The dominance of major gold trading centers

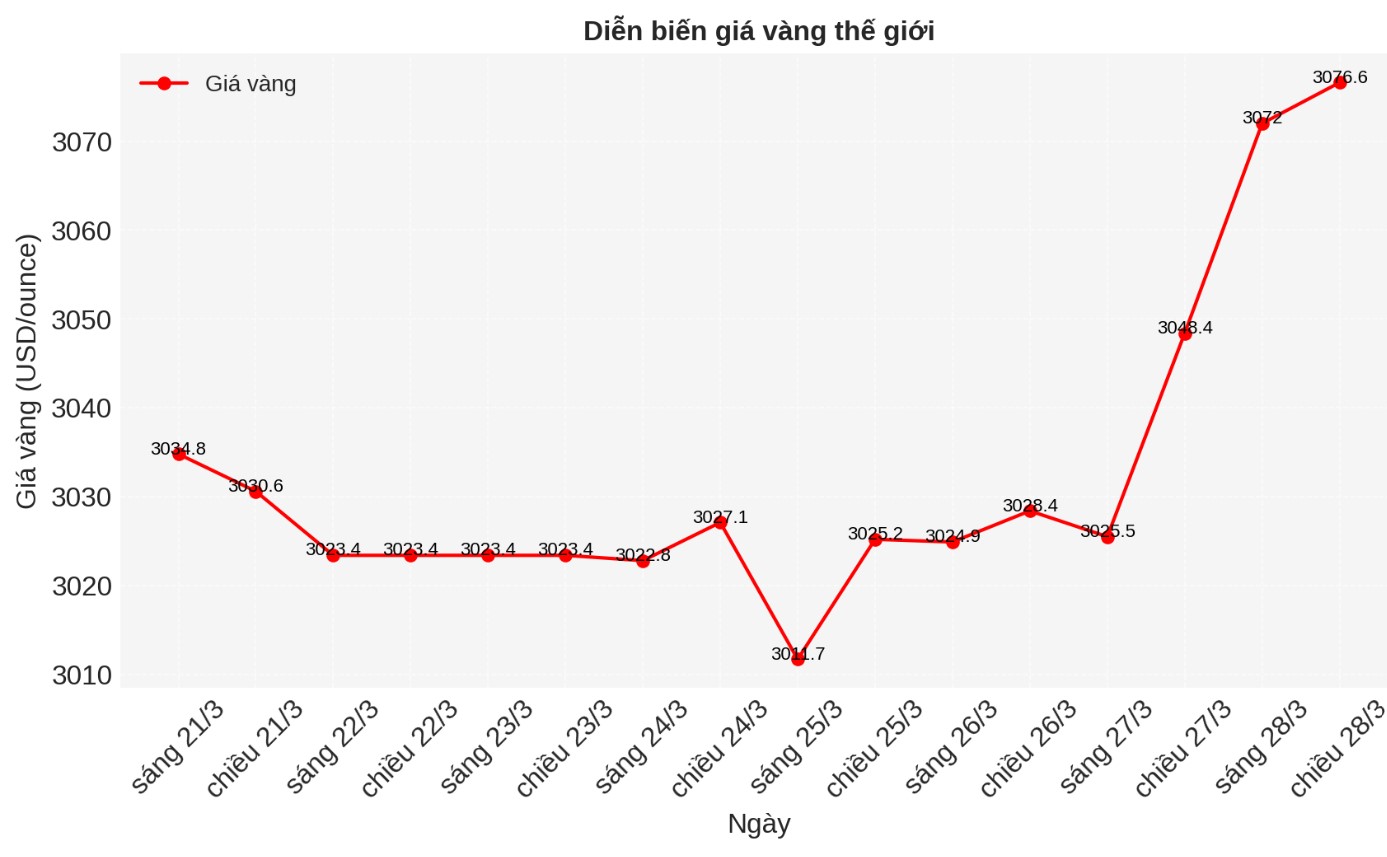

World gold prices have risen, continuously breaking records, driven by safe-haven cash flow after US President Donald Trump announced a plan to impose new tariffs on cars.

Major investors and institutional investors often buy gold from major banks. The price of gold on the spot market is determined by the balance between supply and demand at that time.

London is the main center of influence in the spot gold market, thanks to the London Gold Market Association (LBMA). This Association establishes gold trading standards and creates a framework for off-site transactions, helping banks, agents and organizations make transactions easier. In addition to London, other major gold trading centers include China, India, the Middle East and the US.

Future contract market

World investors often access gold through futures exchanges, where people buy or sell a specific commodity at a fixed price on a day in the future.

COMEX (Commodity Exchange Inc), a member of the New York Commodity Exchange, is the largest gold futures market in terms of trading volume.

The Shanghai futures exchange, China's leading commodity exchange, also offers gold futures. The Tokyo Commodity Exchange, known as TOCOM, is another major player in the Asian gold market.

Investment fund trading products

Exchange-traded products or exchange-traded funds (ETFs) issuing securities with physical metal collateral and allowing users to participate in gold price fluctuations without having to directly own gold.

Exchange-traded funds have become a popular investment form for precious metals. Physical gold exchange-traded funds recorded modest net cash flow of $3.4 billion in 2024, for the first time in four years, despite their holdings falling by 6.8 tons, according to the World Gold Council.

Gold ring and currency market

Retail consumers can buy gold from metal traders selling rings and coins in stores or online. Garlic gold and coins are effective investment vehicles in physical gold.

See more news related to gold prices HERE...