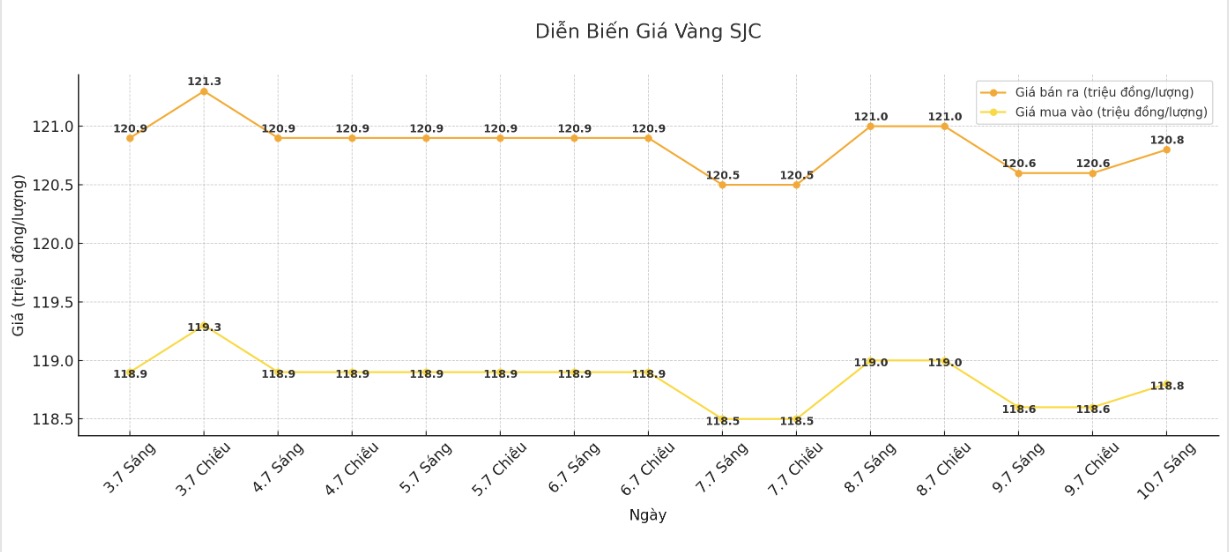

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.8-120.8 million/tael (buy in - sell out), an increase of VND 200,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed the price of SJC gold bars at 118.8-120.8 million VND/tael (buy - sell), up 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.8-120.8 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.1-120.8 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

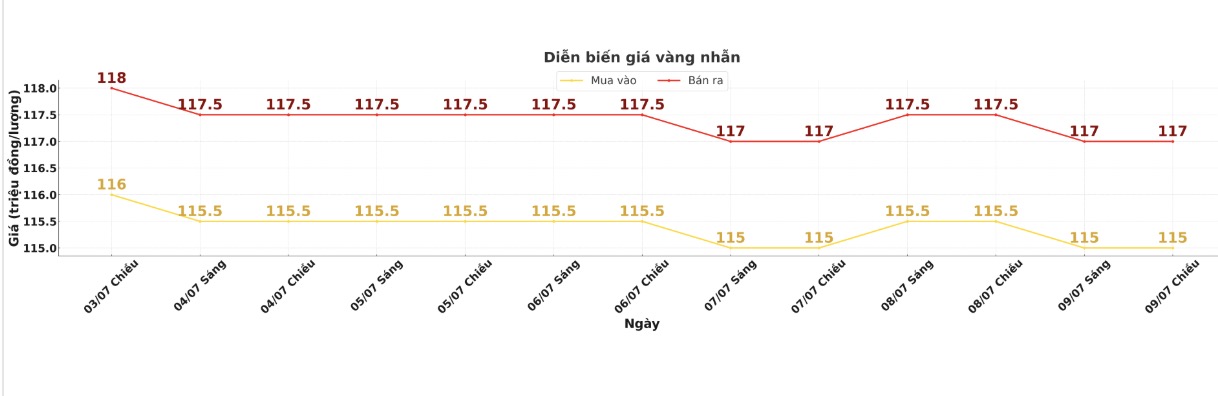

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 115.2-117.2 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.3-118.3 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.2-117.2 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

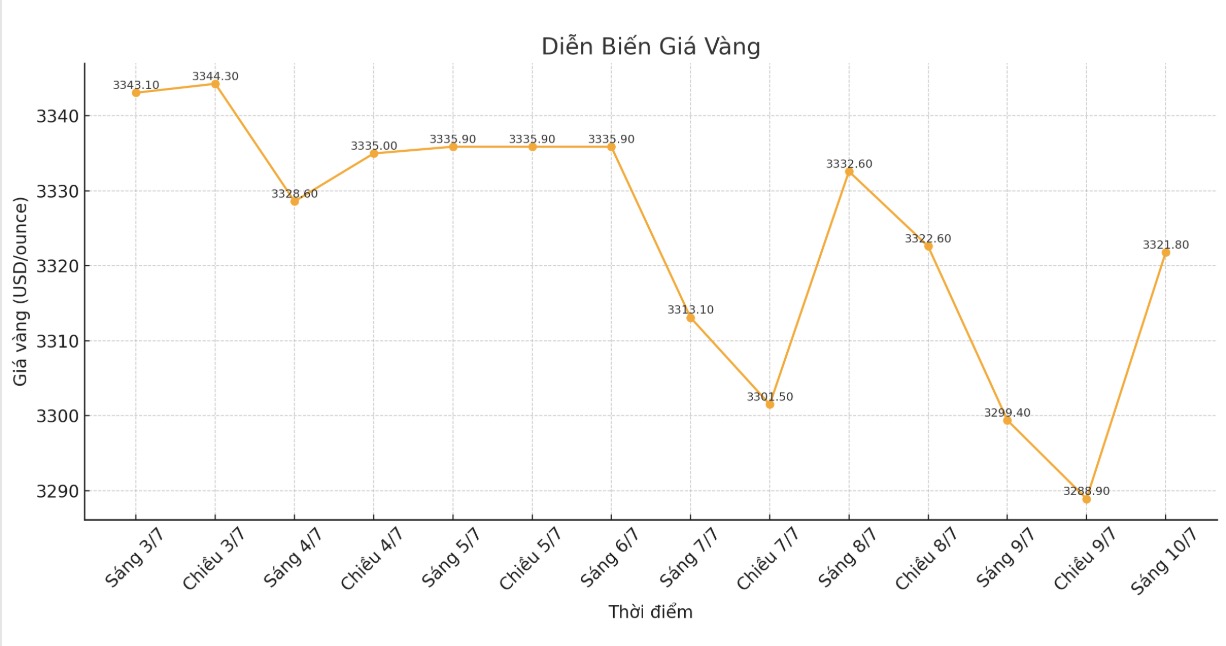

World gold price

At 9:08, the world gold price was listed around 3,321.8 USD/ounce, up 22.4 USD/ounce compared to 1 day ago.

Gold price forecast

After recording a strong increase in the first half of 2025, many investors questioned whether gold, silver and platinum prices have peaked. However, according to Mr. Ole Hansen - Head of Commodity Strategy at Saxo Bank, the factors supporting the precious metal's increase are still intact, and many new drivers may promote prices to continue to increase in the second half of the year.

After a brilliant first half of the year, the investment metals market is entering an accumulation phase. Gold has been flat for the past 12 weeks, creating an opportunity for silver and platinum to catch up. With the increase since the beginning of the year of about 26% for gold and silver, and 54% for platinum, investors are wondering: Is the limit yet?

We believe the answer is not yet, Hansen wrote.

Hansen said the main factors that have pushed the metal price up in recent years are still in place, while new supporting factors are emerging.

Most notably, the prospect of falling US interest rates could red alert demand, especially for precious metals-backed ETFs, as the opportunity cost of holding non-interest-bearing assets like gold will fall against short-term bonds, he said.

Meanwhile, the World Gold Council (WGC) said that gold prices may continue to increase as the US faces a large budget deficit and financial instability, causing global investors to seek gold as a safe haven.

According to the WGC, the additional $3,400 billion in public debt over the next 10 years and the risk of extending the debt ceiling to $5,000 billion could increase pressure on the financial market, weakening the USD and supporting gold.

Experts say that fiscal pressure will continue to cause fluctuations in the bond market, thereby strengthening the role of gold. Although real interest rates are high, gold prices are still rising thanks to the need to prevent risks and buy from central banks.

The WGC believes that instability in economic and trade policies has caused capital flows to withdraw from the US, contributing to a weaker USD, rising bond yields and rising gold prices. Investors are increasingly cautious, making it difficult to accept new bond issuances, causing a large yield gap and making gold an attractive choice.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...