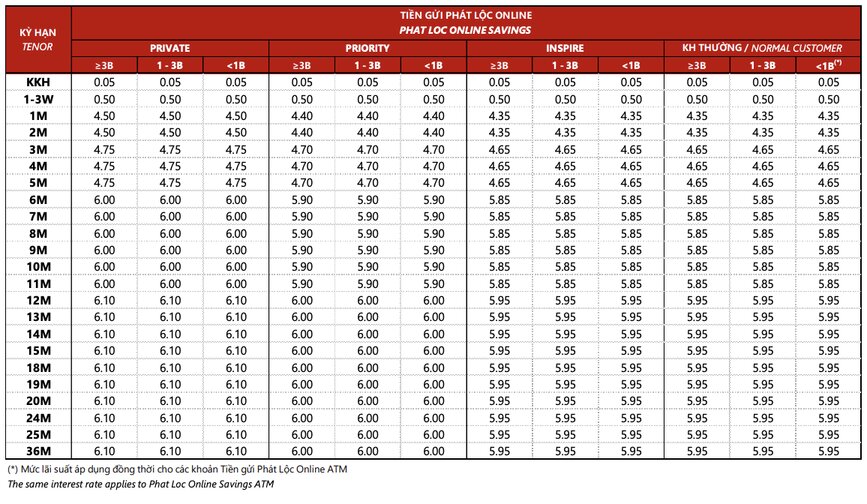

According to the latest capital mobilization interest rate table just announced by Techcombank and effective from December 6, 2025, the bank continues to maintain an attractive interest rate incentive policy for online savings deposits.

The survey shows that the highest interest rate in the whole system is currently 6. 10%/year, applied to the product "Phat Loc Online Deposit". This is the interest rate for priority customers ( Private Banking) for long terms of 12 months or more.

Compared to over-the-counter deposits, online savings at Techcombank bring significantly better yields.

How much interest do you receive if you deposit 1 billion VND?

For the same deposit of 1 billion VND, Private customers at Techcombank are enjoying an interest rate of 0.15% - 0.25% higher than regular customers. This difference brings a significant difference in profit.

Formula for calculation: Interest = 1 billion VND x Interest rate (%/year) x (Number of months deposited / 12)

Below is the amount of money that the top group of customers will receive. Preferential interest rates are superior to the general level:

Thus, if capital is not needed in the next year, depositing at a 12-month term will help customers "pocket" 61 million VND in interest. This is a safe and stable profit in the current market context.

If you want to maximize the profit for long-term idle money, a 36-month term with a total actual interest of up to 183 million VND is a worth considering choice.

For regular customers, the applied interest rate will receive the interest rate and other interest:

Customers can deposit on the digital banking application to ensure they receive this preferential interest rate instead of depositing at the counter.

Note: The table is calculated based on a deposit of 1 to less than 3 billion VND. Interest rates may change if the deposit is less than VND1 billion or larger than VND3 billion.