The situation of cutting losses in apartments is increasing

The rapid increase in housing loan interest rates in recent times is creating great pressure on investors using financial leverage, causing the phenomenon of selling apartments at cut-loss prices to appear more frequently in some areas.

According to analysis from the Vietnam Association of Realtors (VARS), this development does not reflect the general trend of the entire market, but mainly comes from a part of investors participating in the "hot" growth period, using large financial leverage, especially loans with principal grace periods and preferential interest rates.

When the preferential period expires, in the context of high interest rates, increased financial pressure forces many investors to sell to restructure cash flow. Besides, there are many cases of buying according to the "fomo" mentality, accepting to buy at a price difference with the expectation of short-term surfing. When the market stagnates, this group is forced to "cut losses" on the difference to minimize risks.

Assessing the liquidity of the apartment segment in 2025, Mr. Le Dinh Chung, General Director of SGO Homes, said that the average absorption rate in 2025 reached about 68% on the newly opened supply, equivalent to nearly 88,000 successful transactions.

In the first three quarters of the year, many projects, despite having high prices, still recorded good absorption rates thanks to increased real housing and investment demand. However, in the fourth quarter, the absorption rate tended to decrease slightly as supply increased sharply and investor sentiment became more cautious in the context of deposit and lending interest rates starting to rise slightly.

In Hanoi, the average new apartment asking price reached about 100 million VND/m2, an increase of 40% compared to 2024. In Ho Chi Minh City, the average new asking price reached 111 million VND/m2, an increase of 23% compared to the previous year, with a series of luxury projects opened for sale at the end of the year.

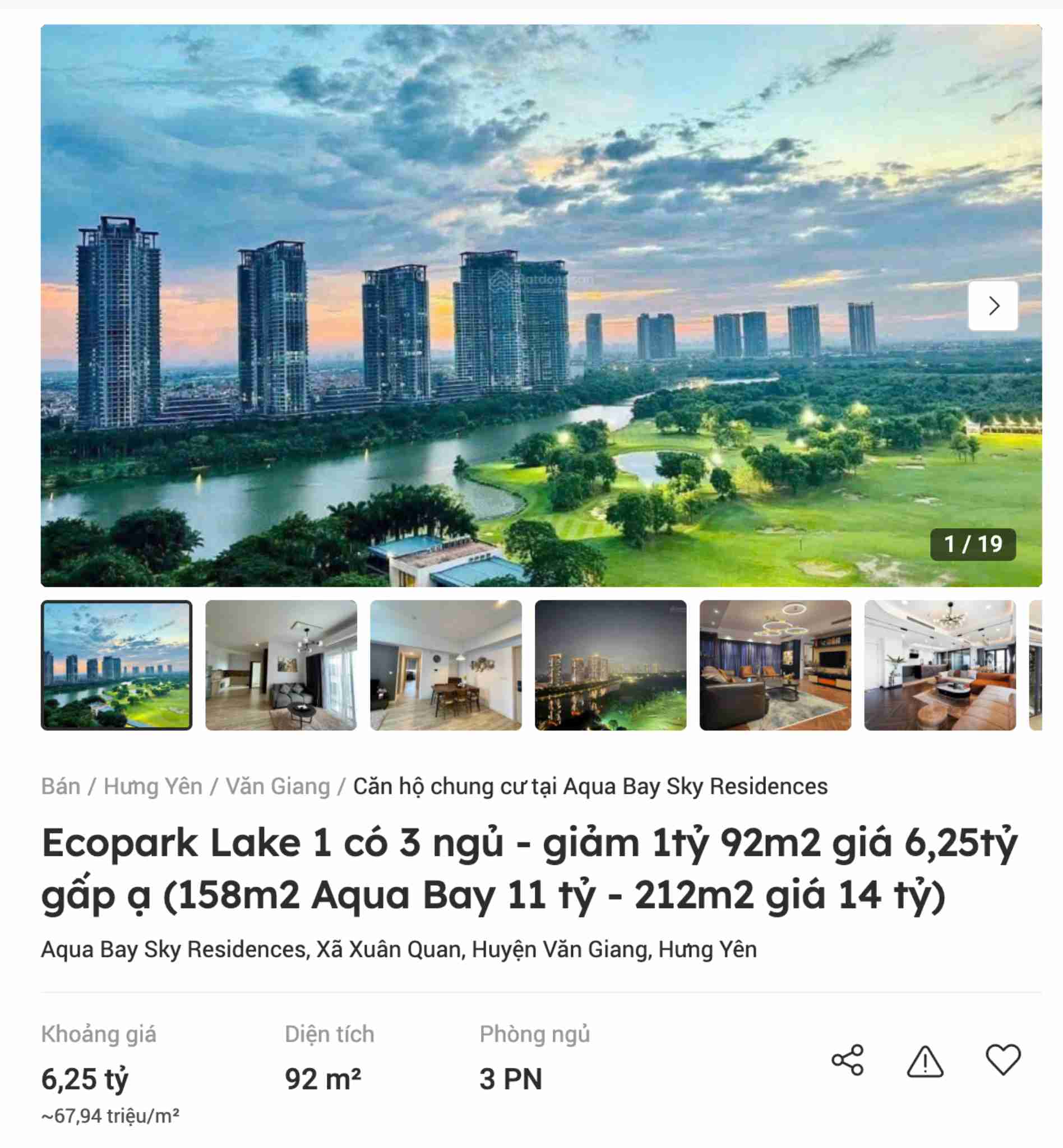

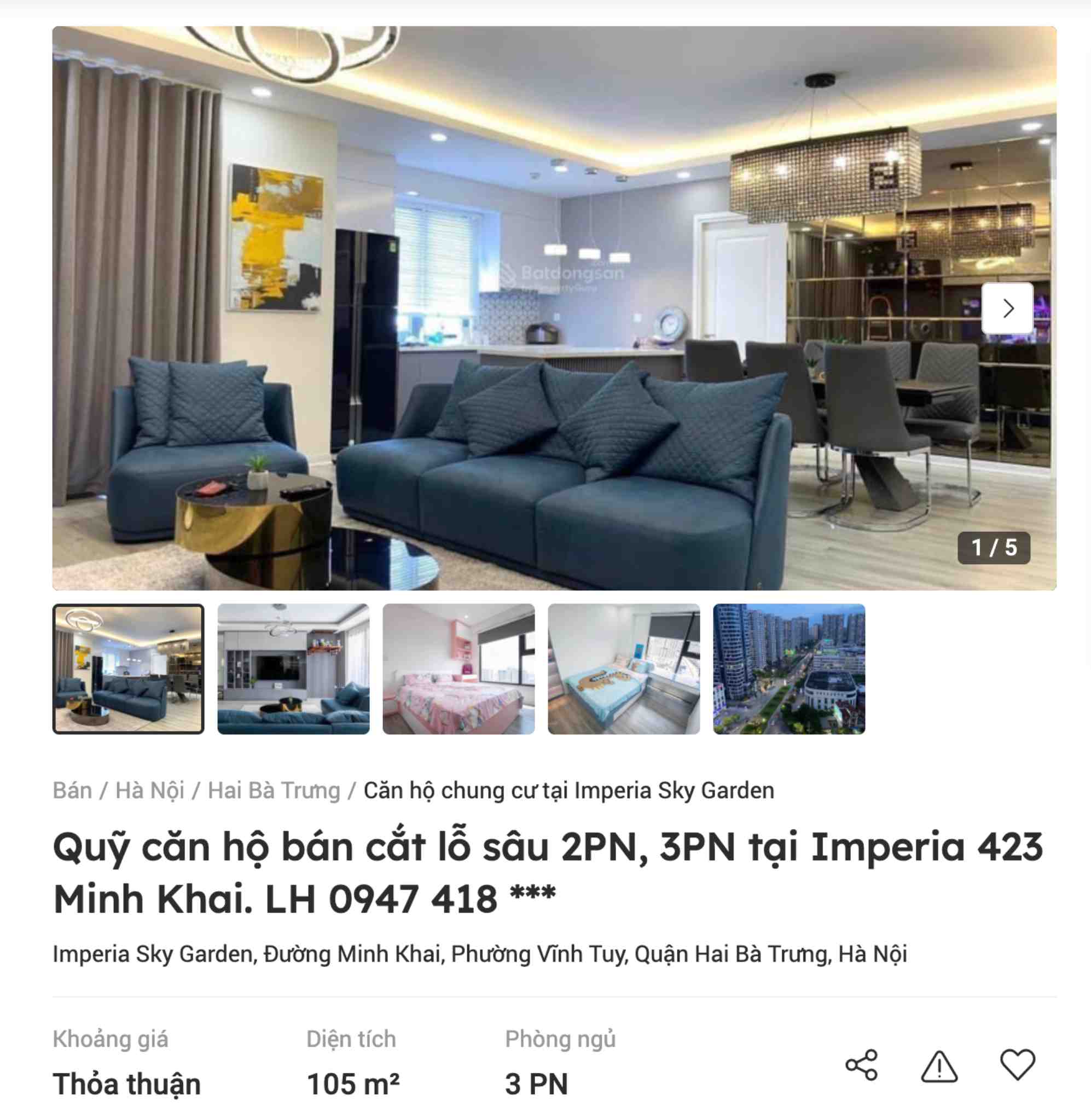

On the secondary market, selling prices in Hanoi increased rapidly in a short time, many areas recorded increases from hundreds of millions to billions of VND per unit. However, the increase tended to slow down at the end of the year, with the appearance of "loss-cutting" sales by a part of investors buying according to FOMO sentiment during the hot period, while the price level in the central area was still maintained stably.

Homebuyers' psychology is more cautious, market liquidity slows down

According to VARS, although it is not a trend that covers the entire market, in the context of increased sales supply, buyers tend to be cautious and wait, causing liquidity to slow down locally in some areas.

Previously, during the Covid-19 epidemic, when interest rates were low and rental rates were relatively attractive, the "house hacking" strategy – buying a real estate and renting part or all of it to compensate for mortgage loans – was considered an effective solution, especially for first-time homebuyers. This strategy helps buyers both own assets and exploit rental cash flow to reduce debt repayment pressure, while accelerating equity accumulation.

Stepping into 2026, the market picture has changed. House prices are rising, mortgage interest rates are rising, while lending standards are becoming increasingly strict, making strategies that were previously effective in the past less feasible. The market is gradually shifting from a quick profit-seeking mindset to prioritizing long-term affordability and financial safety.

According to VARS, in the near future, preferential home purchase loans signed from 2023 after a period of 2-3 years of enjoying low interest rates and principal grace period packages will simultaneously switch to a floating interest rate mechanism. At that time, the actual interest rate payable may increase sharply compared to the initial calculation of borrowers, especially the group using high leverage.

Many first-time homebuyers who have accessed preferential loan packages may also face faster-than-expected interest rate increases, causing financial plans to be disrupted. Risks increase even more in the event that the project is delayed in handover. At that time, investors will face double pressure: increased loan interest costs while they cannot exploit rental cash flow to compensate for financial obligations.

In the context of high interest rates and the rental market no longer as attractive as before, actual cash flow may not be enough to compensate for loan interest, pushing investors into a passive state, even being forced to sell in unfavorable conditions.

VARS believes that financial "fall point" pressure makes investors increasingly cautious, focusing on projects with complete legal status, clear progress, actual exploitation capacity and prices suitable for real housing needs, instead of chasing short-term price increase expectations.