The nearly 30% increase in gold prices this year has attracted strong attention from investors, as more and more analysts target gold prices up to 4,000 USD/ounce. However, not all banks are optimistic about gold.

In the latest report, commodity analysts at Citigroup (a US multinational financial group) lowered their gold price forecasts and warned investors that the precious metal could fall below $3,000/ounce by the end of the year.

According to the new report, Citigroup has adjusted its gold price target for the next 0-3 months to 3,300 USD/ounce, instead of 3,500 USD/ounce as before. At the same time, they also lowered their gold price forecast for the next 6-12 months to 2,800 USD/ounce, down from the previous 3,000 USD/ounce.

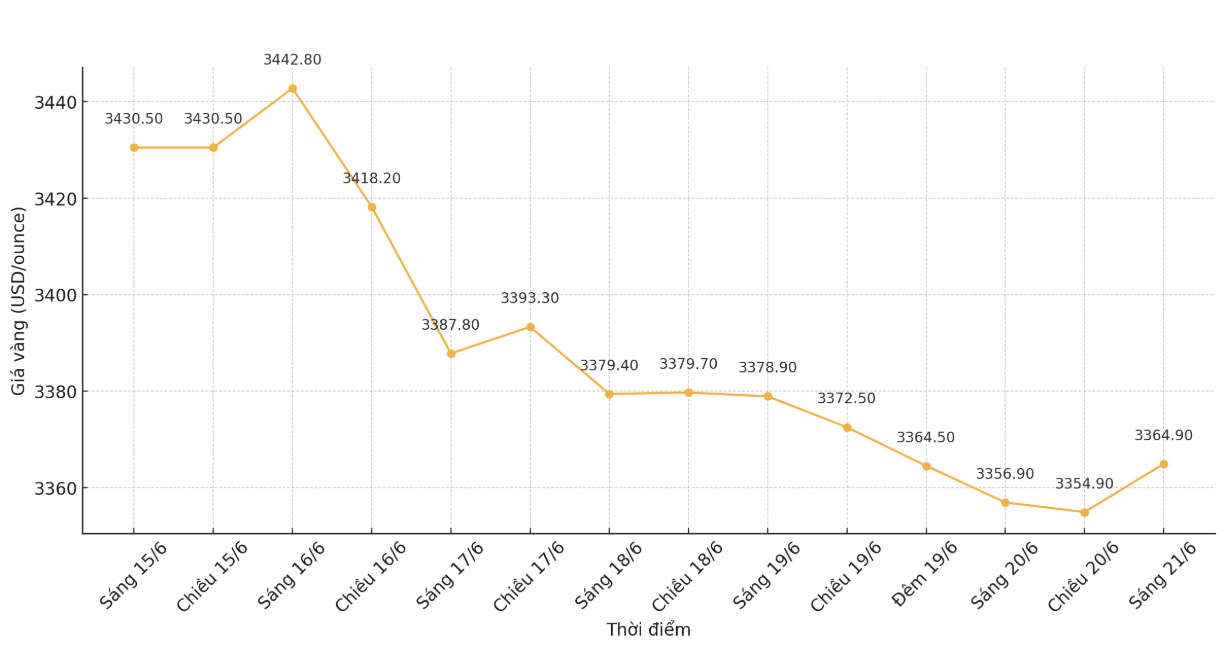

The latest spot gold price recorded at 3,369.54 USD/ounce, almost unchanged compared to the previous session. Citi's year-end target means a decrease of about 16% compared to the current price.

Analysts believe that gold's safe-haven appeal will gradually decrease as we move into 2026, as economic conditions improve.

We see that investment demand for gold will weaken by the end of 2025 and 2026, when support for US President Donald Trump and the country's growth momentum are effective, especially as the US midterm election approaches, Citigroup experts said.

Although economic instability is still high, there are many expectations that the US will avoid recession and inflationary pressures will be controlled.

A major factor that makes Citigroup have a negative view of gold is US monetary policy, when they predict that the US Federal Reserve (FED) will eventually cut interest rates, thereby supporting economic growth.

Looking at different scenarios, analysts said that in the bullish scenario, if geopolitical tensions escalate and economic uncertainty related to trade increase, gold prices could surpass $3,500/ounce in the third quarter of 2025.

Conversely, in the pessimistic scenario, if the global trade war is resolved and geopolitical tensions cool down, gold prices could fall below $3,000/ounce. However, Citigroup only assesses the probability of these two scenarios as 20%.

Despite its cautious stance on gold, Citigroup still has high expectations for the precious metal sector, especially silver. The bank expects silver prices to increase to $40/ounce in the next 6-12 months thanks to tight supply and strong demand.

In an optimistic scenario, silver prices could reach $46 an ounce by the third quarter of 2025 if the global trade war is quickly resolved.