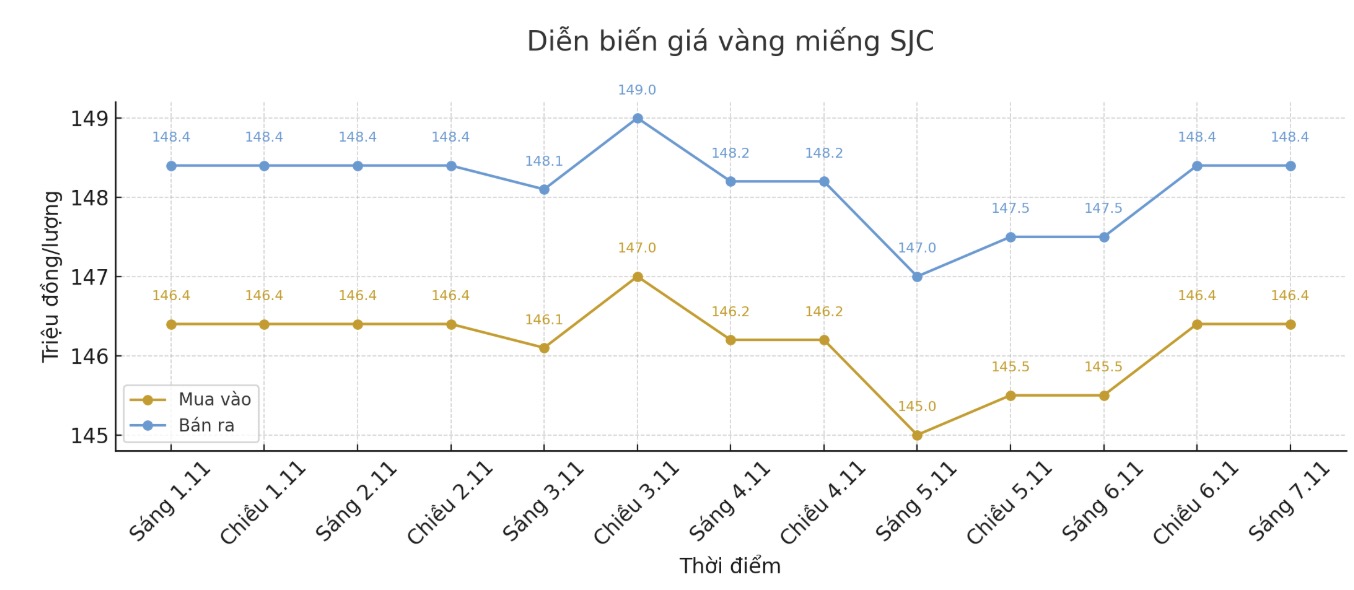

Updated SJC gold price

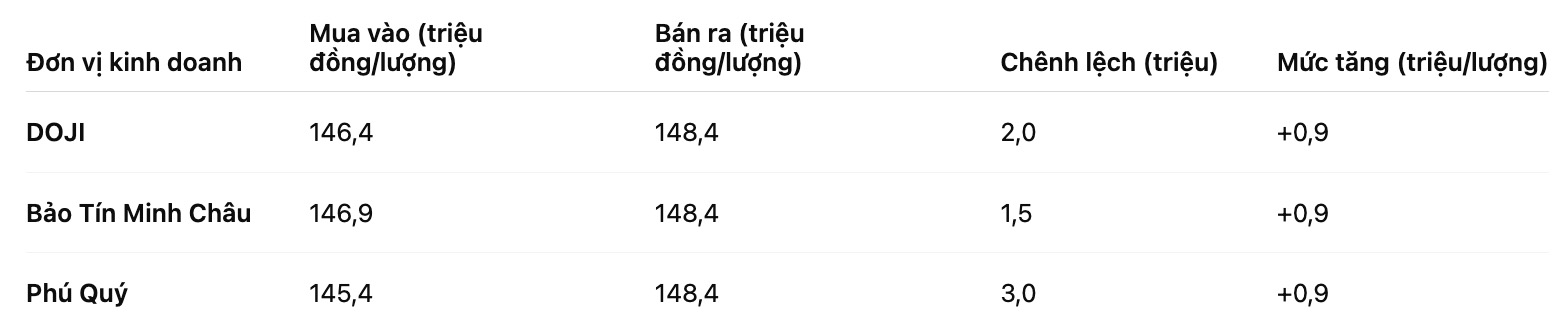

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at 146.4-148.4 million VND/tael (buy in - sell out), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 146.9-148.4 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 145.4-148.4 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

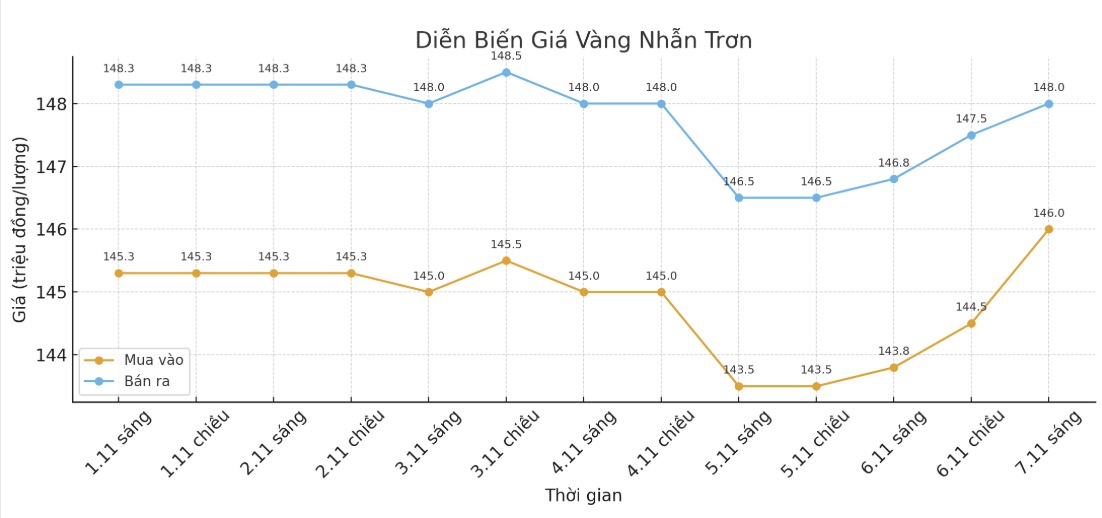

9999 round gold ring price

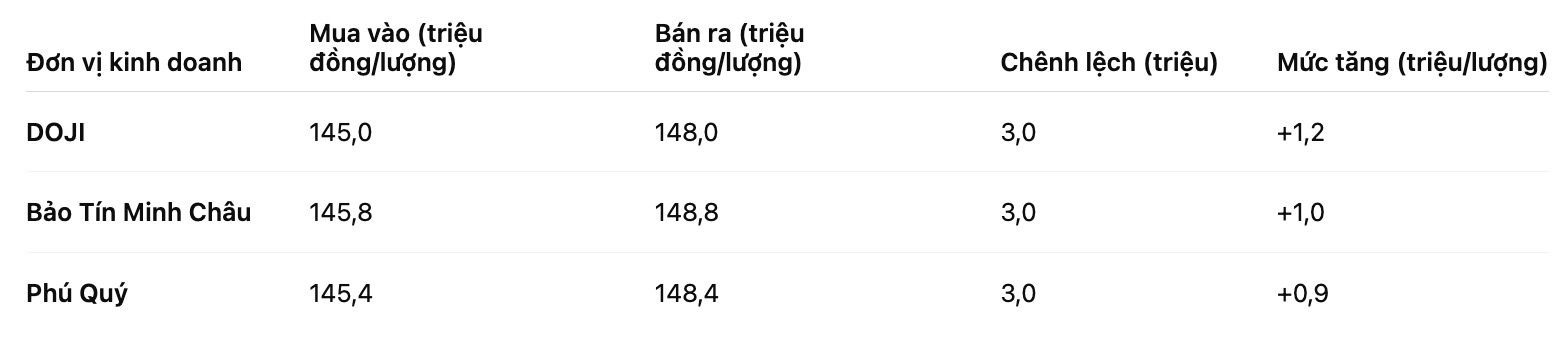

As of 9:00 a.m., DOJI Group listed the price of gold rings at 145-148 million VND/tael (buy - sell), an increase of 1.2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 145.8-148.8 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.4-148.4 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

At 9:15 a.m., the world gold price was listed around 3,997.2 USD/ounce, up 22 USD compared to a day ago.

Gold price forecast

Although the world gold price has not been able to hold the level above 4,000 USD/ounce, experts predict that the precious metal will "retake form" in the first quarter of 2026.

Ewa Manthey, commodity strategist at ING, said in the latest monthly report that she maintains a positive view on the precious metal. According to her, the average gold price in the fourth quarter of this year could reach about 4,000 USD/ounce and will increase to 4,100 USD/ounce in the first quarter of 2026.

Ms. Manthey commented: Even after the recent weakness, gold prices have increased by more than 50% compared to the beginning of the year. Key supporting factors such as central bank demand and safe-haven demand remain. ETF buying will also recover as the US Federal Reserve (FED) is likely to continue cutting interest rates.

We consider the current correction to be healthy, not a sign of reversal. Any further price reduction could attract both individual and institutional investors back."

Gold prices are lacking new upward momentum after Fed Chairman Jerome Powell said it is unlikely to cut interest rates in December. However, analysts believe that the weakness of the US labor market will force the FED to lower interest rates this year and continue into the first half of next year.

Despite Powell's cautious tone, the CME FedWatch tool shows that the market still predicts a 71%, chance of the Fed cutting interest rates next month.

Ms. Manthey noted that investment demand was a key factor in gold's record rally in the third quarter. Expectations of a Fed easing policy soon have prompted investors to pour money into gold ETFs at the fastest pace in years. According to data from the World Gold Council (WGC), global gold ETFs increased by 222 tons in the period from July to September.

Although there has been a phenomenon of capital withdrawal recently, we expect net buying activities to return soon when the FED continues to cut interest rates. The current futures market still shows a more than 70% chance of a rate cut in December," she added.

Technically, the next upside target for bulls is to close above a solid resistance level at $4,100/ounce. On the contrary, the bear's downside target is to push prices below the important technical support level of $3,800/ounce.

The first resistance level seen at today's peak was 4,028.7 USD/ounce, then 4,059.9 USD/ounce. The first support level was at the bottom of the session at $3,973.2/ounce, then reached the low of this week at $3,935.7/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...