Gold may reach $4,000/ounce

Last week, commodity analysts at Bank of America raised their gold price forecast for the next two years, with prices possibly reaching $3,500/ounce by 2027. However, with the current increase, this figure seems quite modest.

Bank of America is not the only organization that has raised expectations. Goldman Sachs now expects gold prices to reach $3,300/ounce by the end of the year.

French bank Societe Generale also issued a similar forecast for 2025. Their analysts even believe that gold could reach $4,000/ounce if geopolitical tensions escalate.

Safe-haven demand boosts gold prices

One thing in common in the above forecasts is the growing instability of the US economy. Bank of America believes that Donald Trump's "America First" policy could turn into a "single America", causing many central banks to buy gold to reduce their dependence on the US dollar.

Meanwhile, Company Generale is skeptical about the ability to maintain the superior position of the United States. In the multi-asset portfolio strategy, they are gradually withdrawing from US assets and moving towards European stocks. They also reduced their holdings of the USD, while increasing the share of the Japanese Yen and Euro. The bank's analysts still maintain a 7% gold portfolio.

Gold continues to be an attractive investment channel in the context of the US government reshaping geopolitical order, leading to important policy responses, said the banks analysts.

Helping demand is rising due to concerns about US tariffs, trade and geopolitical instability, Peter Grant, senior strategist at Zaner Metals, told Reuters, saying that this is the main driver for gold prices to rise.

The collapse of the ceasefire in the Middle East and the prolonged war situation have increased risk-off sentiment globally. Along with that, the market is also affected by new trade policies, causing investors to turn to gold as an effective defense channel.

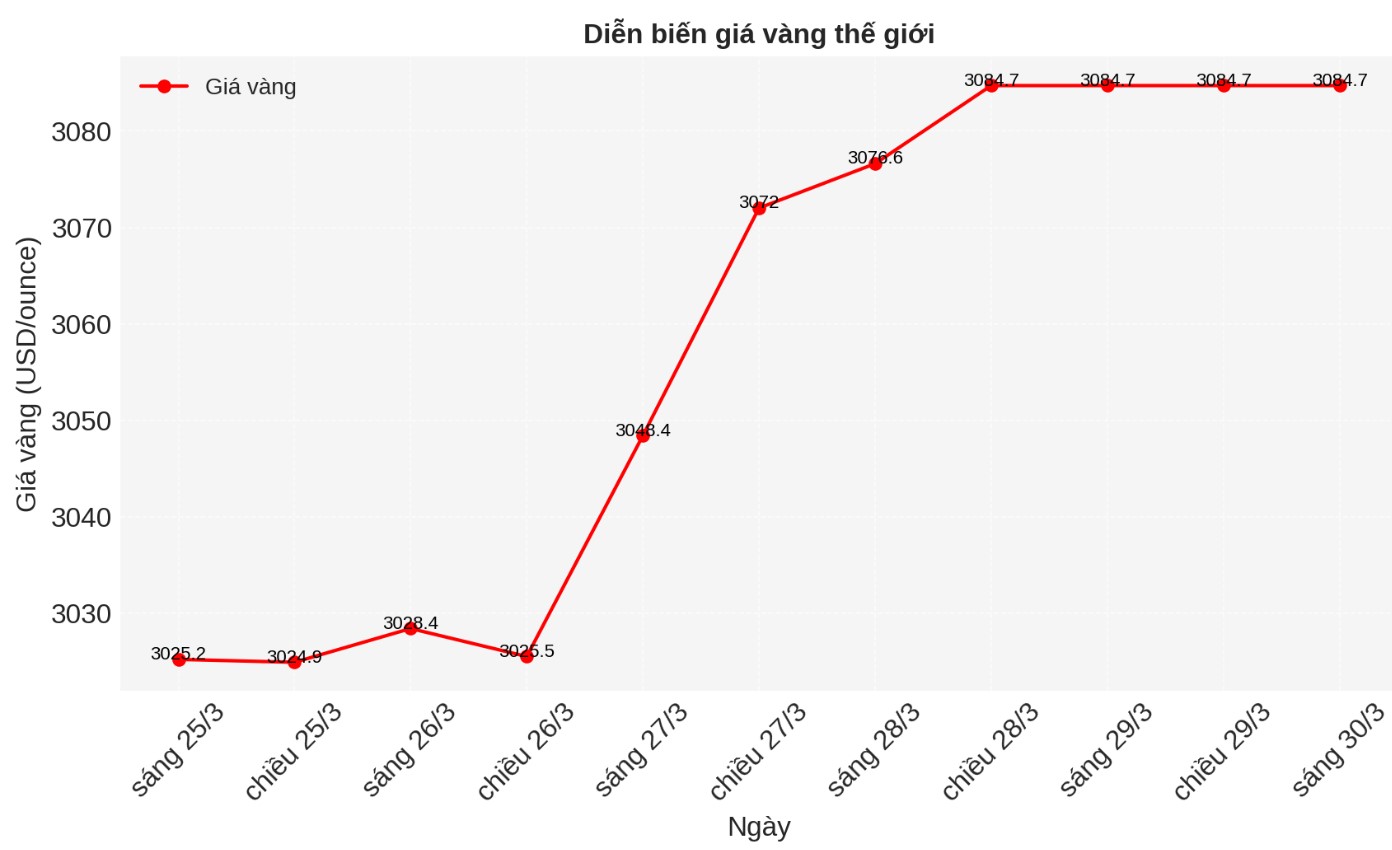

Since the beginning of the year, gold has become one of the assets with the strongest growth rate, surpassing both the S&P 500, large technology stocks and Bitcoin. In the first 50 days of the year, gold prices have increased by more than 400 USD, establishing one of the strongest up cycles in history.

In addition, capital flows into gold ETFs have skyrocketed in the past month, reflecting investors' growing confidence in this precious metal.

See more news related to gold prices HERE...