In a recent interview, Ms. Roukaya Ibrahim - Director of Commodity Strategy at BCA Research - said she is neutral on gold for the next three months due to uncertainties surrounding the monetary policy of the US Federal Reserve (Fed).

Gold has struggled to attract new upward momentum as the market begins to rule out the possibility of a rate cut next month. Interest rate cut expectations were revised after Fed Chairman Jerome Powell said a December cut was not certain. This neutral view has supported the US dollar and yields, creating resistance for gold.

However, in recent days, market expectations have reversed and the possibility of a rate cut has been brought back into the balance. According to the CME FedWatch tool, the market now expects a more than 80% chance of the Fed cutting interest rates next month.

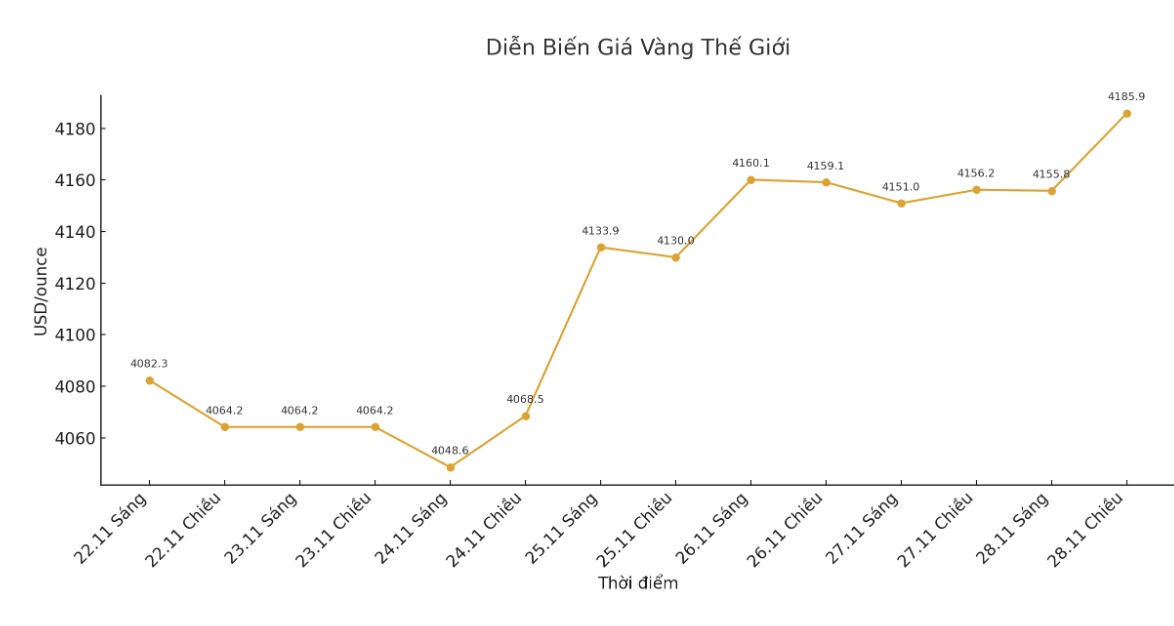

As a result, gold prices are not only holding support above $4,000/ounce but are also testing the important resistance zone around $4,160/ounce.

However, many economists are still cautious and believe that the decision next month is still 50-50.

In this volatile environment, Ms. Ibrahim believes that gold will continue to be held in the current price range, but in the long term she still expects the precious metal to move up to higher levels in 2026.

Recent fluctuations show that gold has reached a bottom. The market is having structural foundational factors. Even if the Fed pauses in December, our base scenario is still that the Fed will continue to cut interest rates next year. Real interest rates will fall and that is good news for gold, she said.

Although the BCA does not forecast a recession in the US economy next year, Ms. Ibrahim said that weak growth could keep inflationary pressures low, creating conditions for the Fed to cut interest rates.

We are really concerned about the growth environment, which is why we think the Fed will have to cut interest rates, she said.

In addition to cyclical factors supporting the long-term upward trend of gold, Ms. Ibrahim also sees more momentum from the fact that investors and consumers seem to be used to high prices. She pointed out that India - one of the world's largest gold consumers - is still seeing strong demand.

Although demand for gold jewelry has decreased as prices have increased, she said demand for gold bars and coins has skyrocketed. According to the Indian government's trade data, the country imported $14.7 billion in gold last month, up 200% from $4.9 billion in the same period last year.

Ms. Ibrahim also expects central banks to continue buying gold to diversify foreign exchange reserves.

Although BCA is optimistic about gold, Ms. Ibrahim is more cautious about silver, although this metal has outperformed gold this year when prices returned to the resistance zone above 53 USD/ounce.

She explained that in a world of economic and geopolitical instability, gold is still a key monetary metal that investors and central banks will continue to rely on. She added that the risk of slowing economic growth could put pressure on industrial demand for silver - a sector that accounts for about half of the total demand of the market.

See more news related to gold prices HERE...