Unusually high gold price difference

In April, world gold prices recorded the strongest fluctuation in 25 years, with an range of up to 540 USD. Notably, the precious metal hit a record high of $3,500.05 an ounce on the afternoon of April 22.

In May, gold prices continued to fluctuate strongly, fluctuating around 325 USD - although lower than the previous month, still far exceeding the average fluctuation of 89 USD/month since 2020.

In the face of fluctuations in world gold prices, domestic gold prices also fluctuated continuously with each session.

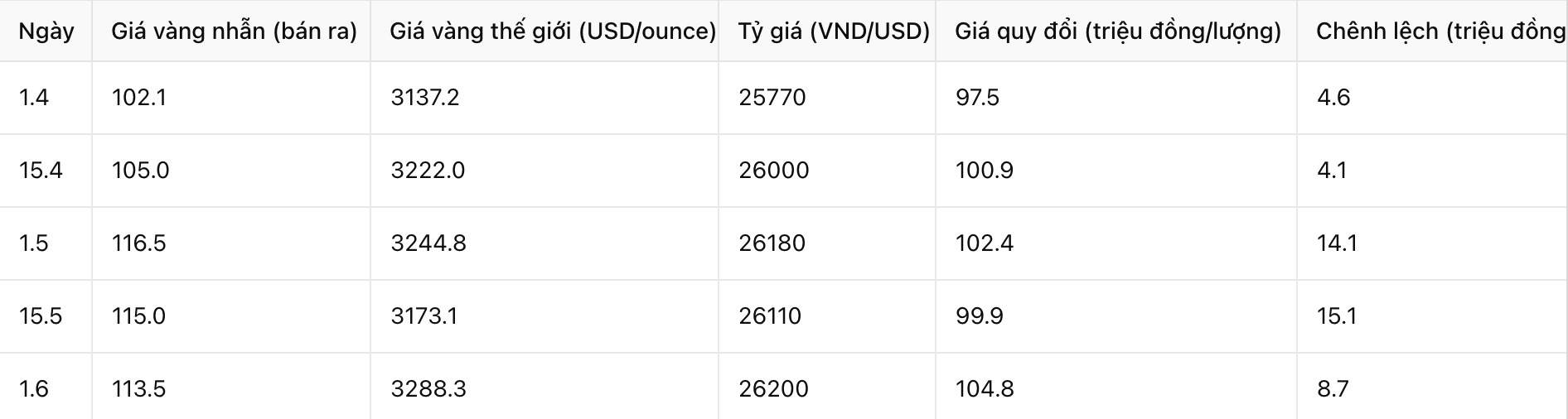

If in April the difference between domestic and world gold ring prices was only 4-4.5 million VND/tael, then in early May, this difference was pushed up to 14.1 million VND/tael.

By mid-May 2025, the difference was even as high as 15.1 million VND/tael. The difference of more than 15 million VND/tael is no longer a normal difference (including taxes, fees, business expenses, etc.), but shows speculation or unusual valuation factors from some large enterprises, creating a large gap between the domestic and world markets.

The huge difference shows warning signs in the domestic gold market, causing domestic buyers to face high risks when gold prices adjust. If the world gold price goes down, domestic gold prices cannot remain unusually high, individual investors will suffer heavy losses.

A series of drastic instructions to help stabilize the market

In response to the above developments, on May 13, 2025, Prime Minister Pham Minh Chinh issued Official Dispatch No. 64/CD-TTg, requesting functional units to closely monitor domestic and international gold price developments, and implement solutions to stabilize the market when necessary. The Prime Minister requested the urgent issuance of inspection conclusions for enterprises and credit institutions trading in gold; proposed to amend and supplement Decree 24/2012/ND-CP on management of gold trading activities, and submit to the Government in a shortened manner in June 2025. Strengthen information and communication work to stabilize people's psychology and create social consensus...

On May 28, General Secretary To Lam had a working session with the Central Committee for Policy and Strategy on mechanisms and policies for effective management of the gold market in the coming time. The General Secretary mentioned the removal of the State monopoly on the gold bar brand in a controlled manner; amending Decree 24 on gold market management.

As of May 30, the State Bank announced the inspection results of 6 major gold trading units in the market including: Saigon Jewelry Company (SJC), DOJI Jewelry Group, Phu Nhuan Jewelry Company (PNJ), Bao Tin Minh Chau, Tien Phong Bank (TPBank) and Export-Import Bank of Vietnam (Eximbank).

The main violations of these businesses are regulations on money laundering prevention such as lack of customer identification, large transaction reports; violations of documents, accounting and taxes; or signs of providing mis information about products to attract customers, unfair competition...

After many drastic instructions, the domestic gold market has begun to record clear changes. The gap between domestic gold ring prices and world gold prices has decreased sharply from more than 15 million VND/tael to about 8.7 million VND/tael.

Along with that, the State Bank's requirement for businesses to be transparent in their price formation mechanisms, publicly listing and reporting on unusual transactions has forced many gold businesses to adjust their strategies, gradually reducing speculative factors. Some credit institutions have also proactively reviewed gold holding activities and online gold transactions to avoid legal risks and violate current regulations.

Note: The difference in gold prices between the domestic and world markets may vary depending on the time of recording on the day, depending on international gold price fluctuations, exchange rates, business policies of each enterprise and supply and demand factors in the domestic market. Therefore, the data in the article is for reference at a specific time.