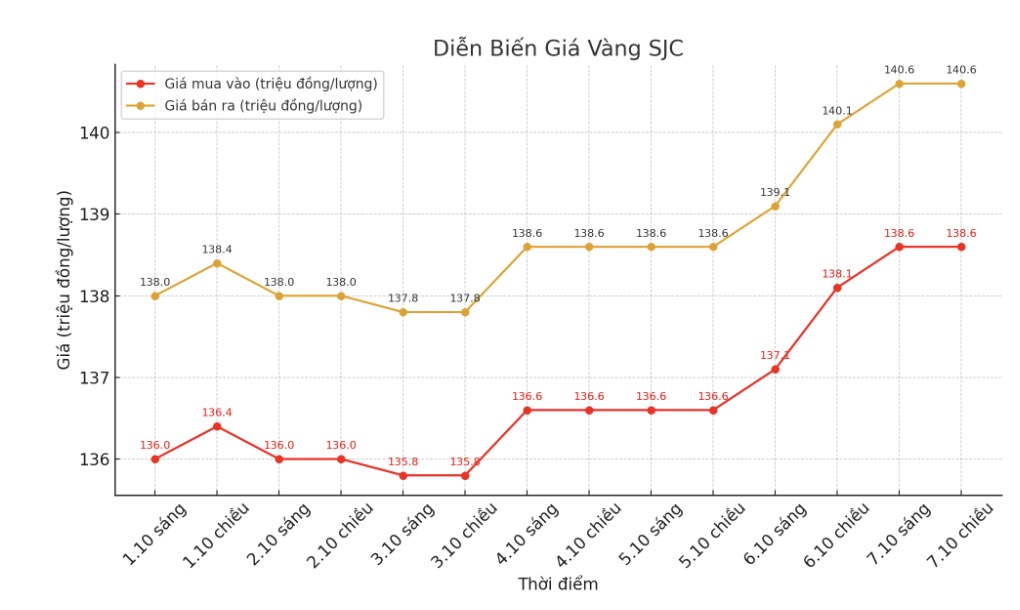

SJC gold bar price

As of 5:45 p.m., the price of SJC gold bars was listed by DOJI Group and Bao Tin Minh Chau at 138.6-140.6 million VND/tael (buy in - sell out), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 138-140.6 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

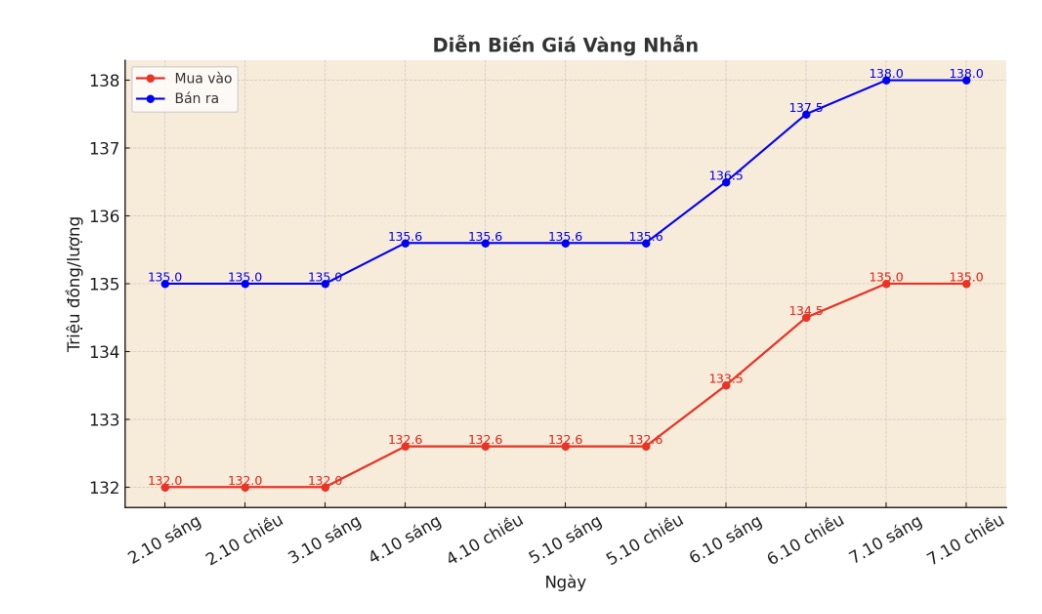

9999 gold ring price

As of 5:45 p.m., DOJI Group listed the price of gold rings at 135-138 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 136.2-139.2 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 135.2-138.2 million VND/tael (buy in - sell out), an increase of 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

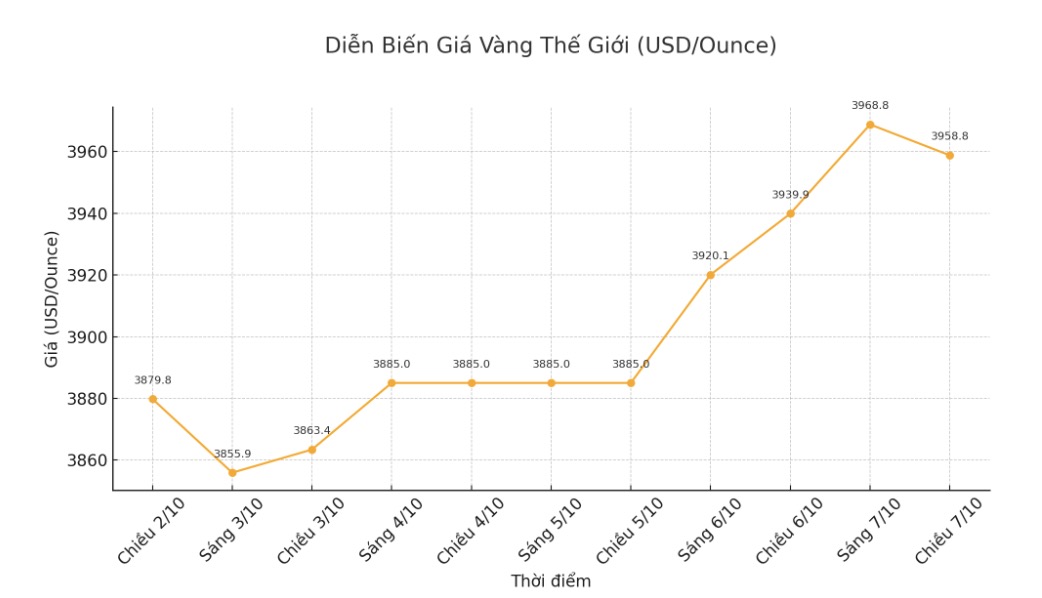

World gold price

The world gold price was listed at 5:45 p.m. at 3,958.8 USD/ounce, up 18.9 USD compared to a day ago.

Gold price forecast

Since the beginning of the year, gold has increased by 51%, thanks to strong buying power from central banks, increased demand for gold-backed ETFs, weaker USD and growing interest from individual investors seeking protection against trade and geopolitical tensions.

On October 7, Goldman Sachs (one of the world's largest financial and banking groups, headquartered in the US) raised its gold price forecast for December 2026 from 4,300 USD/ounce to 4,900 USD/ounce, citing strong capital flows into ETF funds in the West and the possibility of central banks continuing to buy gold.

We believe that the risk for this new forecast is still leaning towards an upward trend, as the private sector's portfolio diversification to the gold market - which is already small in scale - could cause ETF holdings to exceed our interest rate estimates, Goldman said.

Mr. Ole Hansen - Commodity Strategy Director of Saxo Bank - commented: " Strong demand from ETFs is still a key factor, driven by the fear of missing out (FOMO) mentality and declining confidence in traditional Shelters".

Mr. Michael Langford - Investment Director of scorpion Minerals - predicted: "I think gold could reach 4,300 USD/ounce in the next 6 months, as the USD continues to weaken and the macro and geopolitical context is favorable for gold prices to increase".

Notably, one of the most bullish investors on Wall Street has begun to show more caution as the precious metal price approaches the $4,000/ounce mark.

The commodity research group of Bank of America (BofA) is one of the first units to forecast the target of 4,000 USD/ounce since the beginning of this year, saying that as long as investment demand increases slightly, gold can reach this level.

However, as the target is gradually becoming a reality, BofA technical analyst Paul Ciana said that gold prices have reached most of their upside potential and are showing signs of overbought.

Many technical signals at different time frames suggest that golds rally may be wearing down as it approaches $4,000 an ounce, he said. If correct, it is likely that in the fourth quarter, there will be a period of sideways or adjustment.

Regarding risk management, investors should raise the loss stopping point, protect or reduce their buying position. For traders who are trending in reverse, they can consider buying and selling options in the next 4-6 weeks.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...