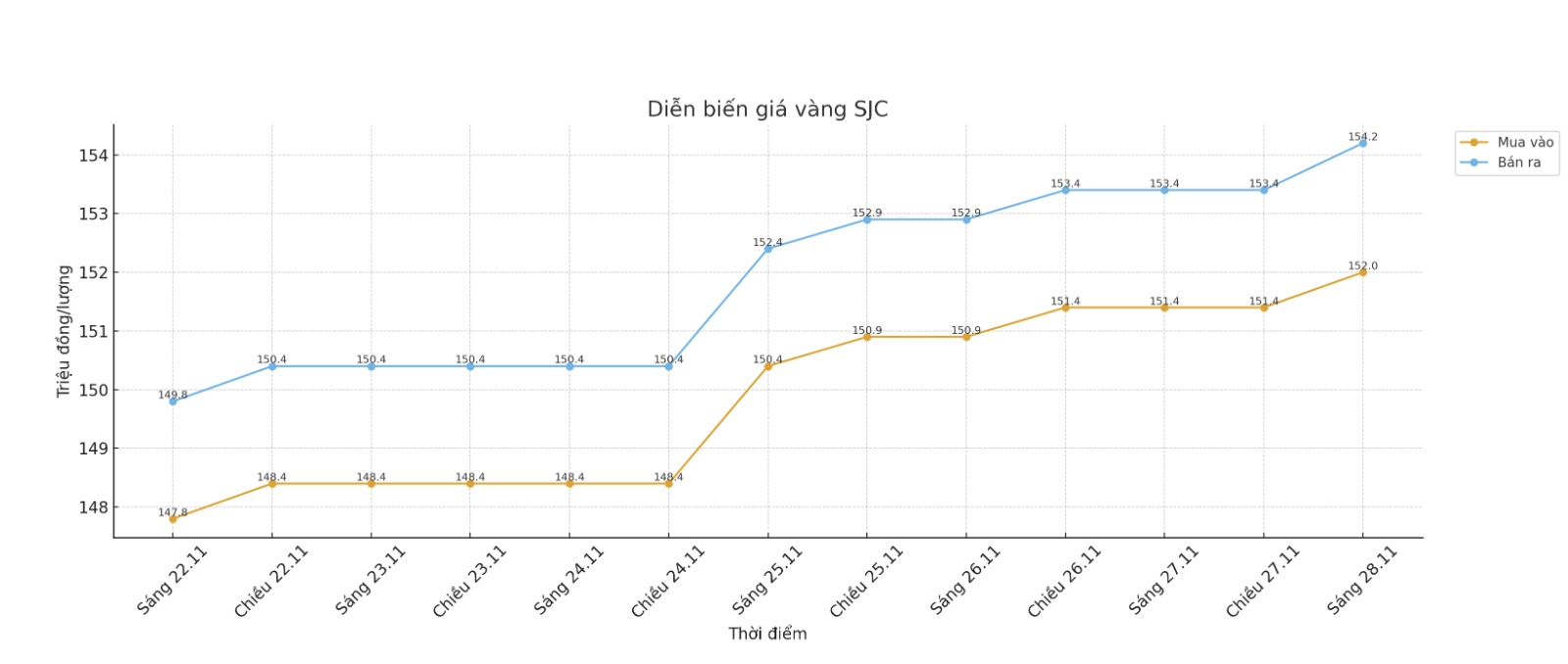

Updated SJC gold price

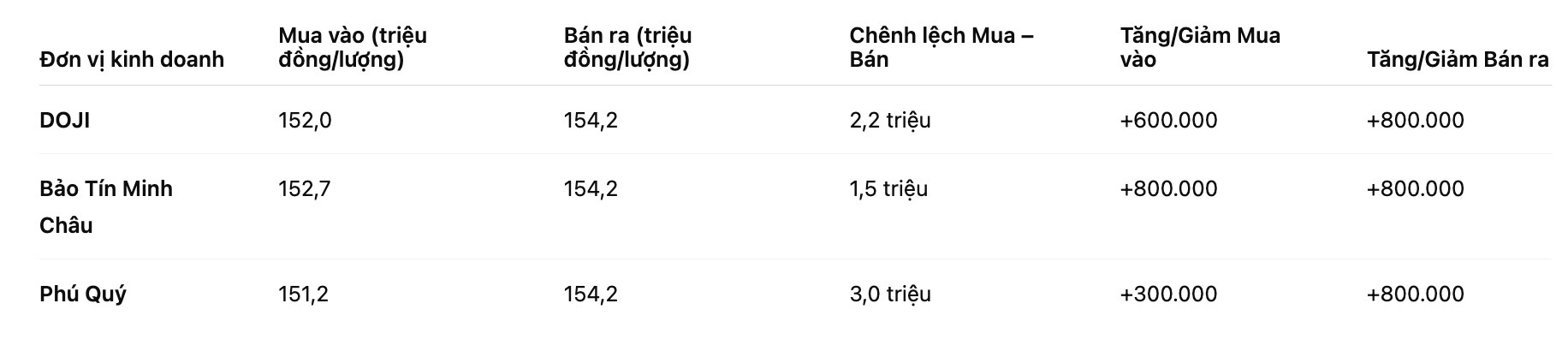

As of 9:40 a.m., DOJI Group listed the price of SJC gold bars at 152-154.2 million VND/tael (buy - sell), an increase of 600,000 VND/tael for buying and an increase of 800,000 VND/tael for selling. The difference between buying and selling prices is at 2.2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 152.7-154.2 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.2-154.2 million VND/tael (buy - sell), an increase of 300,000 VND/tael for buying and an increase of 800,000 VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

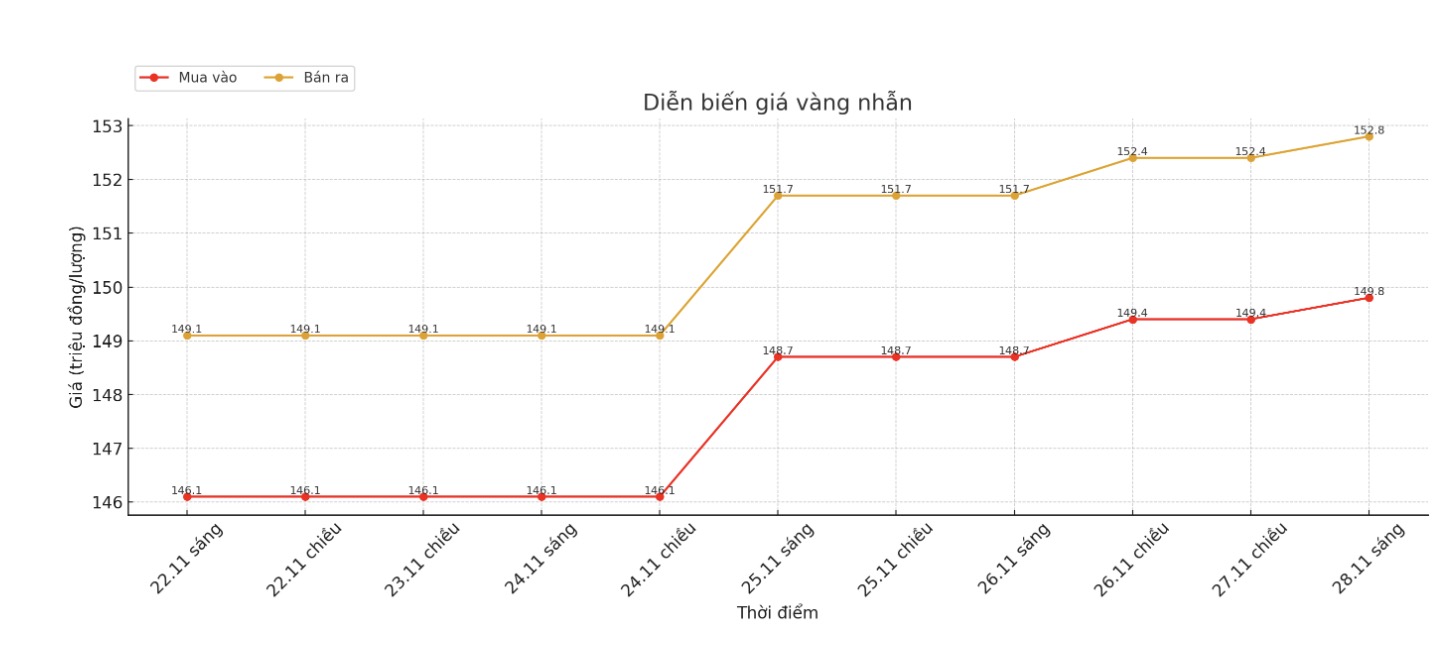

9999 round gold ring price

As of 9:40 a.m., DOJI Group listed the price of gold rings at 149.8-152.8 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150.8-153.8 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150.2-153.2 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

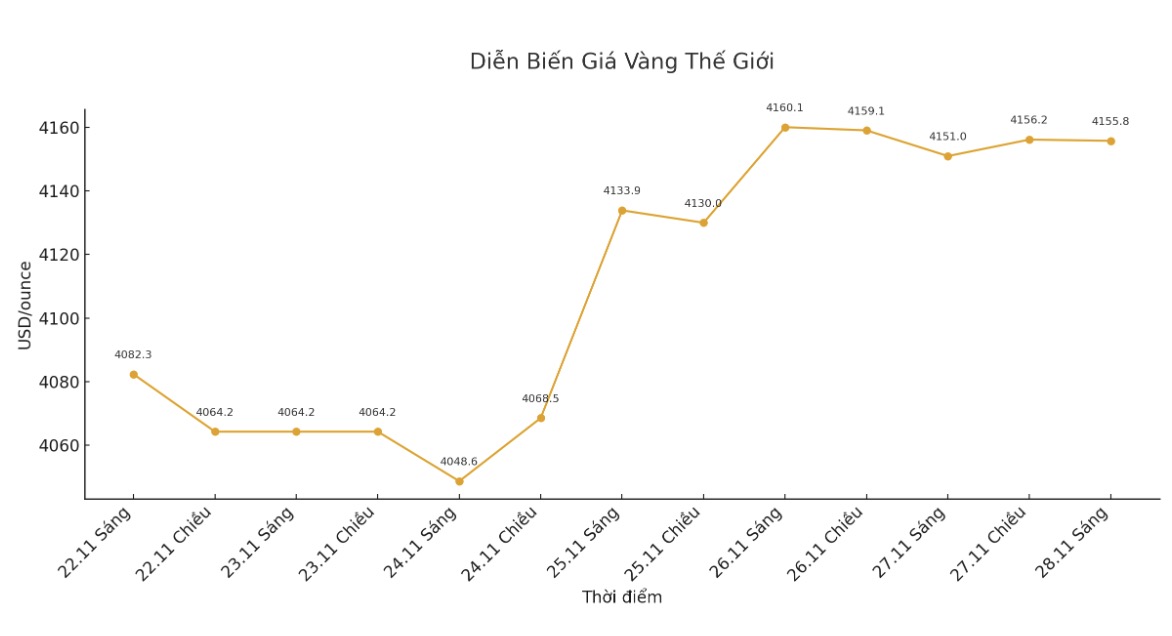

World gold price

At 9:45 a.m., the world gold price was listed around 4,155.8 USD/ounce, down 4.3 USD compared to a day ago.

Gold price forecast

Many major banks in the world predict that gold prices may continue to increase strongly in 2026, with an increase of 17-19% compared to the present.

The Bank of America (BofA) forecasts gold prices to reach $5,000/ounce by 2026, equivalent to an increase of 19% compared to the current level.

According to BofA analysts, factors driving gold prices such as increased deficit spending in the US and President Donald Trump's "unusual" economic policies are still valid. The bank believes that investors have not yet fully exploited the long-term potential of gold, although prices have just adjusted.

Meanwhile, Goldman Sachs forecasts gold will reach $4,900/ounce by the end of 2026, up 17%.

Daan Struyven - co-head of global commodity research at Goldman Sachs - said that factors supporting this year's price increase such as central bank demand and the expected interest rate cut by the Fed will continue.

He noted that the ETF gold market is still small compared to the US bond market, making gold a popular safe-haven asset.

Deutsche Bank forecasts gold could reach $4,950/ounce, up 18%, with a base of around $4,450/ounce.

The bank said that cash flow from central banks and ETF investors remains strong, while technical signals show that "positional adjustment is complete".

However, Deutsche Bank also warned of the risk of gold prices if the stock market corrects deeply, the Fed cuts interest rates less than expected, or geopolitical conflicts cool down.

HSBC forecasts gold prices to fluctuate between $3,600-4.400/ounce, with the highest level equivalent to an increase of 5%.

James Steel - HSBC precious metals analyst - commented that geopolitical fluctuations and the wave of nationalism will continue to put pressure on the gold market.

HSBC said the rally could slow in the second half of 2026 if gold supply increases, physical demand decreases, or central banks limit gold purchases above $4,000.

Forecasts from the big guys of banks show that gold is still a safe haven in the context of economic and geopolitical instability. Although specific increases vary, the common point is that banks believe that demand for gold, especially from central banks and institutional investors, will continue to support gold prices next year.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...