After the strongest acceleration since the oil crisis in 1979, world gold prices are entering a period that many large organizations consider not over.

In 2025, gold recorded its strongest increase in more than four decades. In October, spot gold prices hit a record $4,381 an ounce, while just a few months before that, the market had not yet reached $3,000.

The price increase is driven by persistent demand from central banks and a wave of new investors, from corporate pension management corporations to surprise names in the digital currency sector.

JP Morgan, Bank of America and consulting firm Metals Focus are all in agreement that gold prices could reach the $5,000/ounce mark in 2026.

According to Bank of America strategist Michael Widmer, expectations of continued profits and the need to diversify portfolios are boosting cash flow into gold. Fundamental factors such as the US budget deficit, efforts to narrow the short-term account deficit and weak USD policies continue to create long-term holdings.

In addition, concerns about the independence of the US Federal Reserve, trade tensions and geopolitical instability, including the conflict in Ukraine and relations with Russia and NATO, still make gold an attractive haven, according to Metals Focus.

The big difference of the current cycle is the anchor role of central banks. This is the 5th consecutive year that central banks have stepped up reserve diversification, reducing dependence on USD-denominated assets. According to JP Morgan, this buying power helps gold prices stay at a higher level than before, even when speculative cash flow has at one point withdrawn.

Analysts estimate that to keep gold prices from falling, the market needs about 350 tons of gold per quarter from central banks and investors. It is forecasted that by 2026, this figure could reach an average of 585 tons per quarter.

The share of gold in total managed assets of global investors has increased to 2.8%, compared to 1.5% before 2022, but according to JP Morgan, this is not necessarily a ceiling.

Morgan Stanley forecasts gold prices to hit $4,500 an ounce by mid-2026, while JP Morgan expects an average of above $4,600 in the second quarter and above $5,000 by the end of the year. Metals Focus also set a target of 5,000 USD for the end of 2026.

BIS International Payment Bank noted a rare phenomenon when gold prices and the stock market both increased sharply, something not seen in at least half a century. Part of this year's gold demand comes from a risk-off strategy against strong correction in the stock market, in the context of tariff, trade and geopolitical tensions.

However, risks to gold remain, as deep stock corrections sometimes force investors to sell their safe-haven assets. However, many experts believe that gold is shifting from a cyclical defensive role to a long-term strategic asset in the portfolio.

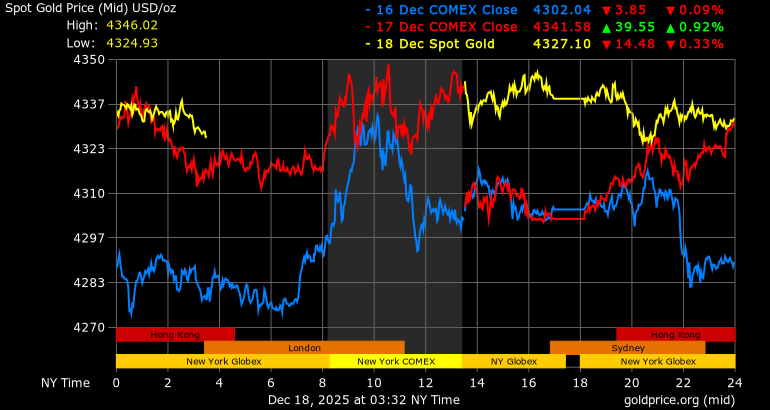

The world gold price at 3:30 p.m. on December 18, Vietnam time, was trading at 4,327.29 USD/ounce.

Domestically, the price of SJC gold bars is trading around 154.4 - 156.4 million VND/tael (buy - sell). The price of 9999 Bao Tin Minh Chau gold rings is trading around 152.2 - 155.2 million VND/tael (buy - sell).