bank (ECB) has just cut interest rates and may cut again if inflation cools down.

Mr. Fawad Razaqzada - an expert at FOREX.com - said that gold could enter an accumulation phase like strong price cycles in the past. He emphasized: Gold is currently 200-week average above 1,275 USD, or higher than 61%. Such a large gap is difficult to maintain without an extremely favorable macro factor.

If the price breaks through the 3,300 mark, the next support zone will be 3,245, then to 3,167, 3,100 and most importantly, $3,000/ounce. If adjusted further, gold could fall to $2,956 or even $2,790/ounce. However, we should not be too optimistic, we need to monitor the market's reaction in the next few days.

Many experts believe that gold will continue to be sensitive to global geopolitical and trade news, especially when the economic data release schedule next week is quite small. Many international markets will also have a holiday until Monday.

Economic data to watch next week

Wednesday: Preliminary manufacturing and service PMI, new home sales in the US

Thursday: long-term goods orders, weekly jobless claims, existing home sales in the US