(1) Red book issuance fee

Fees for granting certificates of land use rights, house ownership rights, and assets attached to land include: Issuing certificates of land use rights, house ownership rights, and assets attached to land; land change registration certificates; cadastral map extracts; documents; cadastral records data.

Based on specific local conditions and local socio-economic development policies to stipulate appropriate fee collection levels, ensuring the following principles: The fee for households and individuals in districts under centrally-run cities, inner-city wards under cities or provincial towns is higher than the fee in other areas; the fee for organizations is higher than the fee for households and individuals.

Thus, the fee for granting a Certificate will be decided by the People's Councils of provinces and centrally run cities to apply to their localities, so there will be no uniformity across the country. However, the fee will usually be from 100,000 VND or less for each newly issued red book.

(Point d, Clause 1, Article 5, Circular 85/2019/TT-BTC)

(2) Registration fee

Pursuant to Article 3 of Decree 10/2020/ND-CP, organizations and individuals must pay registration fees when registering home ownership and land use rights.

The current registration fee for houses and land is 0.5%.

Note: Exemption from registration fees for inherited houses and land or gifts between: Husband and wife; biological father, biological mother and biological child; adoptive father, adoptive mother and adopted child; father-in-law, mother-in-law and daughter-in-law; father-in-law, mother-in-law and son-in-law; grandfather, grandmother and grandchild; paternal grandfather, maternal grandmother and grandchild; brothers, sisters and siblings are now granted certificates of land use rights, house ownership rights and other assets attached to land by competent state agencies.

(3) Document appraisal fee

The appraisal fee for the issuance of a land use right certificate is the fee for the appraisal of the dossier, the necessary and sufficient conditions to ensure the issuance of a certificate of land use rights, house ownership rights and assets attached to the land (including initial issuance, new issuance, issuance of re-issuance, issuance of certificates and certification of changes to issued certificates) according to the provisions of law.

Based on the area of the land plot, the complexity of each type of dossier, the purpose of land use and the specific conditions of the locality to determine the fee collection for each case

(Point i, Clause 1, Article 5, Circular 85/2019/TT-BTC (amended and supplemented in Circular 106/2021/TT-BTC))

(4) Personal income tax

- The tax rate for land sales is 2% on the purchase, sale or sublease price.

- How to calculate tax:

+ Personal income tax on income from land purchase and sale is determined as follows:

Personal income tax payable = Transfer price x Tax rate 2%

+ In case the land purchase and sale is co-owned, the tax obligation is determined separately for each taxpayer according to the real estate ownership ratio.

In cases of land division associated with the transfer, donation, and inheritance of land use rights in the following cases, personal income tax is not required:

- Transferring land use rights between husband and wife; biological father, biological mother and biological child; adoptive father, adoptive mother and adopted child; father-in-law, mother-in-law and daughter-in-law; father-in-law, mother-in-law and son-in-law; paternal grandfather, paternal grandmother and grandchild; maternal grandfather, maternal grandmother and grandchild; brothers, sisters, brothers together.

- Receiving inheritance or gifts of land use rights between husband and wife; biological father, biological mother and biological child; adoptive father, adoptive mother and adopted child; father-in-law, mother-in-law and daughter-in-law; father-in-law, mother-in-law and son-in-law; paternal grandfather, paternal grandmother and grandchild; maternal grandfather, maternal grandmother and grandchild; brothers, sisters and siblings together.

(Article 12 of Circular 111/2013/TT-BTC (amended and supplemented in Circular 92/2015/TT-BTC)

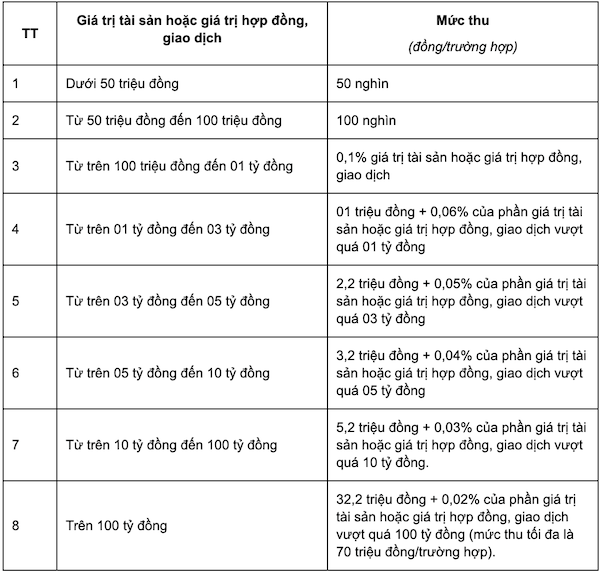

(5) Real estate notary fee

Notary fee for transfer or donation contracts for land use rights is calculated according to the value of land use rights. Accordingly, the collection rate is as follows: