USD Index

On November 25, in the US market, the USD Index (DXY) measuring the fluctuations of the greenback against 6 major currencies "turned around" down 0.02%, anchored at 100.16 points.

The US dollar fell slightly in the opening session of the week, returning a portion of the previous week's profits as comments from influential Fed planner John Williams prompted traders to bet more on the Federal Reserve easing interest rates next month.

Optimism about the Fed cutting interest rates in December increased after New York Fed John Williams suggested on Friday that policy adjustments could take place in the coming time.

This has increased the probability of a 25 basis point rate cut in December to about 69% from about 44% a week earlier.

However, minutes from the recent FED meeting showed that some policymakers still warned that inflation was still too high, leaving December results uncertain.

The focus of the USD this week, a shortened week due to holidays, will be the newly released US economic data, with September retail sales released today.

VND vs USD exchange rate

In the domestic market, at the beginning of the trading session on November 25, the State Bank announced that Vietnam's central exchange rate increased by 8 VND, currently at 25,144 VND.

The reference USD exchange rate at the State Bank's Buying - Selling Trading Department is currently at: 23,937 VND - 26,351 VND, up 7 VND for buying and 9 VND for selling, respectively.

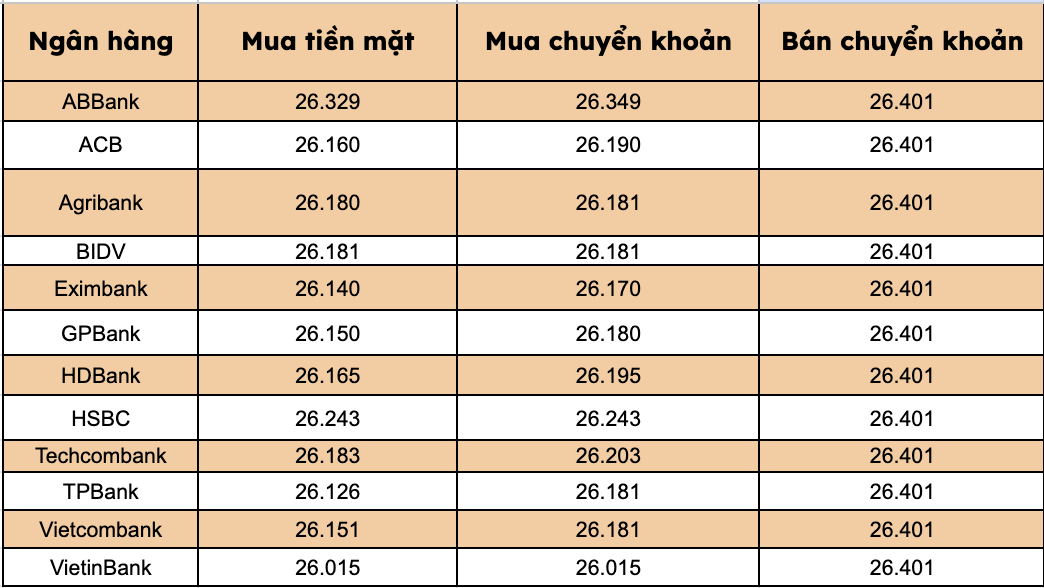

At commercial banks, USD prices have mostly increased sharply compared to the previous session.

Most banks listed USD selling prices at VND26,401/USD, up VND9/USD.

Bank with the highest cash and transfer price: HSBC (26,243 VND/USD).

The difference between buying and selling prices at banks fluctuates within a large range of 158-386 VND/USD.