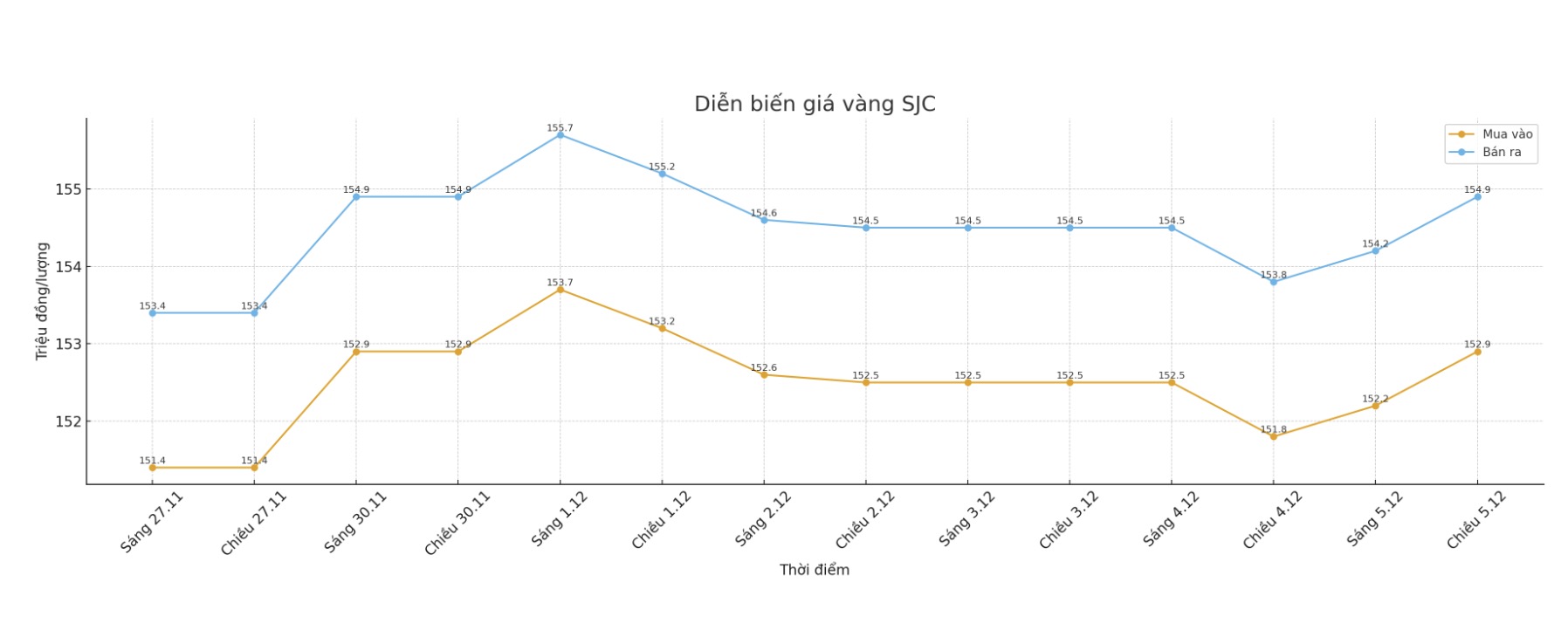

SJC gold bar price

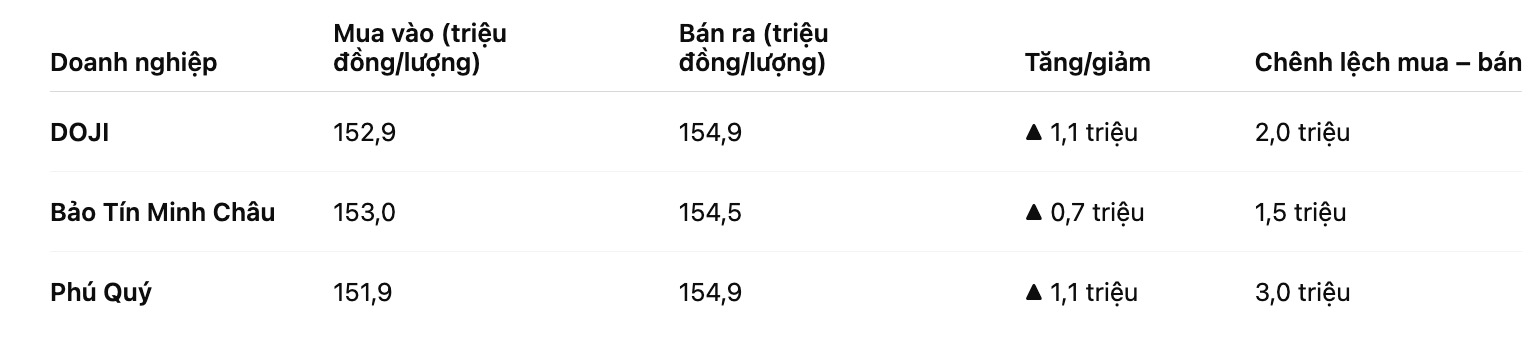

As of 6:00 a.m. on December 6, the price of SJC gold bars was listed by DOJI Group at VND152.9-154.9 million/tael (buy in - sell out), an increase of VND1.1 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153- 154.5 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.9-154.9 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

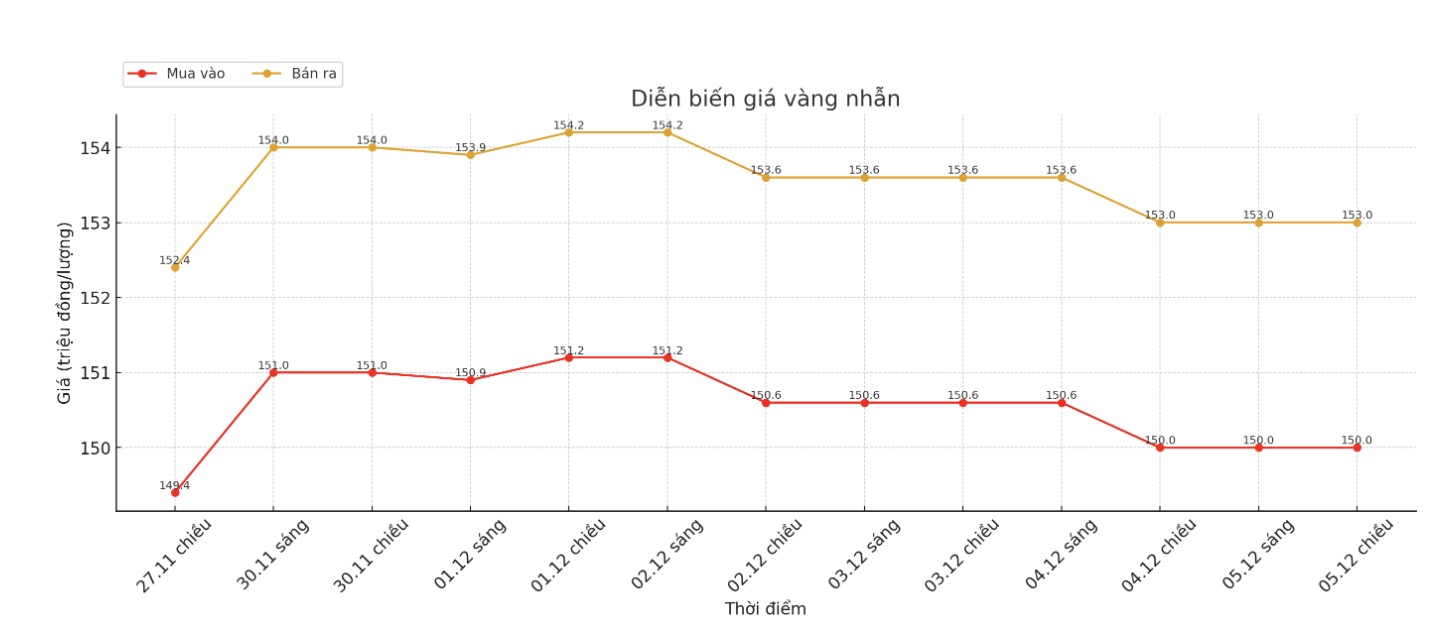

9999 gold ring price

As of 6:00 a.m. on December 6, DOJI Group listed the price of gold rings at 150-153 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151-154 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150.3-153.3 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

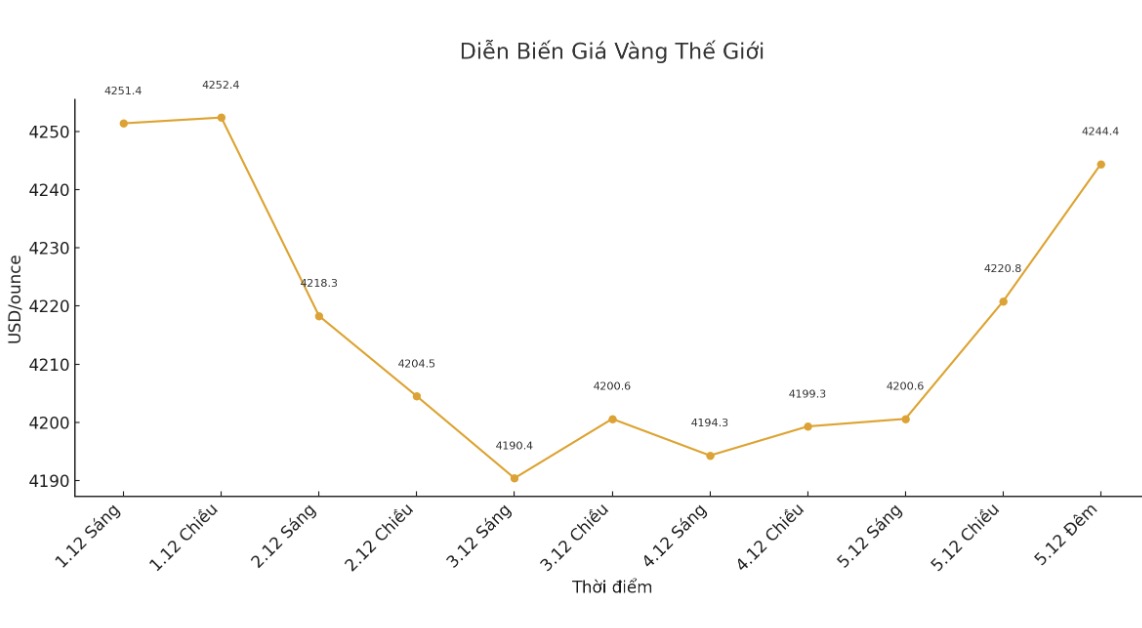

World gold price

The world gold price was listed at 9:57 p.m. on December 5, at 4,244.4 USD/ounce, up 36 USD compared to a day ago.

Gold price forecast

Gold prices increased as positive technical signals continued to strengthen the psychology of speculators holding a buying position in the futures contract market.

The global stock market moved in opposite directions in the trading session last night. US stock indexes are expected to open slightly as the New York trading session begins.

In overnight news, the Central Bank of India cut key interest rates. The country's central bank today lowered its benchmark interest rates for the first time in six months and signaled it was ready to continue to ease, as it forecast inflation to remain relatively low.

India's interest rate cut comes ahead of the Federal Reserve's expected rate cut next week.

Meanwhile, China is expected to maintain a loose monetary policy at upcoming important meetings. According to Bloomberg, Chinese leaders are likely to continue pursuing a manufacturing-based growth strategy at policy meetings this month.

Technically, the bulls on the February gold contract are aiming for their next target of closing above the strong resistance zone at the contract peak/record of $4,433/ounce. Meanwhile, the bears' next short-term bearish target is to push prices below the important technical support zone at 4,100 USD/ounce.

The immediate resistance level is at 4,273.3 USD/ounce, then 4,300 USD/ounce. The first support level was the bottom overnight at 4,224.6 USD/ounce, followed by 4,200 USD/ounce.

Key outside markets today showed that the USD index was moving sideways, crude oil prices fell slightly and were trading around 69.5 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.11%.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...