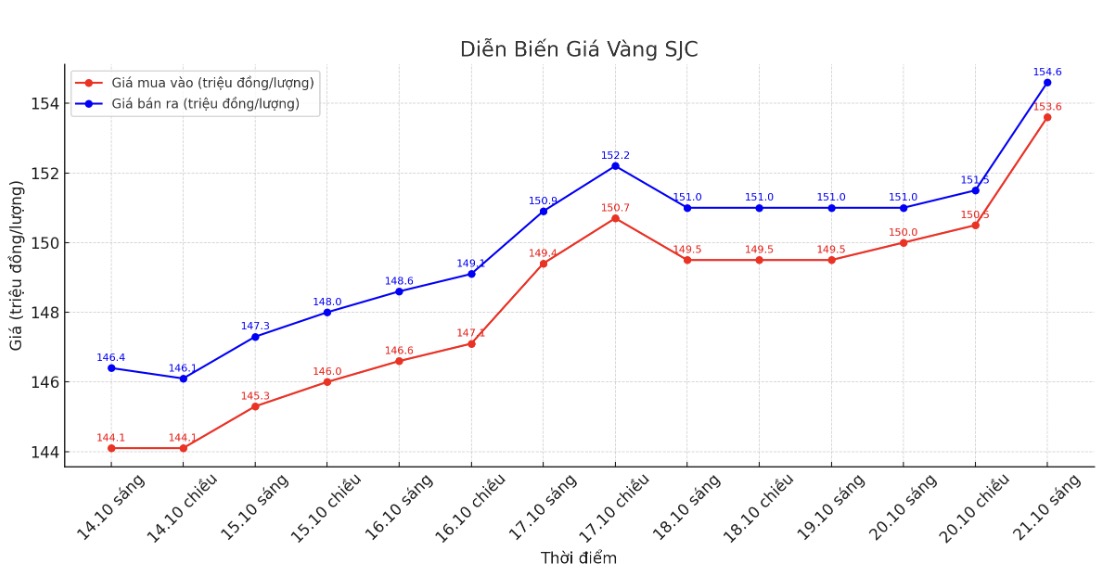

Updated SJC gold price

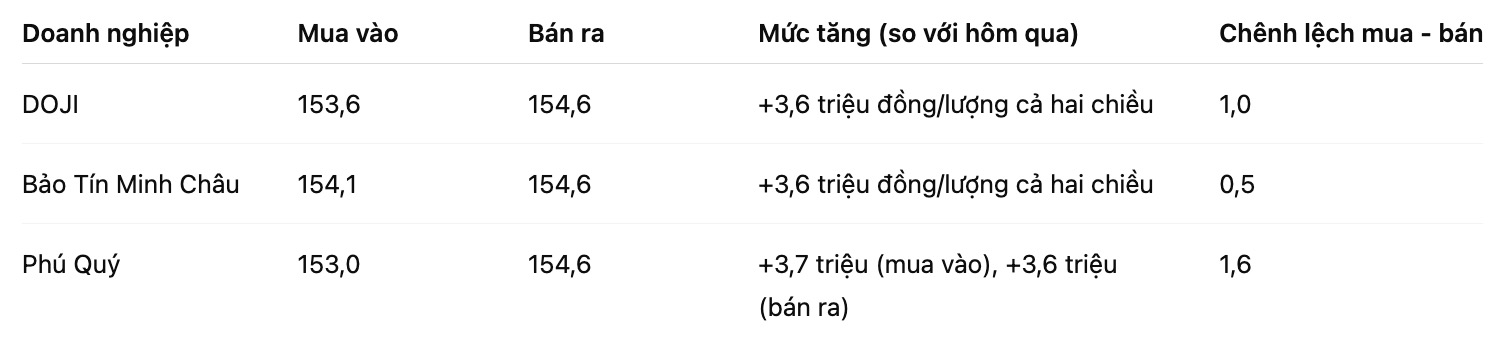

As of 10:15, the price of SJC gold bars was listed by DOJI Group at 153.6-154.6 million VND/tael (buy - sell), an increase of 3.6 million VND/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 154.1-154.6 million VND/tael (buy - sell), an increase of 3.6 million VND/tael in both directions. The difference between buying and selling prices is at 500,000 VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 153-154.6 million VND/tael (buy - sell), an increase of 3.7 million VND/tael for buying and an increase of 3.6 million VND/tael for selling. The difference between buying and selling prices is at 1.6 million VND/tael.

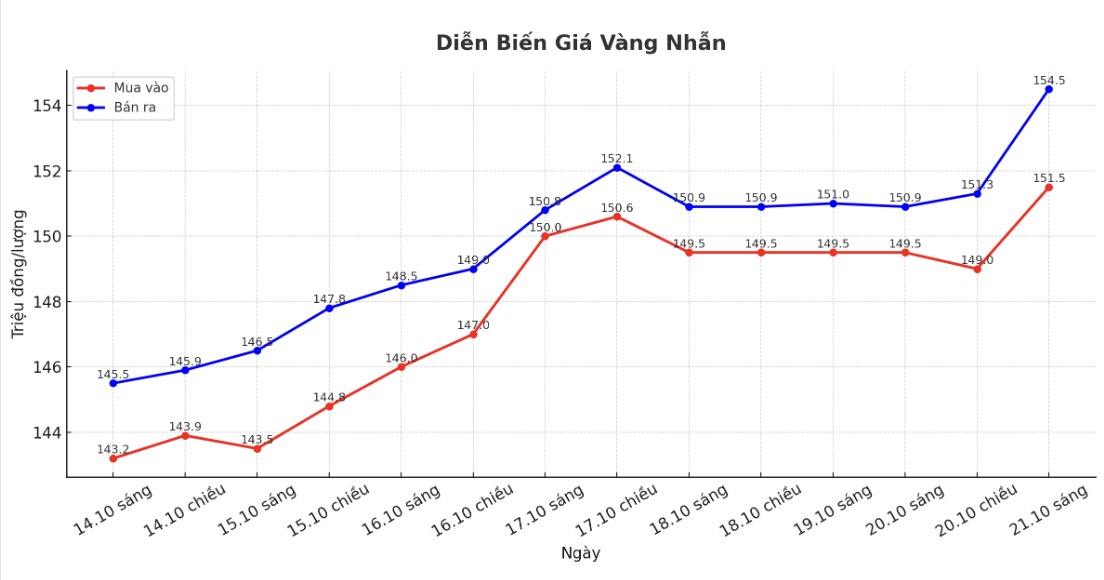

9999 round gold ring price

As of 10:15, DOJI Group listed the price of gold rings at 151.5-154.5 million VND/tael (buy - sell), an increase of 2 million VND/tael for buying and an increase of 3.6 million VND/tael. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 157.5-160.5 million VND/tael (buy - sell), an increase of 2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.6-154.6 million VND/tael (buy - sell), an increase of 3.6 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is showing signs of decreasing, but is still too high, causing risks for individual investors to increase. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

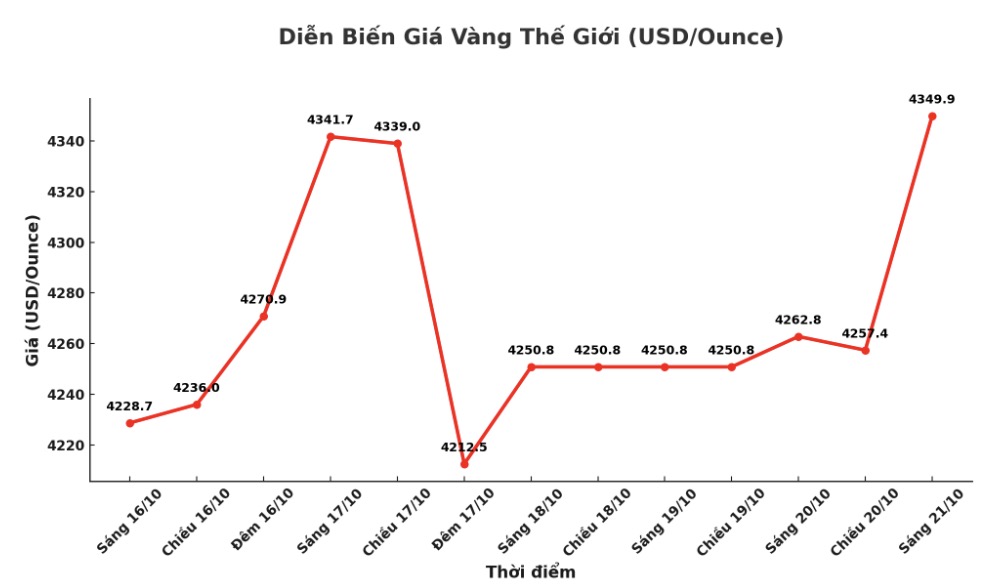

World gold price

At 10:40, the world gold price was listed around 4,349.9 USD/ounce, up 87.1 USD.

Gold price forecast

Gold prices opened the first trading sessions of the new week quite positively, almost completely erasing the sharp decline in the last session of the week.

Gold's rally is being driven by a series of political and trade uncertainties. According to Mr. Sagar Khandelwal - strategist of UBS Global Wealth Management, real interest rates falling, the weaker US dollar, increased public debt and escalating geopolitical tensions could push gold prices to $4,700/ounce in the first quarter of 2026, while stocks of gold mining enterprises could increase faster.

Gold has gained more than 60% this year, surpassing all other assets, as the US government's shutdown and trade tensions return have added new momentum to the market.

While the scale and pace of strong growth could increase volatility, we still believe that gold is an important component of a sustainable investment strategy, he wrote.

Mr.handelwal warned that real US interest rates could fall into the negative zone when the FED cuts interest rates in the context of persistent inflation.

We believe this will weaken the attractiveness of the US dollar and boost investment flows into gold, he said.

According to the World Gold Council, global gold ETFs recorded a capital flow in September of up to 17 billion USD, bringing the total capital flow in the past three months to 26 billion USD - the highest level in history.

UBS believes that investment demand could increase further, especially as the central bank continues to buy gold strongly, helping total global demand this year reach about 4,850 tons - the highest since 2011.

If individual investors start diversifying from US Treasury bonds to gold like the trend of central banks spot prices could increase even more, said Mr. Khandelwal.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...