Gold prices fell sharply in the session of October 21 as investors took profits after the precious metal hit a new peak in the previous session, driven by expectations of the US to soon cut interest rates and increased safe-haven demand.

At 15:03 on October 21 (Vietnam time), the December gold futures on COMEX decreased by 1.3% to 4,303.60 USD/ounce.

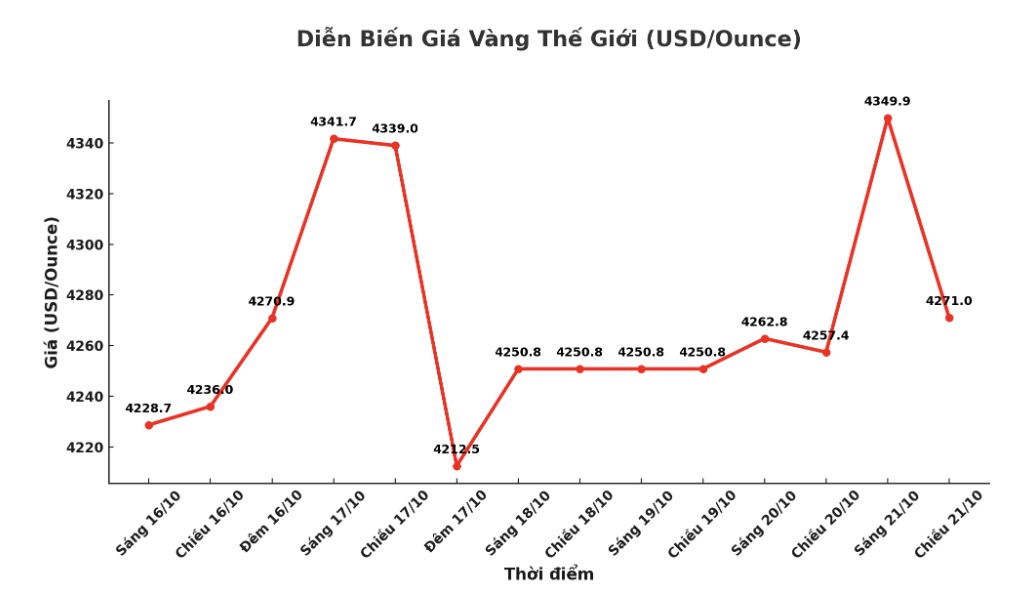

At 4:00 p.m. the same day, spot gold prices fell sharply to $4,271/ounce, after hitting a record high of $4,381.21/ounce on October 20.

Gold prices are still likely to increase further, but the current growth rate is quite strong, so every time a new peak is set, there will be a technical correction, said Nitesh Shah - commodity strategist at WisdomTree.

The combination of factors such as geopolitical and economic instability, strong investment demand, net buying by central banks and expectations of the US Federal Reserve (FED) cutting interest rates has helped gold prices increase by 63% since the beginning of the year.

Investors are now paying attention to the US consumer price index (CPI) report due out on Friday. The data is forecast to show September inflation rose 3.1% year-on-year, reinforcing expectations that the Fed will cut interest rates by 25 basis points at next week's meeting.

Gold - a non-profit asset - often benefits in a low interest rate environment.

The Asian stock market increased on October 21, supported by the hope of cooling down US-China trade tensions. Japan's Nikkei index also rose as Ms. Sanae Takaichi prepared to become a new prime minister, putting pressure on the yen to weaken.

Many investors have yet to participate in the gold rally and will take advantage of buying when prices correct, thereby limiting the short-term decline, said UBS expert Giovanni Staunovo.

In other metals markets, spot silver fell nearly 4% to 50.39 USD/ounce, platinum lost 3.9% to 1,574.05 USD/ounce, while paladi fell 4.5% to 1,428.25 USD/ounce.

According to traders and analysts, the flow of silver from the US and China to the London market has helped reduce the lack of liquidity at the world's largest precious metals exchange.

See more news related to gold prices HERE...