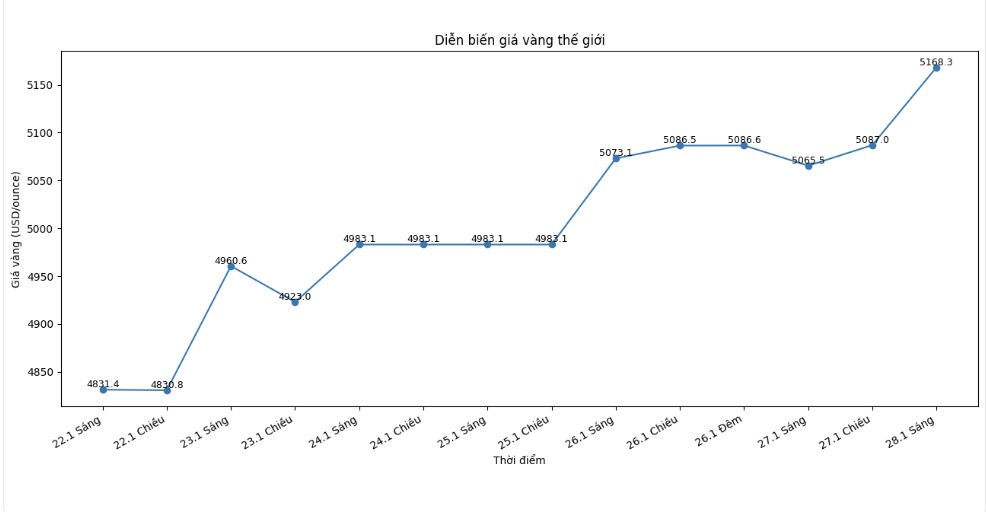

Throughout January, gold prices continuously conquered new milestones. As of today, gold futures contracts have increased by about 100 USD, at times exceeding the threshold of 5,180 USD/ounce.

This is not only a new milestone for the price-rising market, but also reflects a fundamental change in the way the global financial system values this precious metal amidst unprecedented instability.

Escalating geopolitical tensions are causing investors to turn to safe assets. Disagreements between the US and NATO related to Greenland, trade threats targeting Canada with the ability to impose 100% tariffs, and prolonged instability in the Middle East have created high and sustainable "risk fees", directly boosting gold demand.

Unlike short-term market shocks, these structural fluctuations show that global risks will continue to extend, thereby continuing to support gold prices even during normal corrections.

Another important support factor comes from the strong gold buying activity of central banks, especially in emerging economies, as they accelerate reserve diversification and reduce dependence on the USD.

On average, global central banks buy about 60 tons of gold per month, more than three times higher than the pre-2022 average (only about 17 tons/month). This sovereign demand helps create a "floating price" for the market, reduce volatility and maintain stable demand – something that capital flows from individual or institutional investors can hardly replace.

Many major financial institutions have strongly raised their gold price forecasts. Goldman Sachs currently set a target of 5,400 USD/ounce in December 2026, up from the previous forecast of 4,900 USD. J.P. Morgan forecasts that the average gold price will reach about 5,055 USD/ounce in the fourth quarter of 2026 and may reach 5,400 USD by the end of 2027.

Some more optimistic viewpoints, such as ICBC Standard Bank and Yardeni Research, suggest that gold prices could completely reach from $6,000 to $7,150/ounce this year if current conditions continue to be maintained. These forecasts are not speculative, but based on actual supply and demand, monetary policy expectations and changes in global reserve strategies.

Not only gold, the silver market also increased sharply. At the end of January, silver prices peaked at over $100/ounce, thanks to safe-haven cash flow and concerns about supply for industrial demand. In one year, silver prices increased by more than 200%, pulling the gold/silver price ratio down to below 60 times - the lowest level in more than a decade, showing that the metal still has room to increase in price.

The breadth of the price increase is clearly shown through the record trading volume. On January 26, CME Group Exchange recorded a new record with 3.3 million metal contracts traded in one day, an increase of 18% compared to the previous record. Daily gold and silver trading volume both reached unprecedentedly high levels, with the participation of individual investors (through small contracts) to large organizations. This shows true market confidence, not a fragile, easily reversible increase.

Unlike previous price increase cycles, this increase is supported by many simultaneous sources of demand. Gold holdings in ETF funds in the West have increased by another 500 tons since the beginning of 2025, reversing the long-term withdrawal trend. Super-rich people are increasing physical gold purchases, while J.P. Morgan forecasts capital inflows into ETFs to reach 250 tons and demand for gold bars and gold coins in 2026 to exceed 1,200 tons. The convergence of demand from central banks, financial institutions, individual investors and the wealthy has created many solid "supports" for the market.

Notably, gold prices rose sharply even when real interest rates remained high – which goes against traditional rules. This shows that the relationship between gold and macroeconomic factors may have changed, although investors still need to monitor whether this shift is sustainable.

Technically, the gold price trend is assessed as very positive as the price is maintained on all important average lines, continuously setting higher peaks and bottoms. The psychological milestone of 5,000 USD has shifted from the resistance zone to support, while 5,400 USD is considered the next important target. If this threshold is sustainably exceeded, the market may witness a wave of buying following the momentum and short selling positions.

See more news related to gold prices HERE...