Gold prices were steady in the trading session on April 25, heading for the third consecutive week of increase as investors continued to maintain optimism, while closely monitoring developments in trade negotiations between the US and China.

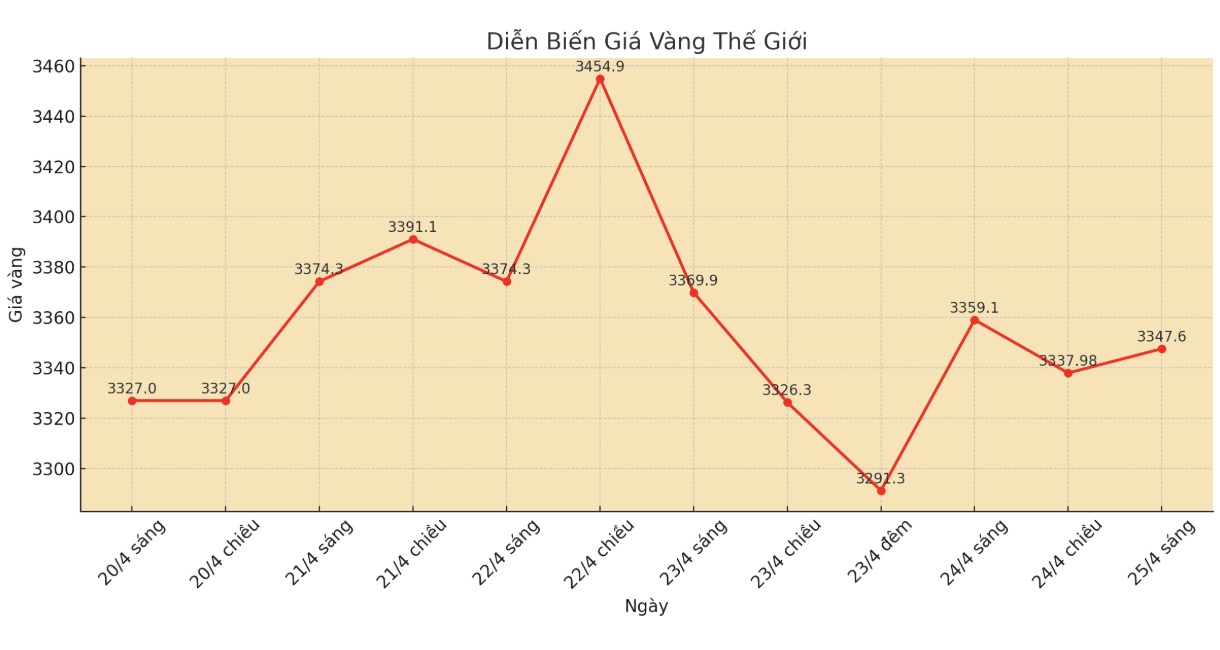

At 9:50 (Vietnam time), spot gold prices stood at $3,348/ounce. US gold futures rose 0.3% to $3,359/ounce.

Although gold purchases are high and could lead to a short-term correction, selling momentum is still limited as investors see gold as an effective preventative channel in the context of uncertainty, said Yeap Jun Rong, market strategist at IG.

US President Donald Trump affirmed on April 24 that trade talks with China are still ongoing, rejecting China's claim that there have been no discussions to ease trade tensions between the two countries.

Meanwhile, a spokesperson for China's Ministry of Commerce said that if the US really wants to resolve the dispute, it needs to lift all unilateral tariffs.

Gold prices have risen more than $700 since the beginning of the year, setting many new records and peaking at $3,500.05/ounce on April 22. This precious metal is often considered a safe asset in times of uncertainty and benefits in a low interest rate environment.

In the long term, the factors supporting gold remain solid, with room for expansion of foreign exchange reserves in emerging markets as they gradually adjust to the reserve structure of developed economies, Mr. Rong added.

The US Federal Reserve (FED) officials are not in a hurry to adjust monetary policy, waiting for more data to assess the impact of the Trump Trump administration's tariff policies on the economy. Traders predict the FED will cut interest rates by about 84 basis points from now until the end of 2025.

Regarding the geopolitical situation, Mr. Donald Trump criticized Russian President Vladimir Putin after the missile and drone attack on the Ukrainian capital Ukraine Ukraine Ukraine, which is considered the biggest attack of the year.

The market for other precious metals recorded spot silver prices falling 0.5% to 33.42 USD/ounce, platinum fell 0.1% to 969.65 USD/ounce, palladium fell 1.2% to 943.24 USD/ounce.