Accordingly, compulsory car insurance for cars (also known as civil liability insurance) is a type of insurance related to the issue of compensation for damage to life, health and property of third parties if the damage is caused by the insured person's car.

When a problem occurs, the insurance company will pay the insurance amount according to the regulations. This is a compulsory type of car insurance for cars participating in traffic. If this insurance is not available, the vehicle owner will be fined.

According to a survey by Lao Dong Newspaper reporters in early November, there are many insurance companies selling auto civil liability insurance (compulsory auto insurance) such as: PVI Pjico BIC Auto Insurance, Bao Viet...

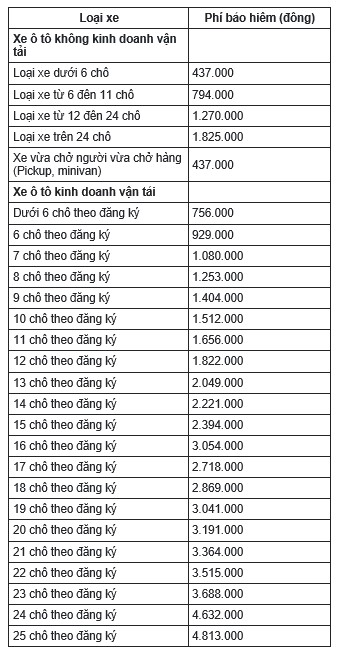

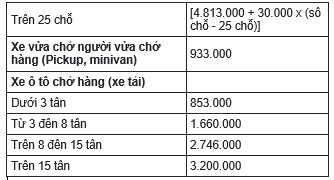

Regarding compulsory auto insurance premiums of companies as prescribed in Appendix I of Decree 67/2023/ND-CP.

According to this regulation, the compulsory auto insurance fee for a period of 1 year for each type of vehicle is specified as follows:

(Note: Not including 10% VAT)

Compulsory auto insurance premiums in some other cases such as Compulsory auto insurance premiums in some other cases as follows:

Learning car: This type of car is calculated at 120% of the insurance premium of the same type of car.

Taxi: Calculated at 170% of the insurance premium of a business vehicle with the same number of seats.

Specialized vehicles: Ambulance insurance premiums are calculated at 120% of the insurance premiums for vehicles that carry both people and goods (pickup, minivan).

Insurance premium for cash transport vehicles is calculated at 120% of insurance premium for vehicles with less than 6 seats.

Insurance premiums for other specialized vehicles with specified design tonnage are calculated at 120% of the insurance premiums for cargo vehicles with the same tonnage; in the case of vehicles without specified design tonnage, insurance premiums are calculated at 120% of the insurance premiums for cargo vehicles with tonnage under 3 tons.