The global gold market fell sharply as a series of US economic data showed that the labor market maintained unexpected strength, increasing expectations that the US Federal Reserve (FED) will continue to keep high interest rates for a long time.

According to the US Department of Labor, in June, the economy created 147,000 more non-farm jobs, far exceeding the forecast of about 111,000 by analysts. At the same time, the unemployment rate fell from 4.2% to 4.1%, contrary to expectations of an increase to 4.3%. In addition, data for April and May were also adjusted upward, further consolidating the assessment that the US labor market has not shown any clear signs of cooling down.

Not only that, the latest number of weekly jobless claims also decreased to 233,000, lower than the forecast of 240,000. The four-week average - which is considered more reliable due to eliminating short-term fluctuations - also reached 241,500 orders, an improvement compared to last week. However, the number of claims continues to remain around nearly 2 million people.

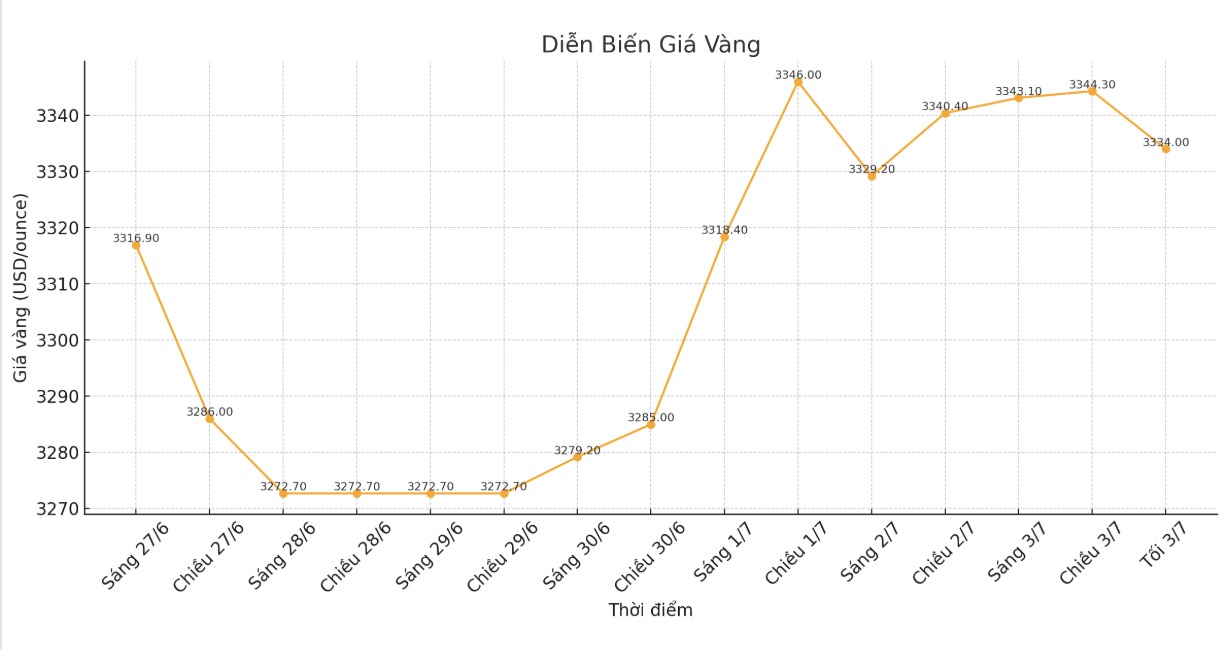

Immediately after this series of positive figures, spot gold prices continued to slide strongly. Thursday's session saw prices fall nearly 0.9% to $3,327.18 an ounce. In the session on Friday, the sell-off continued, pulling the price down to 3,323.7 USD/ounce, down a total of more than 1% on the day.

Experts say that positive employment data has almost dispelled hopes that the Fed will soon loosen monetary policy. Chris Zaccarelli - Investment Director at Northlight Asset Management - said that with a solid labor market, the FED is likely to delay until the end of the third quarter or until the fourth quarter to start considering reducing interest rates.

In addition, the report also points to a slowing trend in wage inflation. Average hourly earnings in June rose just 0.2%, below the expected 0.3%. This has eased inflation concerns, but also suggested that income growth may be entering an adjustment phase.

Although many economic data are considered positive, many analysts emphasized that most of new jobs come from the public sector. This may reflect the unsustainability of job growth in the long term, but for now it is still enough to reinforce the view that the FED maintains a cautious monetary policy, continuing to put pressure on gold as a traditional safe haven.