Gold price developments last week

Last week, precious metals investors continued to see positive developments in gold prices, although the increase slowed down somewhat as optimism about trade tax increased. Purchasing power from Asian markets and many other places still supports gold prices to maintain their upward momentum.

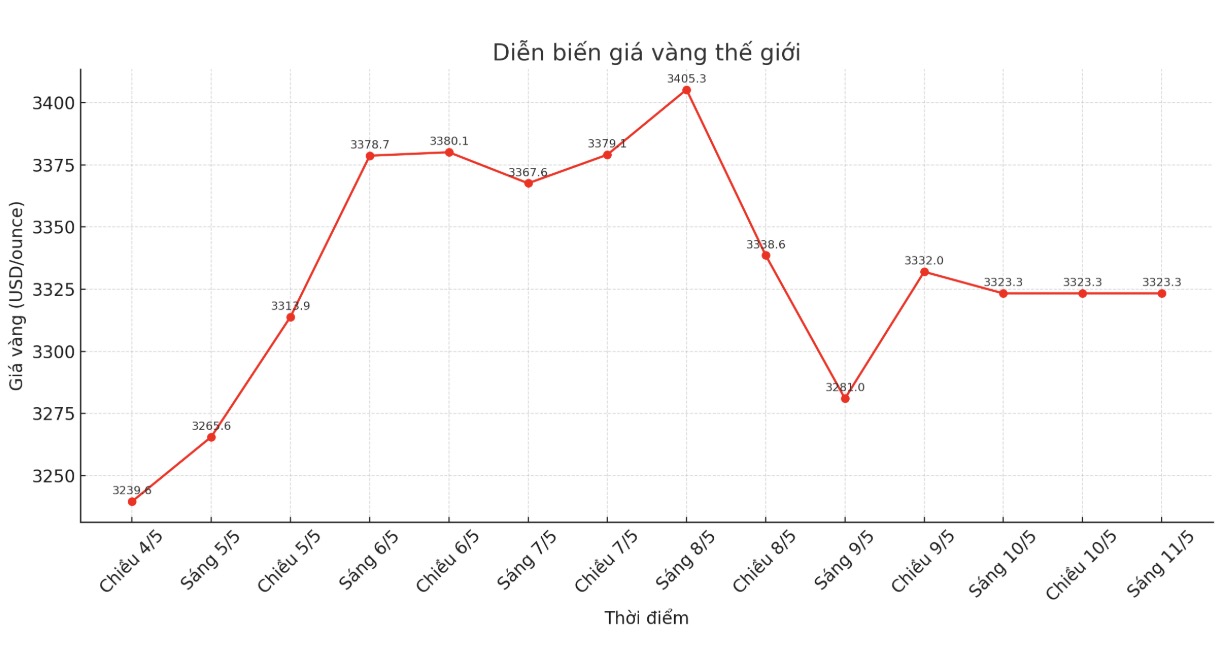

Spot gold opened the week at $3,239.76/ounce and despite many strong fluctuations, this was the lowest level of the week.

As early as 4:00 a.m. on Monday New York time, the European market pushed gold prices from $3,263 to $3,320/ounce. As North American investors entered the market, prices continued to peak at $3,336 an ounce before closing time. After that, the Asian market continued to increase prices to a peak of 3,382 USD/ounce in just the first two hours of trading.

Gold prices continued to climb on Tuesday, surpassing the $3,431/ounce mark at around 5:00 p.m., before falling under profit-taking pressure, causing prices to turn to $3,365/ounce at the beginning of the Asian session.

Midweek is the least volatile period, when gold fluctuates in a narrow range of about 30 USD, despite economic data, interest rate announcements and press conferences of the US Federal Reserve (FED).

By 10pm on Wednesday, gold prices tried to regain the $3,400 mark but quickly plummeted to $3,330/ounce at 2:30am the next morning. When information about the expected meeting between the US and China was released on Thursday morning, gold continued to lose value, falling to $3,277/ounce at the beginning of the Asian session.

However, this low price attracted bottom-fishing cash flow, helping gold recover to $3,330/ounce at 1:00 a.m. on Friday (New York time). The trading session on the weekend in North America was quite quiet.

Experts predict gold prices next week

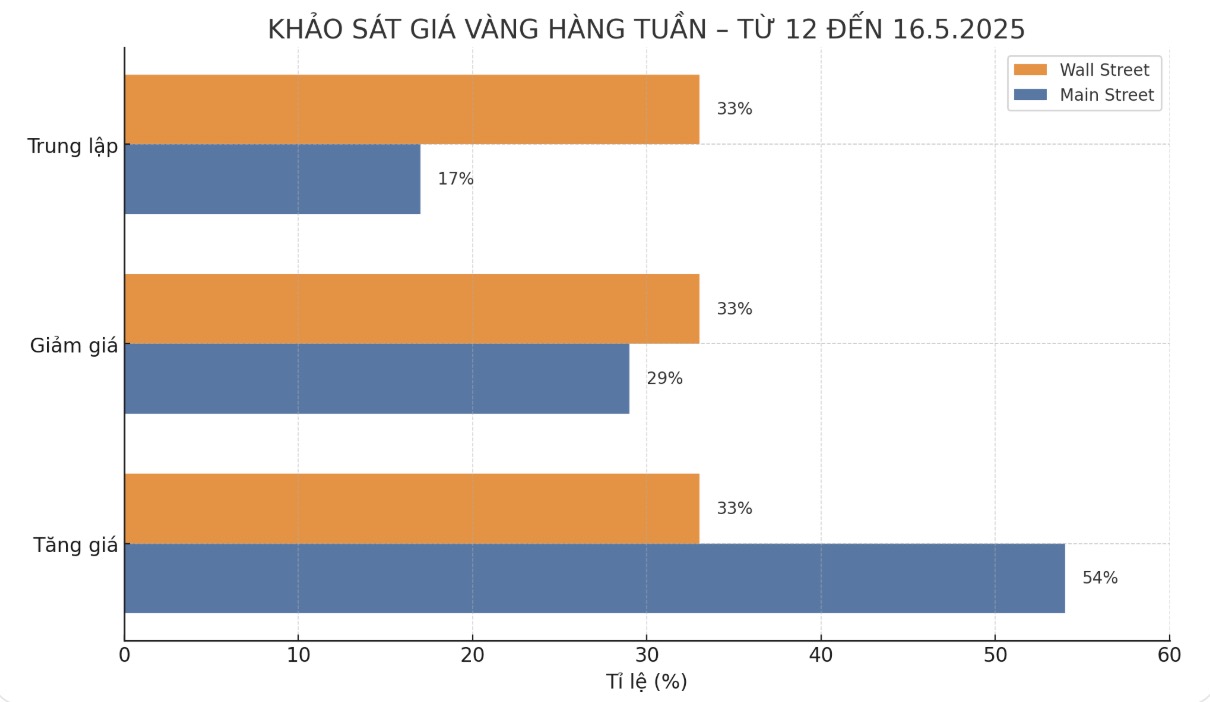

The latest weekly gold price survey by Kitco News shows that experts share the view between price increase, price decrease and neutrality. Meanwhile, the majority of retail investors are still leaning towards the scenario of gold prices continuing to increase after a series of recent strong increases.

Of the 15 analysts participating in the survey, 5 people (33%) predict gold prices will increase next week. 5 others said the price would decrease, while the remaining 5 people said the price would be flat.

The online survey on Kitco attracted 267 retail investors, with the results continuing to lean the uptrend as last week. 144 people (54%) believe gold prices will increase, 77 people (29%) predict prices will decrease, while 46 people (17%) believe prices will move sideways next week.

Economic calendar affecting gold prices next week

After a week dominated by a Fed meeting and tariff discussions, the US market next week will welcome a series of important economic data, covering most sectors of the economy.

The first highlight is the US consumer price index (CPI) report for April released on Tuesday. Investors are waiting to see if consumer inflation has enough to prompt the Fed to cut interest rates in June.

However, the information high will be on Thursday, when a series of key data will be released simultaneously at 10:00 a.m. (US time), including the Producer Price Index (PPI), retail sales in April, weekly jobless claims, Empire State manufacturing survey and FED Philadelphia manufacturing survey. At the same time, FED Chairman Jerome Powell will also speak in Washington, D.C., attracting more market attention.

The final important data of the week is the preliminary results of the May Consumer Confidence Index released by the University of Michigan on Friday morning.

See more news related to gold prices HERE...