Gold price increases by more than 4 million VND/tael after a week

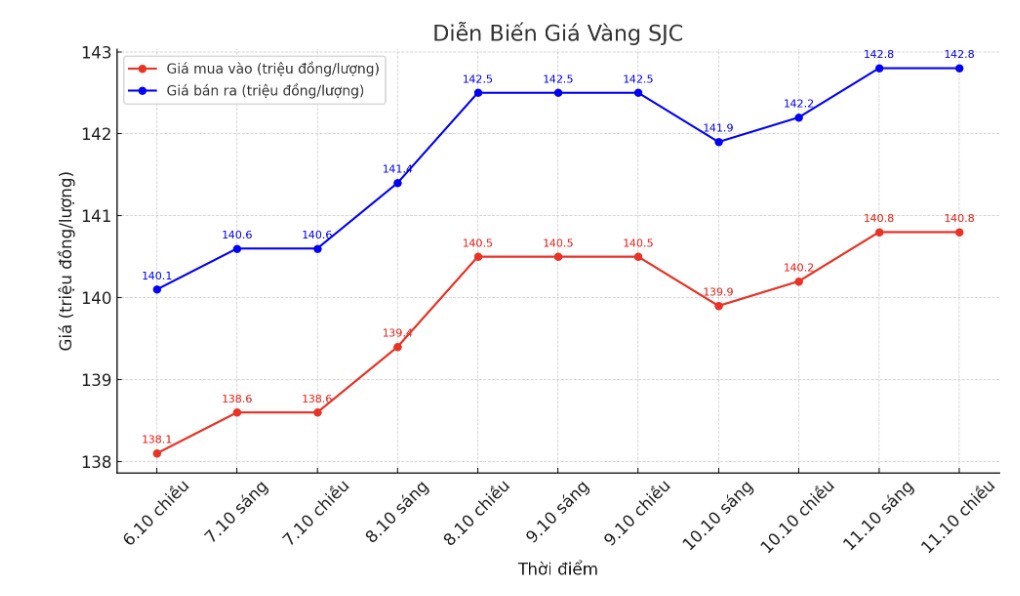

At the end of last week's trading session, Saigon Jewelry Company SJC listed the price of SJC gold bars at 140.8-142.8 million VND/tael (buy - sell). Compared to last weekend (October 5), SJC gold bar prices have increased by VND4.2 million/tael in both directions.

Bao Tin Minh Chau also adjusted the price of SJC gold to the same level of 140.8-142.8 million VND/tael, an increase of 4.2 million VND/tael compared to a week ago. The difference between the buying and selling prices at these two systems remains at 2 million VND/tael.

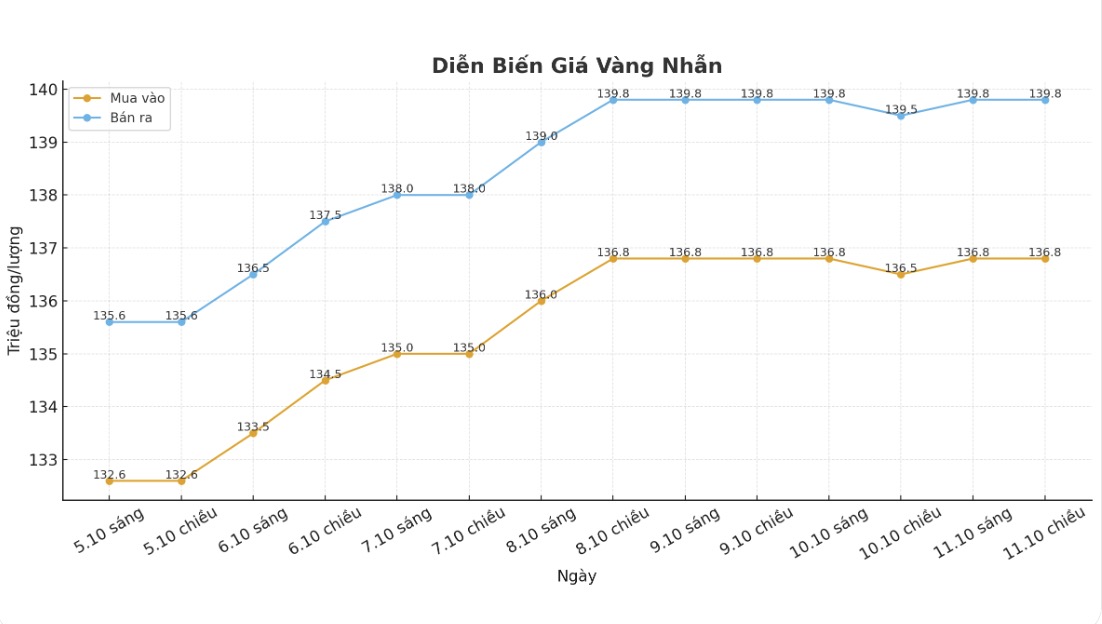

The price of 9999 gold rings also recorded a similar increase. At Bao Tin Minh Chau, gold rings were listed at 138.4-141.4 million VND/tael, up 4.8 million VND/tael compared to last week. Phu Quy Group listed at 137.3-140.3 million VND/tael, up 4.6 million VND/tael in both directions.

Analysts said that domestic gold prices increased sharply due to the influence of global growth when world gold exceeded the threshold of 4,000 USD/ounce and investors' defensive psychology in the context of increasing economic and political instability.

Investors only make small profits despite strong gold increase

If buying SJC gold at Bao Tin Minh Chau or Saigon Jewelry Company SJC in the session of October 5 and selling it today (October 12), investors will make a profit of about 2.2 million VND/tael.

Similar to 9999 gold rings, buyers at Bao Tin Minh Chau made a profit of about 1.8 million VND/tael, while buyers at Phu Quy even made a profit of about 1.6 million VND/tael.

The main reason for the "eaten" profit is because the difference between buying and selling prices is still high, commonly from 2 to 3 million VND/tael. This range makes buyers, although benefiting from the price increase, unable to earn a commensurate profit.

When the difference is 2-3 million VND/tael, buyers almost lose this amount right at the transaction time, because if they sell immediately, they will suffer corresponding losses. Therefore, although the gold price increased by more than 4 million VND/tael during the week, most of the profit was deducted by this difference.

Simply put, gold prices must increase by at least 2-3 million VND/tael for buyers to break even, and only when they exceed that threshold will they make a real profit. This is the reason why even though gold has increased sharply, investors are still making only thin profits.

Currently, at many jewelry stores in Hanoi and Ho Chi Minh City, the scene of people lining up to buy gold is no longer uncommon. From early morning, many people have been waiting with the mentality of "buy in time before prices continue to increase", clearly demonstrating the FOMO mentality - fear of missing out on opportunities. Buying gold in a trending way and surfing can easily put buyers at risk when the market reverses.

In the context of the buying-selling gap remaining at a high level of 2-3 million VND/tael, along with strong price fluctuations in recent days, the gold market is at risk of being adjusted down at any time if profit-taking forces increase or world prices turn around. At that time, those who buy gold "surfing" may not be able to sell out in time, and may even suffer losses if they sell them at the time of cooling down.

People should be cautious and avoid following the crowd psychology, because short-term profits from gold are no longer attractive compared to the potential risks. Buying gold should be based on long-term goals and actual financial capacity, instead of investing in the trend of "seeing people buying, I also buy".

See more news related to gold prices HERE...