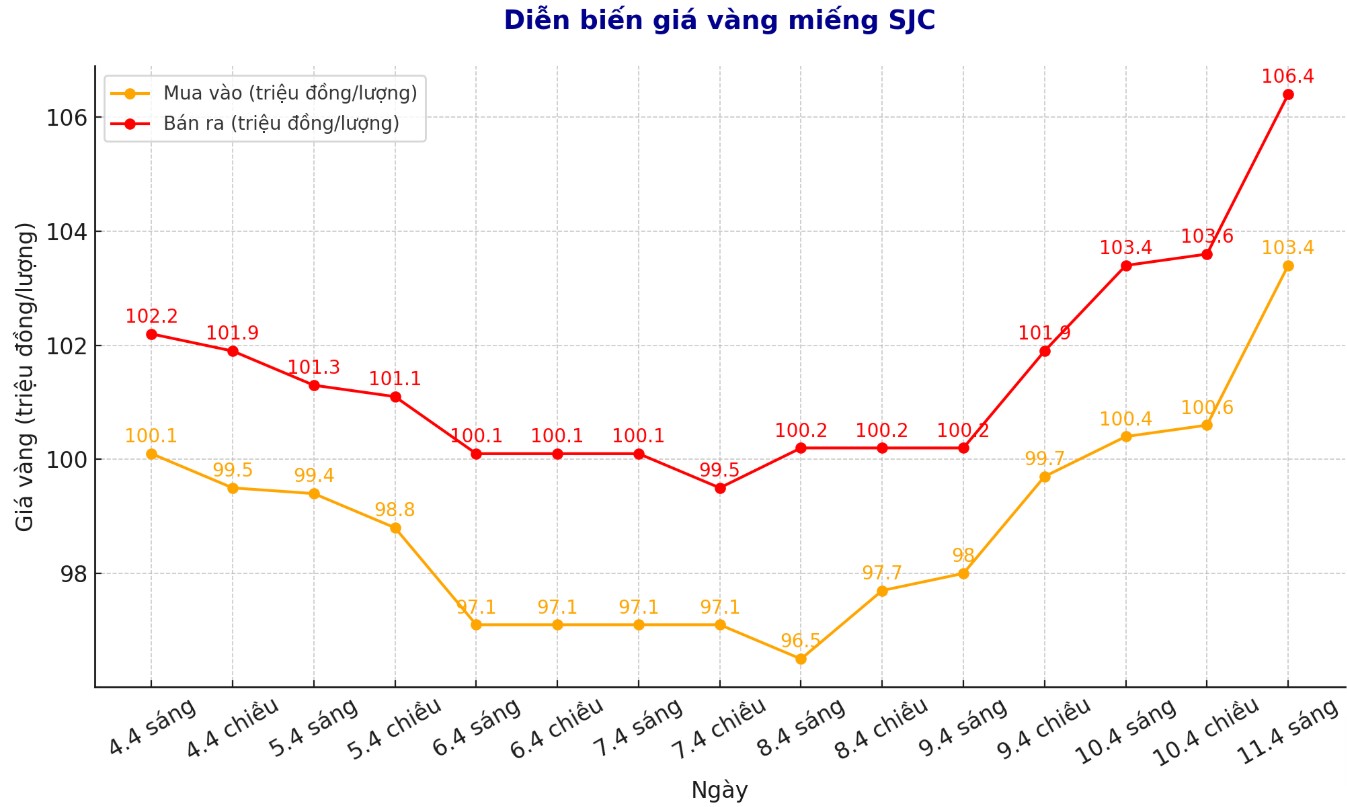

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 103.4-106.4 million VND/tael (buy - sell), an increase of 3 million VND/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 103.4-106.4 million VND/tael (buy - sell), an increase of 3 million VND/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 103.4-106.4 million VND/tael (buy - sell), an increase of 3 million VND/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

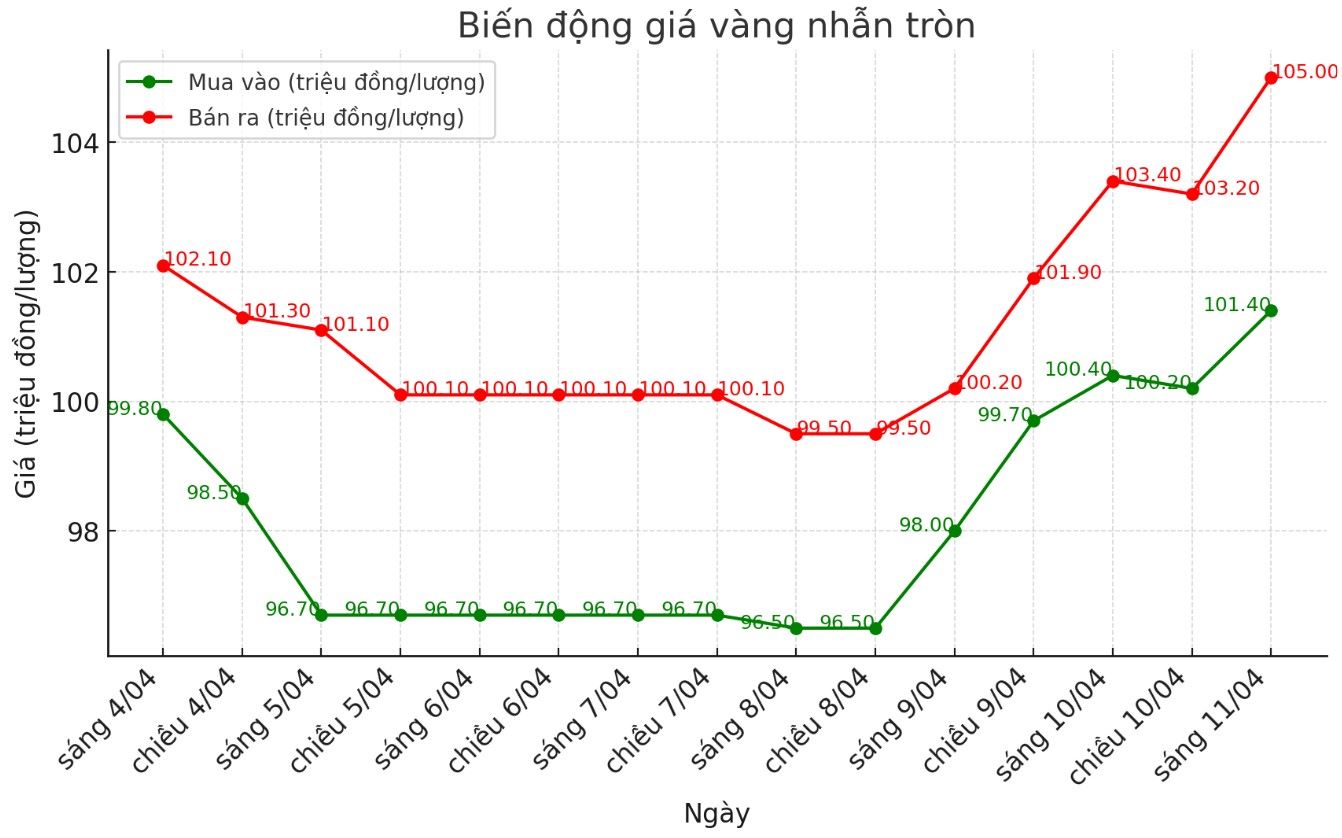

9999 round gold ring price

As of 9:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 101.4-105 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 1.6 million VND/tael for selling. The difference between buying and selling prices is at 3.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 102.5-106.4 million VND/tael (buy - sell), an increase of 2 million VND/tael for buying and an increase of 2.9 million VND/tael for selling. The difference between buying and selling is 3.9 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed to an excessively high level, causing risks for individual investors to increase.

In the context of many fluctuations in the world gold market, the large difference between buying and selling in the domestic market is a clear warning sign. If gold prices turn down, buyers will face a huge loss. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

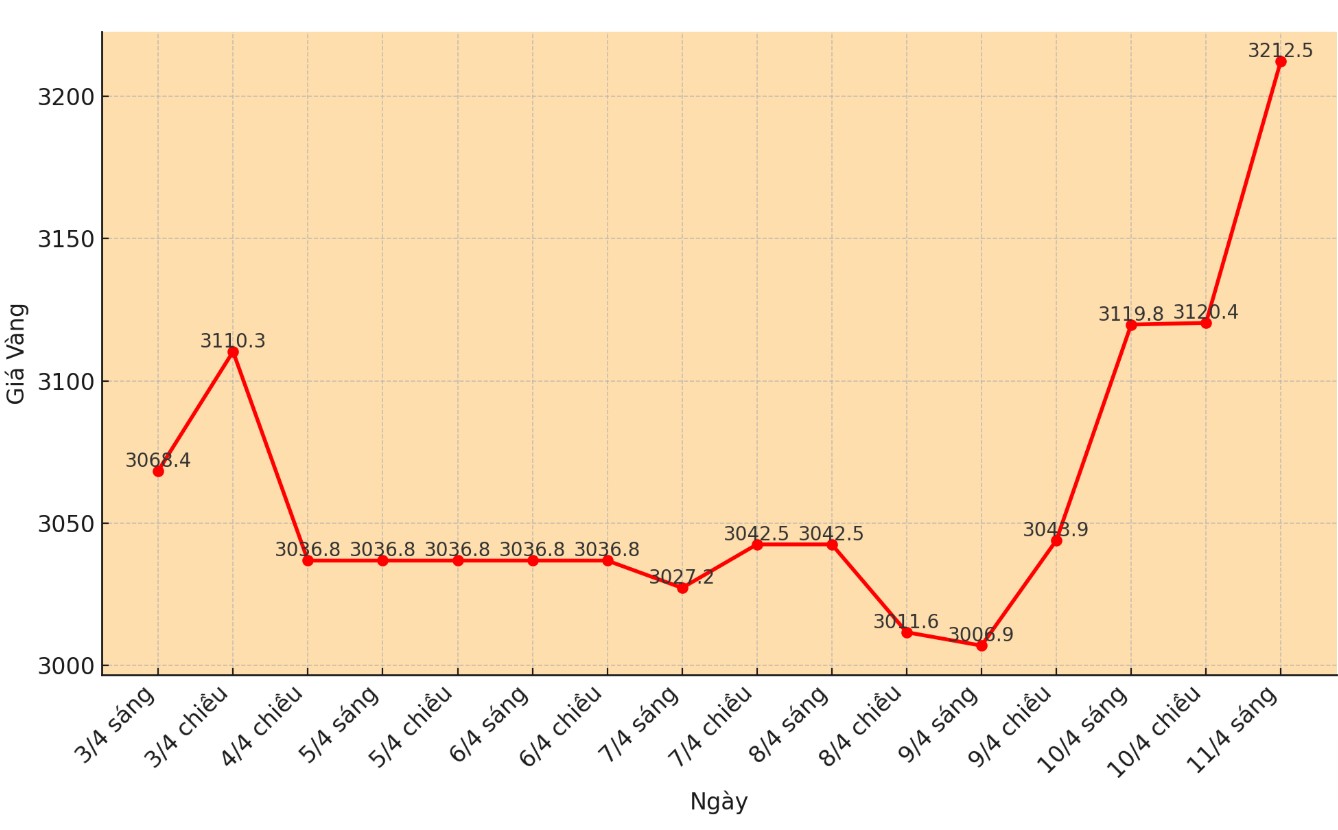

World gold price

At 8:50 a.m., the world gold price listed on Kitco was around 3,212.5 USD/ounce, up 119.8 USD compared to the beginning of the trading session yesterday morning.

Gold price forecast

According to Kitco, gold has become attractive due to strong safe-haven demand. The US stock market is fluctuating, concerns about the US-China trade war, as well as the US inflation report cooling down, are prompting precious metals traders this weekend.

There are also concerns about the stability of the US bond market.

World gold prices increased sharply after the number of weekly US jobless claims decreased, while the CPI decreased more than expected.

The number of Americans filing for new unemployment benefits is lower than economists predicted. The number of initial jobless claims to states in the week ended April 5 was 223,00, according to the US Department of Labor on Thursday.

This figure is lower than expected, as experts predict it will be 226,000. Last week's figure was revised down to 219,000.

According to the US Bureau of Labor Statistics on Thursday (local time), the country's consumer price index (CPI) fell 0.1% last month, after rising 0.2% in February. This inflation data is lower than expected, as economists expect the CPI to increase by 0.1%.

The report said that overall inflation in the past 12 months increased by 2.4%, down sharply from 2.9% in February. Economic experts have forecast annual inflation to increase by 2.5%.

Mr. Nikos Tzabouras - senior market analyst at Tradu.com - said that gold is regaining its position as a safe haven in the context of instability and may continue to set new peaks.

However, he also noted that if the US and its partners reach a trade deal, the appeal of gold could decline. In addition, the possibility of the US Federal Reserve (FED) cutting interest rates in the coming time could support the USD's recovery, thereby putting pressure on gold prices.

See more news related to gold prices HERE...