On the Government Portal, Mr. N.H.A.V reflected that Clause 2, Article 32 of Decree No. 100/2024/ND-CP stipulates the selling price of social housing as follows: Gib = (TD+L)/Sb *Ki*(1+GT).

However, also according to this Decree, the TD (ungal): Is the total cost of construction investment (including value added tax) for the area of social housing as prescribed in Clause 2, Article 22 of this Decree.

Thus, if the transformative formula includes value added tax, when calculating the price, Gib has included value added, but then continues to multiply by (1+GTGT), then the selling price of social housing is calculated twice as value added tax (the value of input added added added in the transformative and output added value is in the formula (1+GTGT).

Mr. V asked, also according to this Decree, when buying, you have to pay additional input value added tax, but when renting, there is no need?

The Ministry of Construction responds to this issue as follows:

Article 2 of Decree No. 10/2021/ND-CP stipulates the subjects of application as follows:

This Decree applies to agencies, organizations and individuals related to the management of investment costs for construction of projects using public investment capital, foreign state capital for public investment, and PPP projects.

Organizations and individuals shall refer to the provisions of this Decree to manage construction investment costs for projects other than those specified in Clause 1 of this Article.

According to Decree No. 10/2021/ND-CP (Clause 2, Article 5, Clause 2, Article 12, Clause 2, Article 25, Clause 2, Article 31), for projects using public investment capital, non-state capital for public investment, and investment projects under the public-private partnership (PPP) method, the total investment in construction (TD) including value added tax is determined according to each cost item.

Therefore, the regulation of total construction investment costs including value added tax in the formula for determining social housing prices is to ensure compliance with regulations on construction investment cost management.

According to Article 7 of the Law on Value Added Tax, the taxable price for goods and services sold by a business establishment is the selling price without value added tax. Currently, there is no regulation on the selling price without value added tax determined on the basis of costs excluding value added tax.

The 2023 Housing Law stipulates the determination of rental prices and rental prices for social housing invested in construction using public investment capital and trade union financial resources (in Article 86); determining the selling prices, purchase rental prices, and rental prices for social housing invested in construction without public investment capital or trade union financial resources (in Article 87).

In which:

Clause 1, Article 86 stipulates: In the case of social housing rental, the rental price is calculated at the full cost of housing maintenance; the cost of recovering investment capital for housing construction for a minimum period of 20 years, from the date of signing the rental contract.

Social housing prices are determined as follows:

Calculate all costs to recover investment capital for housing construction, including: costs for investment in the construction of social housing works, compensation, support, and resettlement costs, costs for investment in the construction of technical infrastructure systems, social infrastructure implemented by investors of social housing construction investment projects (if any) within the project scope, except for cases subject to construction investment for business purposes or having to hand over to the State for management according to the approved project content; interest (if any); reasonable and valid expenses of the business, including sales organization costs, business management costs, expenses with sufficient invoices and documents directly related to the construction investment project according to the provisions of law; profit level specified in Clause 2, Clause 85 of this Law.

The incentives specified in Points a, b, dd, g and h, Clause 2, Article 85 of this Law and the maintenance fee payable by the buyer as prescribed in Article 152 of this Law shall not be included.

The rental price for social housing is determined according to the provisions of Clause 1 of this Article.

The rental price of social housing, including housing maintenance costs, is agreed upon by the investor of the social housing construction investment project with the lessee according to the price framework prescribed by the Provincial People's Committee".

Decree No. 100/2024/ND-CP detailing a number of articles of the Housing Law on the development and management of social housing stipulates the determination of rental prices and purchase prices of social housing invested in and built by the State using public investment capital and trade union financial resources (Article 31); determining the selling price, purchase rental price, social housing rental price invested in construction without public investment capital, trade union financial resources (Articles 32, 33 and 34, and the total cost structure of investment in construction of social housing areas (Clause 2, Article 22, etc.

In which:

Clause 2, Article 32 and Clause 2, Article 33 stipulate: "Td (component) is the total cost of construction investment (including value added tax) of the social housing area as prescribed in Clause 2, Article 22 of this Decree, determined based on the investment capital settlement value approved by a competent state agency; in case the settlement has not been approved, it will be determined based on the construction investment cost approved by a competent state agency or the construction investment cost based on the actual bidding results (if any)".

Clause 1, Article 34 stipulates: "The method of determining the rental price of social housing invested in construction without public investment capital, the financial resources of trade unions are applied according to the method of determining the rental price of social housing using public investment capital prescribed in Clause 1, Article 31 of this Decree.

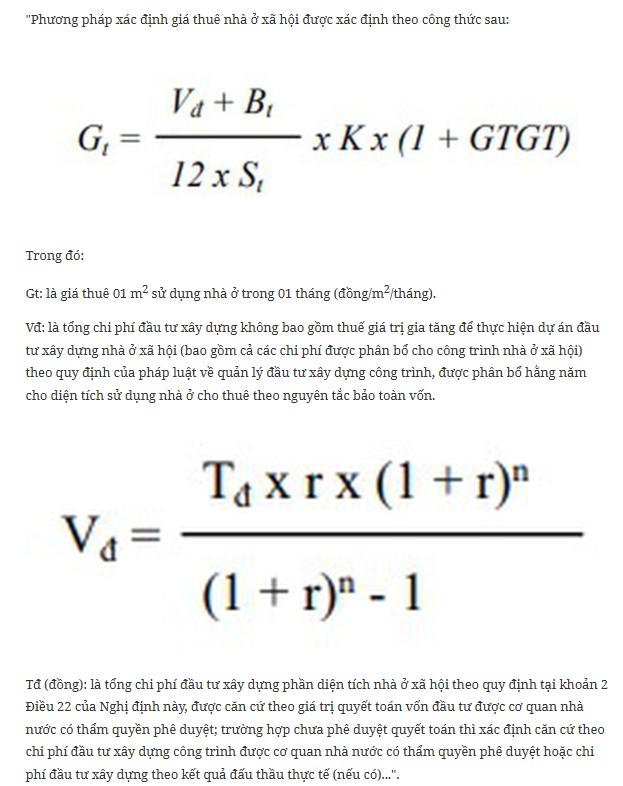

At point b, clause 1, Article 31, it is stipulated:

The Ministry of Construction acknowledges your above opinion and will study and accept it in the process of amending Decree No. 100/2024/ND-CP, ensuring consistency with the current law on management of construction investment costs.